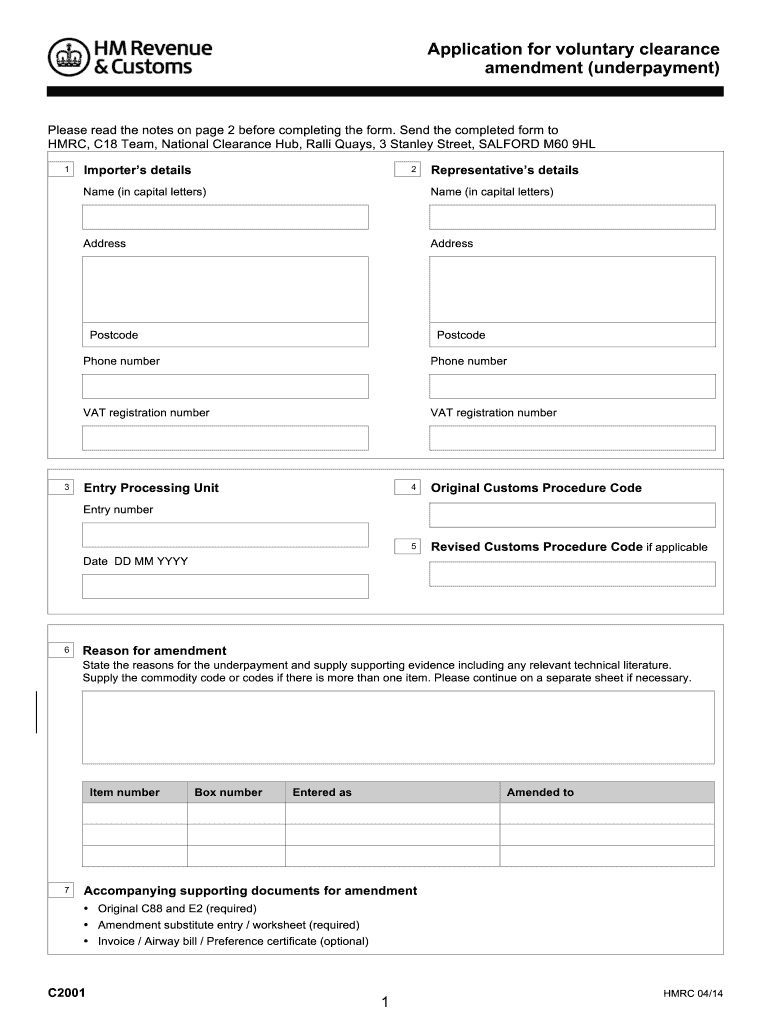

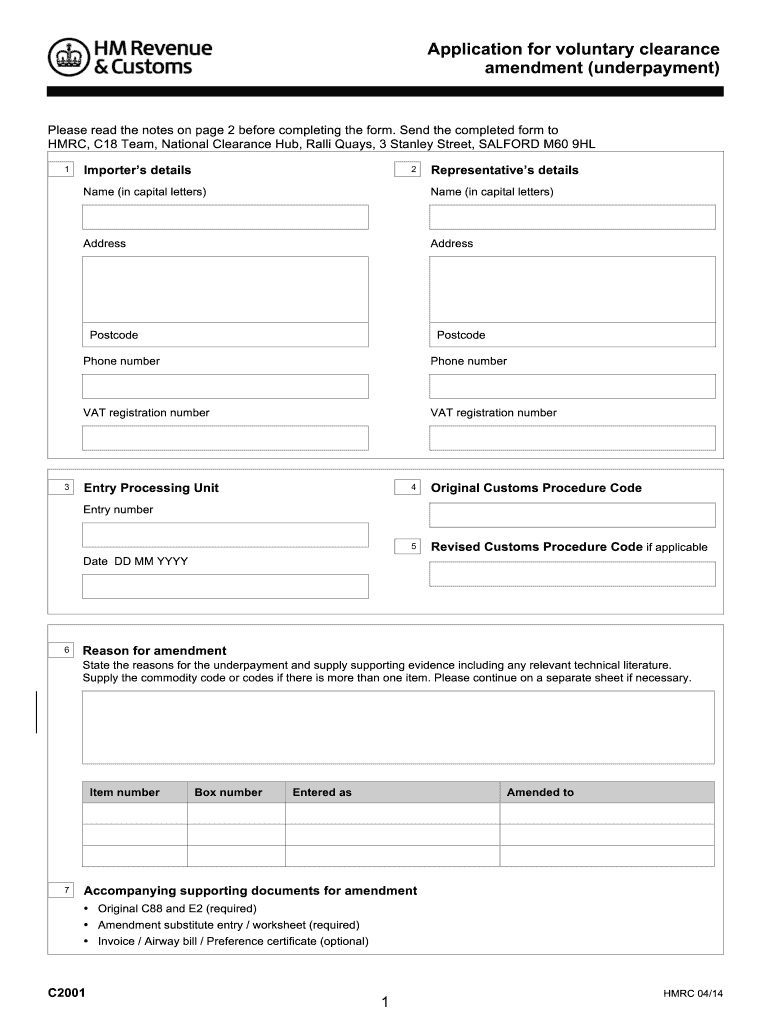

UK HMRC C2001 2014-2025 free printable template

Get, Create, Make and Sign UK HMRC C2001

How to edit UK HMRC C2001 online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC C2001 Form Versions

How to fill out UK HMRC C2001

How to fill out UK HMRC C2001

Who needs UK HMRC C2001?

Instructions and Help about UK HMRC C2001

Hi I'm Kate I'm Service Designed for GOV UK the online home for all the UK governments content and services Over the last year I've been part of a team that's trying to change the way that citizens interact with public services online Every week millions of people come to GOV UK to do complex and sometimes really life-changing tasks like registering a birth learning to drive or starting a business And we know this stuff isn't easy There's lots of information to find and transactions to complete And when users find this stuff hard to do it costs them and the government time and money So we created something new on GOV UK Something that were calling step by step journeys These journeys guide users through complex tasks breaking them down into clear steps with simple guidance Over the last year we've worked with 15 different government departments leading a process of collaborative service design The outcome is that were now able to present crucial government services previously complex and fragmented as simple step by step journeys These include learning to drive a car getting childcare starting a business or what to do when someone dies Since launch they've been used by over 105 million people who are now completing services quicker and easier than before For example we've seen an increase in the number of successful applications for free child care as a result And this pattern is repeated across the services we've worked on This is a project that helps government redesign and improve end-to-end services This is government working collaboratively to bring together content improve that content and then start to work on the underlying service and policy This is a big step forwards for government, but it's just the beginning There are hundreds of these journeys we want to build providing simple online services for the things that really matter Thanks

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit UK HMRC C2001 on an iOS device?

How do I edit UK HMRC C2001 on an Android device?

How do I fill out UK HMRC C2001 on an Android device?

What is UK HMRC C2001?

Who is required to file UK HMRC C2001?

How to fill out UK HMRC C2001?

What is the purpose of UK HMRC C2001?

What information must be reported on UK HMRC C2001?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.