AZ AZ-140V 2023 free printable template

Show details

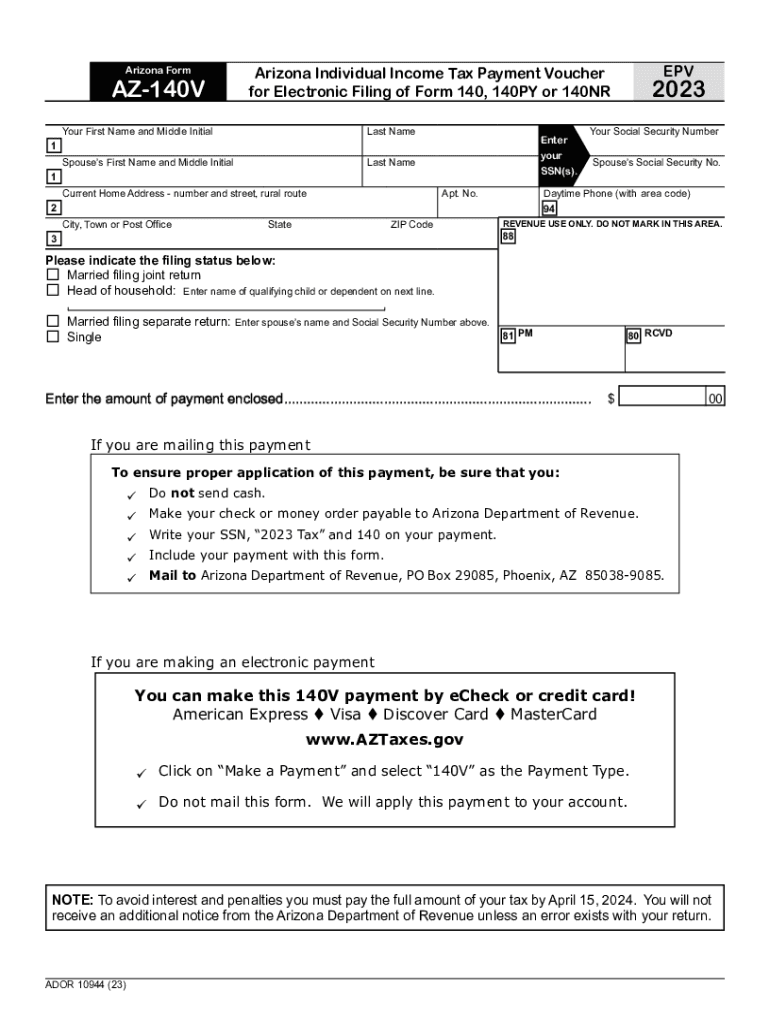

Arizona FormAZ140V

Your First Name and Middle InitialLast NameSpouses First Name and Middle InitialLast NameEnter

your

SSN(s).1

1

Current Home Address number and street, rural routeApt. No.StateZIP

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

How to fill out AZ AZ-140V

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

To edit the AZ AZ-140V tax form, you can use pdfFiller's online editing tools. Simply upload your form to the platform, and then utilize the editing features to make any necessary changes. After editing, you can save or download the completed form for your records.

How to fill out AZ AZ-140V

Filling out the AZ AZ-140V form involves gathering several pieces of information required by the Arizona Department of Revenue. Ensure you have personal identification details, income figures, and any other required documentation at hand. Follow the form instructions carefully to accurately report your financial data.

About AZ AZ-140V 2023 previous version

What is AZ AZ-140V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ AZ-140V 2023 previous version

What is AZ AZ-140V?

The AZ AZ-140V form, known as the Arizona Individual Income Tax Payment Voucher, is used by taxpayers to submit payments along with their income tax returns. This form is particularly useful for those making estimated tax payments or those who owe additional tax at the time of filing.

What is the purpose of this form?

The purpose of the AZ AZ-140V form is to facilitate the payment of taxes owed by individuals to the state of Arizona. It ensures that payments are properly credited against the taxpayer's account and simplifies the processing of individual income tax obligations.

Who needs the form?

Taxpayers who are making payments for their Arizona state income tax obligations need to complete the AZ AZ-140V form. This includes individuals who have underpaid throughout the year or are filing amended returns showing that they owe additional tax.

When am I exempt from filling out this form?

You are exempt from filling out the AZ AZ-140V form if you do not owe any additional taxes or if your total tax liability is already settled or paid through withholding. Additionally, if you are filing your return electronically and paying through electronic means, this form is not required.

Components of the form

The AZ AZ-140V form typically includes sections for personal identification, details about the tax period, and the amount being paid. It may also require information about prior payments and credits that could apply to your current tax liability.

What are the penalties for not issuing the form?

Failing to file the AZ AZ-140V form when required can lead to penalties, including fines and interest on the unpaid amount. The Arizona Department of Revenue may assess penalties for late payments or insufficient payments, which can increase the overall amount due.

What information do you need when you file the form?

When filing the AZ AZ-140V form, you will need to provide your Social Security number, details regarding your payment amount, and tax period. It's also helpful to have your last year’s tax return on hand for reference to ensure accuracy.

Is the form accompanied by other forms?

The AZ AZ-140V form may accompany your individual income tax return or serve as a standalone payment voucher. If you’re filing your return and providing payment at the same time, ensure that both forms are properly completed and submitted together.

Where do I send the form?

The completed AZ AZ-140V form should be mailed to the Arizona Department of Revenue at the address specified in the form instructions. If submitting online, ensure you follow the respective online payment procedures outlined by the Department of Revenue.

See what our users say