What is a W-3 form?

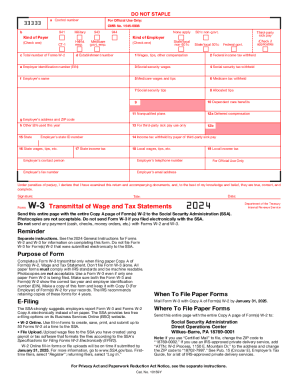

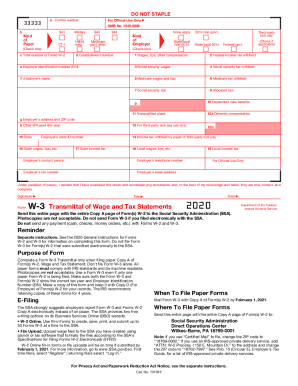

The Form W-3, also known as the Transmittal of Wage and Tax Statement, is designed for taxpayers in the United States. It is used as a document that summarizes and transmits employers' W-2s and reports financial activity to appropriate official institutions. Internal Revenue Service and Social Security Administration utilize data in these forms to keep track of compensations, such as salary, wages, or tips throughout the year.

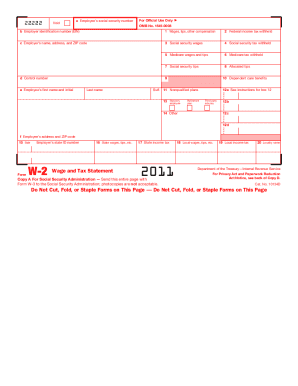

Who should file Form W-3 2011?

All employers are required to submit a W-3 form to the Internal Revenue Service and Social Security Administration along with any W-2s. The W-3 tax form act as cover sheet and summary of all W-2s submitted, so if you file one or more W-2s for your employees, you need to file W-3 form as well.

How do I fill out an IRS Form W-3 in 2012?

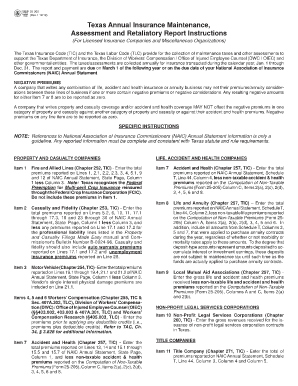

There is a small table to fill out. Check in the box to determine the kind of payer and kind of employer. Provide the correct employer identification number, employer's name and address, territorial ID number, contact person, and fax number. Then provide the amounts of wages, tips, and other compensations, income tax withheld, social security wages, social security tax withheld, Medicare wages, and tax withheld social security tips. There are also sections to input non-qualified plans, deferred compensation, income tax withheld by the payer of third party sick pay.

You can use pdfFiller to accelerate the filing process and fill out the template online:

- Select Get Form at the top of the page.

- Move through fillable fields of the W-3 form template to insert your information.

- Click Done to close the editor.

- Select the Download button from the right sidebar.

- Print it out, attach Copy A of W-2, and send the documents by mail. Otherwise, go to the Business Services Online website.

- Register your account if you are a first-time filer or sign in to your account.

- Upload the prepared documents to the service.

Is Form W-3 accompanied by other documents?

You should file it only together with Copy A of W-2.

When is form W-3 due?

The due date of this record is January 31.

Where do I send the IRS Form W-3?

Unlike W-2s, employers are not required to send W-3 tax forms to their employees. Completed W-3s are only mailed to the Social Security Administration at the follow address:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

W-3s can otherwise be filed with SSA online.