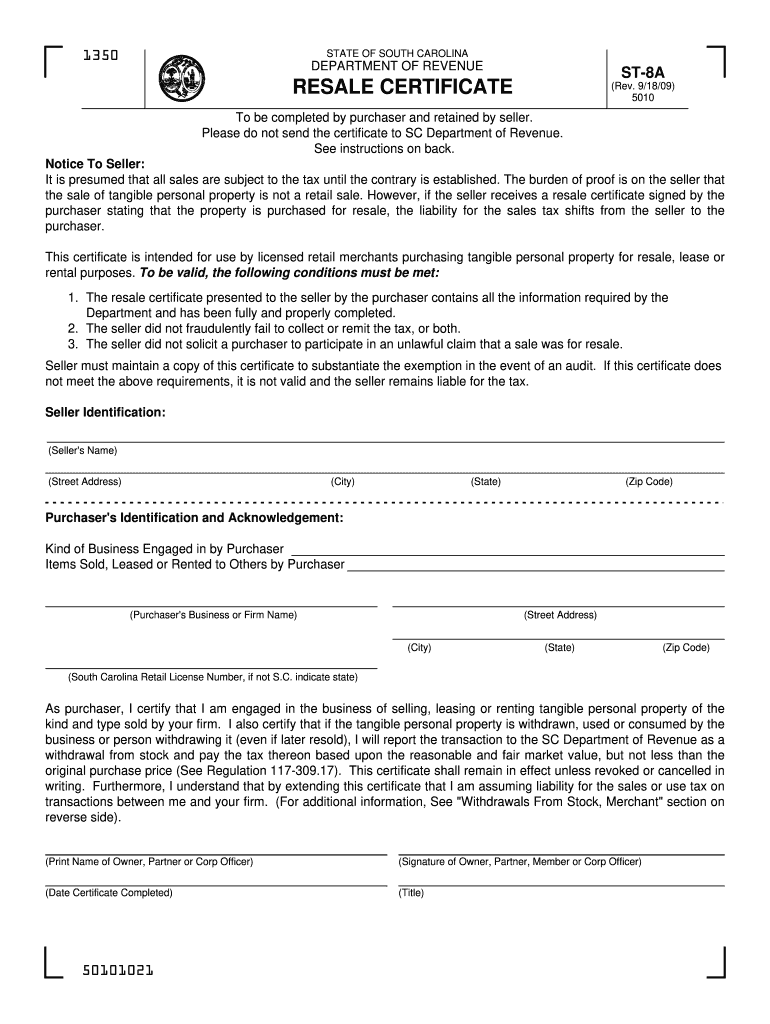

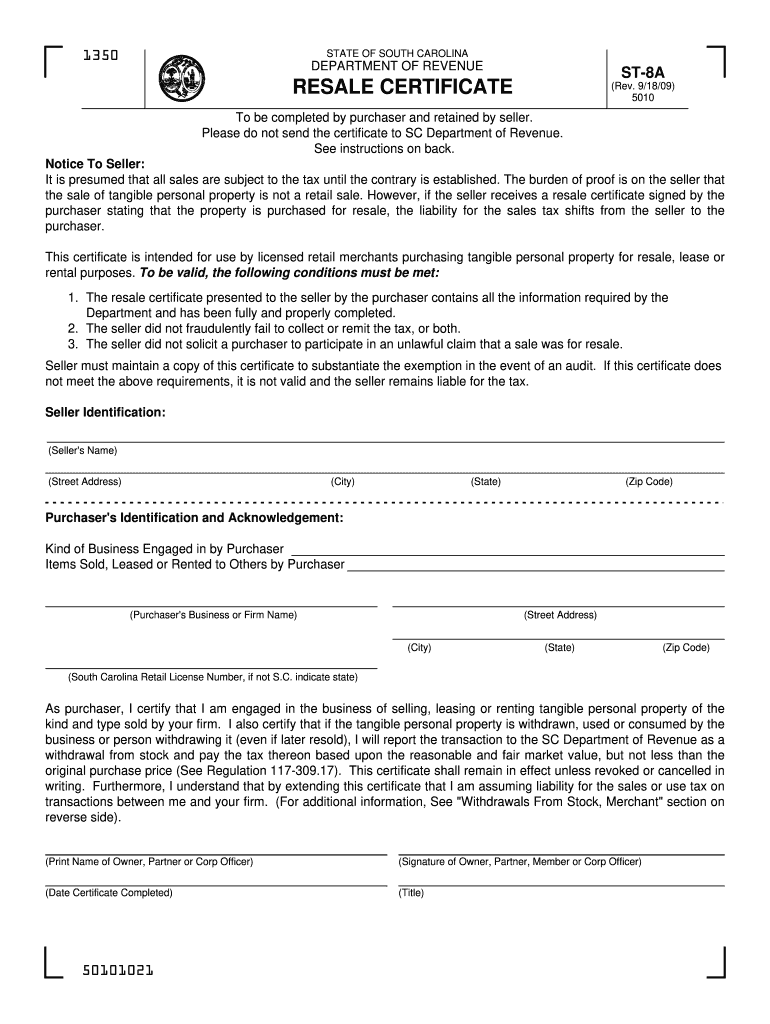

SC DoR ST-8A 2009 free printable template

Show details

A South Carolina Note A copy of Form ST-8A Resale Certificate can be found at the Department s website www. STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE ST-8A RESALE CERTIFICATE Rev. 9/18/09 To be completed by purchaser and retained by seller. Sctax. org. It is not required that Form ST-8A be used but the information requested on the form is required on any resale certificate accepted by the seller. Please do not send the certificate to SC Department of Revenue. See instructions on back....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR ST-8A

Edit your SC DoR ST-8A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR ST-8A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR ST-8A online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SC DoR ST-8A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR ST-8A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR ST-8A

How to fill out SC DoR ST-8A

01

Download the SC DoR ST-8A form from the official website or request a physical copy.

02

Begin by filling out your personal information, including your name, address, and contact information.

03

Identify the type of claim you are submitting and enter the relevant details in the designated sections.

04

Provide documentation to support your claim, such as receipts or relevant records.

05

Review the form for accuracy and completeness to avoid delays.

06

Sign and date the form at the bottom to certify the information provided.

07

Submit the completed form either electronically or via postal mail to the appropriate address listed on the form.

Who needs SC DoR ST-8A?

01

Individuals or businesses seeking to claim a tax refund or credit.

02

Tax preparers or accountants assisting clients with tax filings.

03

Any party requiring to report specific tax-related information to the Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What sales are exempt from NYS sales tax?

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

What items are exempt from sales tax in New York?

Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax. Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

What is the Virginia sales tax exemption?

Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for resale,” where you buy something with the intent of selling it to someone else.

What products do not get taxed?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices. Sales of items paid for with food stamps.

How can I avoid paying sales tax in USA?

Yet because most states tax most sales of goods and require consumers to remit use tax if sales tax isn't collected at checkout, the only way to avoid sales tax is to purchase items that are tax exempt.

What services are exempt from sales tax in California?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices. Sales of items paid for with food stamps.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SC DoR ST-8A directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your SC DoR ST-8A and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make edits in SC DoR ST-8A without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your SC DoR ST-8A, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit SC DoR ST-8A on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share SC DoR ST-8A on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is SC DoR ST-8A?

SC DoR ST-8A is a specific form used for reporting sales and use tax in South Carolina.

Who is required to file SC DoR ST-8A?

Businesses and individuals who have taxable sales or use tax obligations in South Carolina are required to file SC DoR ST-8A.

How to fill out SC DoR ST-8A?

To fill out SC DoR ST-8A, taxpayers should provide their business details, report total sales, calculate taxes owed, and complete other required fields as instructed.

What is the purpose of SC DoR ST-8A?

The purpose of SC DoR ST-8A is to provide a comprehensive report of sales and use tax liabilities for accurate tax collection and compliance.

What information must be reported on SC DoR ST-8A?

Information that must be reported on SC DoR ST-8A includes the total sales, exempt sales, taxable sales, and the total amount of sales and use tax owed.

Fill out your SC DoR ST-8A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR ST-8a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.