AZ AZ-140V 2015 free printable template

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

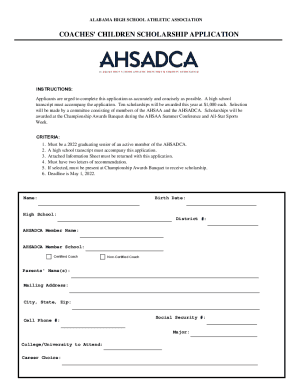

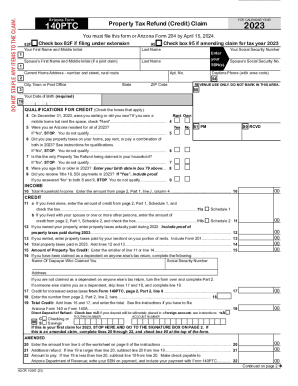

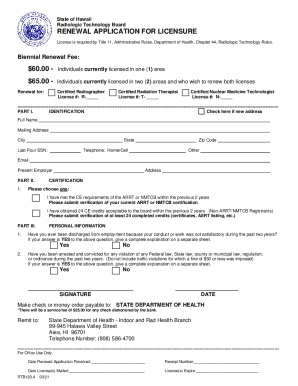

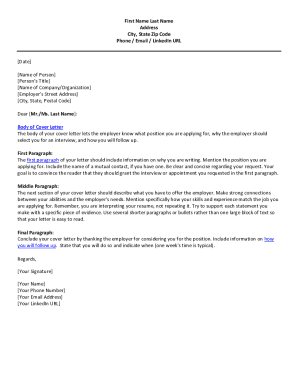

How to fill out AZ AZ-140V

About AZ AZ-140V 2015 previous version

What is AZ AZ-140V?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

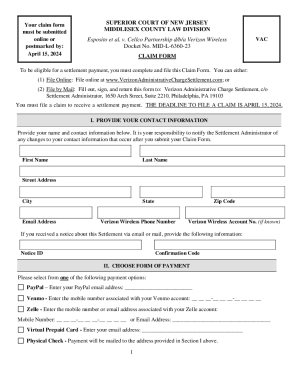

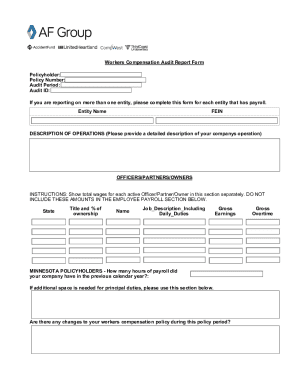

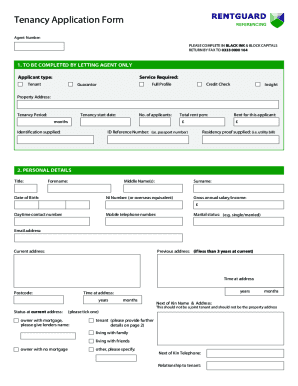

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about AZ AZ-140V

How can I correct mistakes on my submitted AZ AZ-140V?

To correct errors on your submitted AZ AZ-140V, you need to file an amended version of the form. This involves marking the form as amended and ensuring that any corrections are clearly indicated. Keep in mind that it's essential to retain documentation of the original submission and the changes made for your records.

What should I do if my AZ AZ-140V submission is rejected?

If your AZ AZ-140V is rejected, you should first check the specific rejection codes provided. Common issues include incorrect information or formatting errors. Once identified, correct the mistakes and resubmit the form, either through the same method or using an alternate approach if necessary.

What is the record retention period for the AZ AZ-140V?

The record retention period for the AZ AZ-140V generally follows the standard protocols, which stipulate keeping copies for at least four years. This period allows for any audits or inquiries into the submitted information to be adequately addressed and ensures compliance with record-keeping regulations.

Can I e-file my AZ AZ-140V using mobile devices?

Yes, it is possible to e-file your AZ AZ-140V using mobile devices, provided that you are using compatible software or applications designed for form submissions. Ensure that you have a stable internet connection and that your device meets any technical requirements specified for e-filing functions.

What should I do if I receive an audit notice regarding my AZ AZ-140V?

If you receive an audit notice related to your AZ AZ-140V, it’s crucial to respond promptly and gather the necessary documentation that supports your filing. This includes proof of payments, relevant correspondence, and any amendments filed. Consulting with a tax professional can also be beneficial in navigating the audit process.