AZ AZ-140V 2024-2025 free printable template

Show details

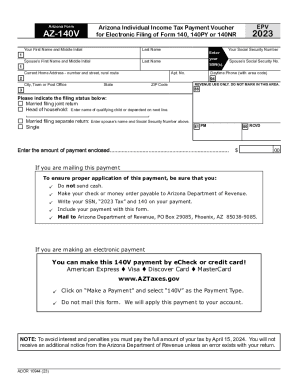

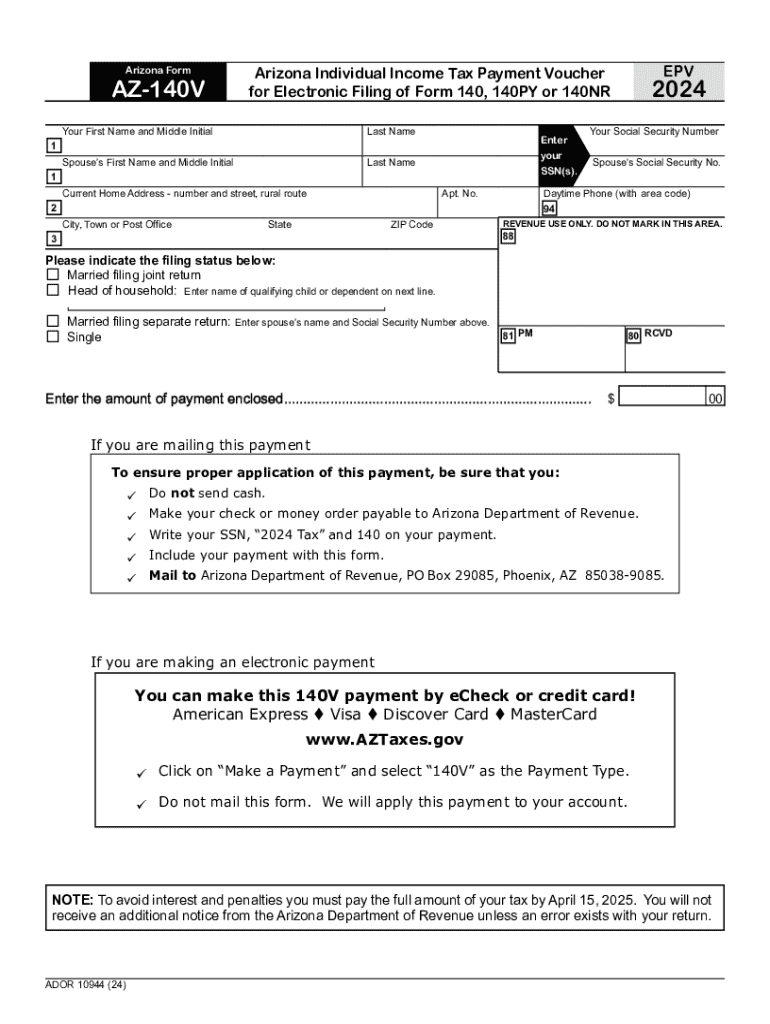

Arizona Form AZ-140V EPV Arizona Individual Income Tax Payment Voucher for Electronic Filing of Form 140, 140PY or 140NR Your First Name and Middle Initial Last Name Spouse’s First Name and Middle

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

How to fill out AZ AZ-140V

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

To edit the AZ AZ-140V tax form, you can utilize the features available on pdfFiller. Start by uploading the form to the platform. Once uploaded, click on the fields that need to be modified. You can add text, dates, or checkboxes as necessary. After making your changes, ensure to save the updated version to prevent data loss.

How to fill out AZ AZ-140V

Filling out the AZ AZ-140V requires specific information related to tax obligations. Follow these steps to ensure accurate completion:

01

Obtain a copy of the form from a reliable source or download it from the official website.

02

Read the instructions carefully to understand what information is requested.

03

Provide your personal information, including your name, address, and taxpayer identification number.

04

Fill in any relevant sections based on your specific tax situation.

05

Review all entries to ensure accuracy before submission.

Latest updates to AZ AZ-140V

Latest updates to AZ AZ-140V

The AZ AZ-140V is reviewed and updated periodically to reflect changes in tax laws and requirements. Always check the official Arizona Department of Revenue website or tax news outlets for the most current version and any amendments. This ensures you're working with the correct and updated form for your filings.

All You Need to Know About AZ AZ-140V

What is AZ AZ-140V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About AZ AZ-140V

What is AZ AZ-140V?

AZ AZ-140V refers to the Arizona transaction privilege tax (TPT) form. This form is essential for taxpayers engaging in activities subject to Arizona's transaction privilege tax, which is similar to a sales tax levied on businesses and service providers.

What is the purpose of this form?

The purpose of the AZ AZ-140V is to report and remit transaction privilege taxes owed to the state of Arizona. Businesses and individuals use this form to disclose their tax liability related to sales, services, or other taxable transactions conducted in the state.

Who needs the form?

Any individual or business entity that conducts taxable transactions in Arizona must complete the AZ AZ-140V. This includes retailers, service providers, and manufacturers who are selling goods or services to Arizona residents.

When am I exempt from filling out this form?

Exemptions from filing the AZ AZ-140V may apply in certain situations, such as specific organizations or types of transactions deemed non-taxable under Arizona law. For instance, some non-profit organizations and government entities may be exempt. It is crucial to verify your exemption status with the Arizona Department of Revenue.

Components of the form

The AZ AZ-140V consists of several key sections, including taxpayer identification details, income types, and tax liabilities. The form typically includes fields for reporting gross income, deductions, and the total tax due, segmented by applicable business classifications.

Due date

The due date for submitting the AZ AZ-140V is usually the 20th of the month following the reporting period. For example, if you are filing for January, the form is due by February 20. Consulting the Arizona Department of Revenue for specific deadlines is advised, especially during tax season or during changes in tax law.

What payments and purchases are reported?

The AZ AZ-140V requires the reporting of all taxable sales, services provided, and any business activities that attract the transaction privilege tax. This includes both retail sales and the provision of taxable services.

How many copies of the form should I complete?

Typically, you need to complete one copy of the AZ AZ-140V for submission. However, it is advisable to keep a copy for your records and reference any transactions reported in future filings.

What are the penalties for not issuing the form?

Failing to file the AZ AZ-140V or inaccuracies in the submission can lead to penalties, which may include fines and interest charges on taxes owed. Repeated failures to comply can result in more severe consequences, such as audit increased scrutiny from the Arizona Department of Revenue.

What information do you need when you file the form?

When filing the AZ AZ-140V, you need to provide accurate personal information, detail all taxable sales and services provided, and calculate the total tax liability. It is also important to have documentation ready in case the state requires proof or verification of the reported figures.

Is the form accompanied by other forms?

Depending on your business activities, you may be required to submit additional forms alongside the AZ AZ-140V. Consulting the guidelines provided by the Arizona Department of Revenue will help determine if supplementary forms are necessary for your specific situation.

Where do I send the form?

Completed AZ AZ-140V forms should be mailed to the Arizona Department of Revenue at the address specified on the form. Electronic submission may also be available, which could expedite processing. Always check the latest filing instructions for the preferred submission methods.

See what our users say