IRS 1120-L 2022 free printable template

Show details

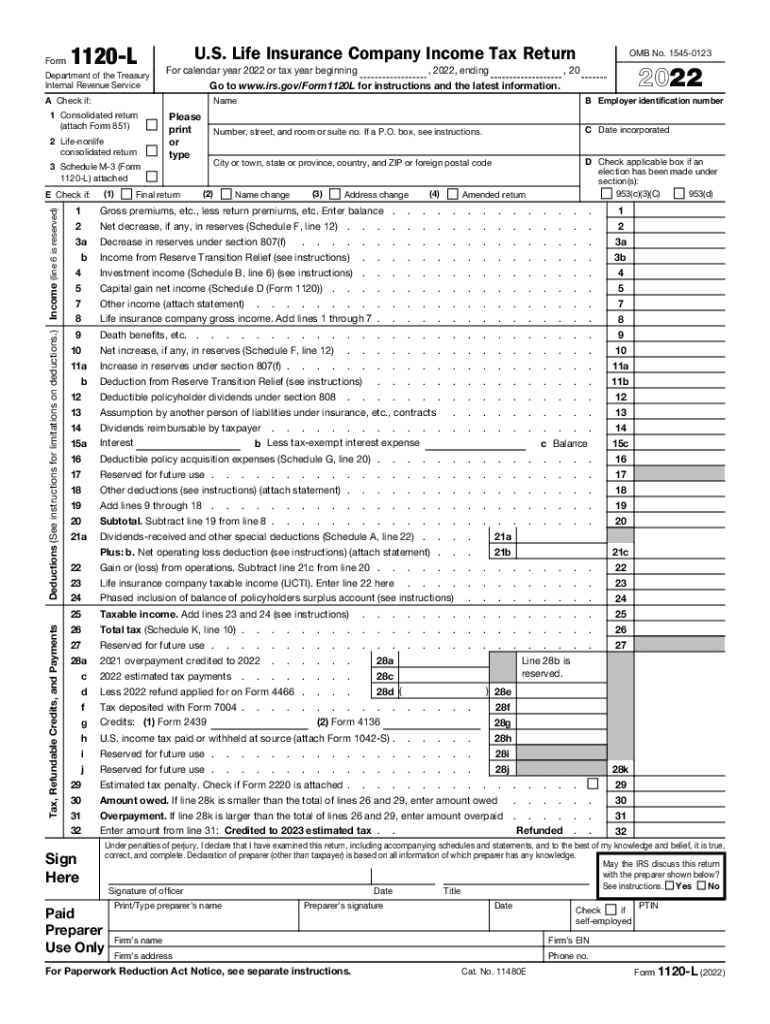

Form1120LDepartment of the Treasury Internal Revenue Service. S. Life Insurance Company Income Tax Returner calendar year 2022 or tax year beginning2 Lifenonlife consolidated returnless print or type3

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

How to fill out IRS 1120-L

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

You can edit IRS 1120-L by using a reliable PDF editing tool. To effectively make changes, open the form in the PDF editor and utilize the editing features. Ensure that all modifications comply with IRS regulations to maintain accuracy and validity.

How to fill out IRS 1120-L

To fill out IRS 1120-L, follow these steps:

01

Download the form from the IRS website or access it through a PDF editor.

02

Begin by entering your organization’s name and address in the designated fields.

03

Report income, deductions, and other required financial information accurately.

04

Verify the accuracy of all entries before submitting.

About IRS 1120-L 2022 previous version

What is IRS 1120-L?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-L 2022 previous version

What is IRS 1120-L?

IRS 1120-L is the tax form used specifically for reporting income, gains, losses, deductions, and credits of a life insurance company. This form is crucial for tax compliance in relation to the unique nature of life insurance operations.

What is the purpose of this form?

The purpose of IRS 1120-L is to provide the IRS with detailed financial information from life insurance companies. It enables the agency to assess taxes accurately based on the specific attributes of life insurance operations.

Who needs the form?

Life insurance companies that operate in the United States need to file form IRS 1120-L. This includes companies that provide life insurance policies and related financial products to policyholders.

When am I exempt from filling out this form?

Exemptions from filing IRS 1120-L may apply to certain small insurance companies or under specific conditions as defined by IRS regulations. Additionally, organizations that do not qualify as life insurance companies are not required to use this form.

Components of the form

The IRS 1120-L consists of several sections, including income statements, balance sheets, and schedules for reporting various tax credits. Each section must be completed accurately to reflect the company’s financial standing effectively.

What are the penalties for not issuing the form?

Failure to file IRS 1120-L can result in significant penalties. The IRS may impose fines or a failure-to-file penalty, which can accumulate over time and lead to further complications with tax compliance.

What information do you need when you file the form?

When filing IRS 1120-L, you will need detailed financial information including income, expenses, assets, and liabilities. Additionally, relevant schedules that report specific deductions and credits must be included for accurate reporting.

Is the form accompanied by other forms?

IRS 1120-L may need to be accompanied by various schedules and attachments that provide supporting information on income, deductions, and credits. Be sure to review the form instructions for a complete list of necessary documents.

Where do I send the form?

IRS 1120-L must be mailed to the appropriate address provided in the form instructions. The mailing address may vary based on your business location and other factors, so consult the latest guidelines to ensure proper submission.

See what our users say