IRS 1120-L 2023 free printable template

Show details

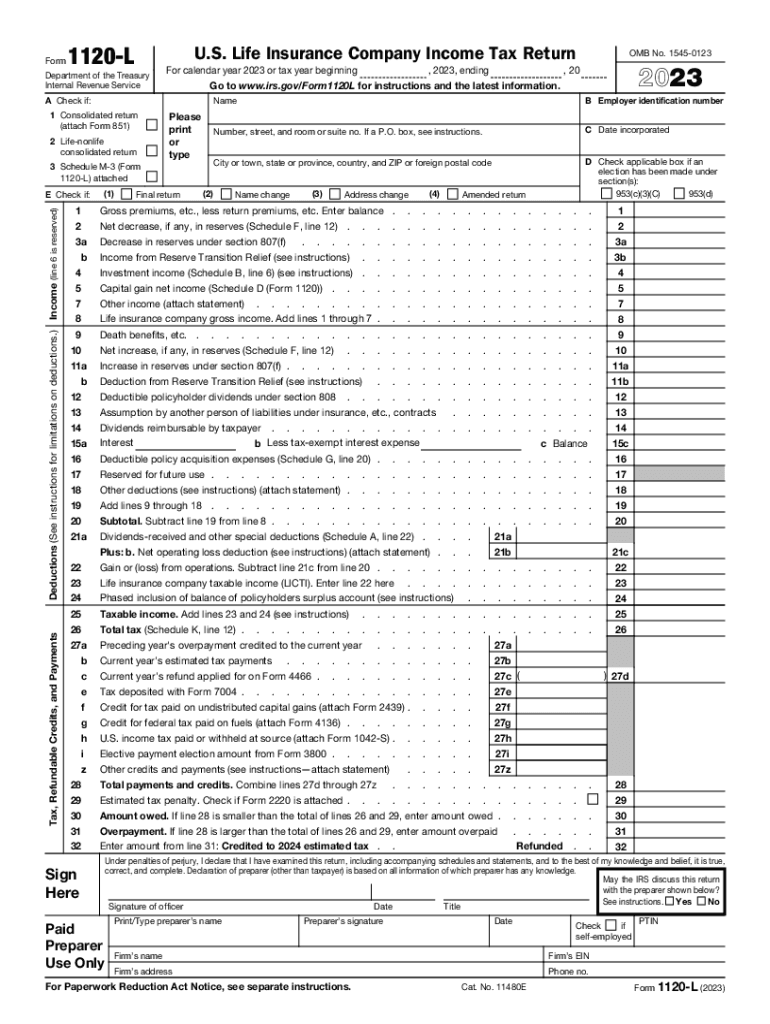

Form1120LU.S. Life Insurance Company Income Tax ReturnDepartment of the Treasury

Internal Revenue ServiceFor calendar year 2023 or tax year beginning2 Lifenonlife

consolidated returnPlease

print

or

type3

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

How to fill out IRS 1120-L

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

Editing the IRS 1120-L form is a straightforward process. To make corrections or updates, download the form, fill in the necessary fields using a PDF editor, or print it out for manual entry. If using software like pdfFiller, simply upload your form and make the appropriate changes online.

How to fill out IRS 1120-L

Filling out the IRS 1120-L form involves several key steps. Start by gathering all necessary financial documents, including income statements and deductions. Then, accurately complete each section of the form, ensuring that all figures are current and reflect your organization's financial reality. Utilize tax preparer's guidance if needed to minimize errors.

About IRS 1120-L 2023 previous version

What is IRS 1120-L?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-L 2023 previous version

What is IRS 1120-L?

IRS Form 1120-L is specifically designed for life insurance companies to report their income, deductions, and tax liability. This form is crucial for compliance with U.S. tax laws governing the financial operations of life insurance entities. It enables the IRS to assess the appropriate taxes owed based on the unique financial structure of these organizations.

What is the purpose of this form?

The primary purpose of IRS Form 1120-L is to ensure that life insurance companies accurately report their income and expenses related to business operations. By filing this form, these companies provide the IRS with the necessary financial information to determine their tax obligations.

Who needs the form?

IRS Form 1120-L must be completed by life insurance companies operating under U.S. jurisdiction. This includes domestic companies involved in issuing life insurance policies. If the organization does not fall under this classification, it is not required to file this specific form.

When am I exempt from filling out this form?

Life insurance companies may be exempt from filing IRS Form 1120-L under certain circumstances. If a company has no income to report for the tax year or operates entirely outside the scope of U.S. tax regulations, it may not need to submit the form. Always consult a tax professional to confirm eligibility for exemption.

Components of the form

The IRS 1120-L consists of several components, including sections for income, deductions, and tax computations. Notable sections include the income statement, where companies report premiums and investment income, and deductions for claims paid, reserves, and other operational costs. Detailed reporting is crucial to meet IRS standards.

Due date

The due date for filing IRS Form 1120-L generally aligns with the corporate tax return filing deadline for most companies. Typically, this date is the 15th day of the third month following the end of the tax year. Organizations should stay informed about any changes to filing dates each tax year.

What payments and purchases are reported?

Reporting on IRS Form 1120-L includes a range of payments and purchases. Companies must disclose premiums collected, investment income, and any operational expenses incurred. Specific line items detail claims paid and other financial obligations related to the life insurance business, ensuring comprehensive transparency.

How many copies of the form should I complete?

When filing IRS Form 1120-L, typically one original copy must be submitted to the IRS. However, it may be advisable to retain additional copies for your records or for state tax filing purposes. Organizations should ensure proper documentation to verify compliance and readiness for potential audits.

What are the penalties for not issuing the form?

Failure to file IRS Form 1120-L on time can result in significant penalties. The IRS may impose a financial penalty based on the amount of tax due for each month the form is late, up to a maximum limit. Additionally, there may be administrative repercussions impacting the company’s standing with the IRS.

What information do you need when you file the form?

To file IRS Form 1120-L accurately, companies need comprehensive financial information, including annual income, claims paid, deductions, and previous tax filings. Organizing this data before filling out the form is essential to expedite the process and reduce errors.

Is the form accompanied by other forms?

Filing IRS Form 1120-L may require additional forms, such as Schedule M-3 for reconciliation of income and expenses. Companies should carefully review the IRS instructions to ensure all necessary documentation is included to avoid filing delays.

Where do I send the form?

Once completed, IRS Form 1120-L must be sent to the specific IRS address designated for business tax returns. This address can vary based on the company's location and whether payment is included. Always check the IRS website for the most current information on where to send your completed form.

See what our users say