SC DoR ST-8A 2016 free printable template

Show details

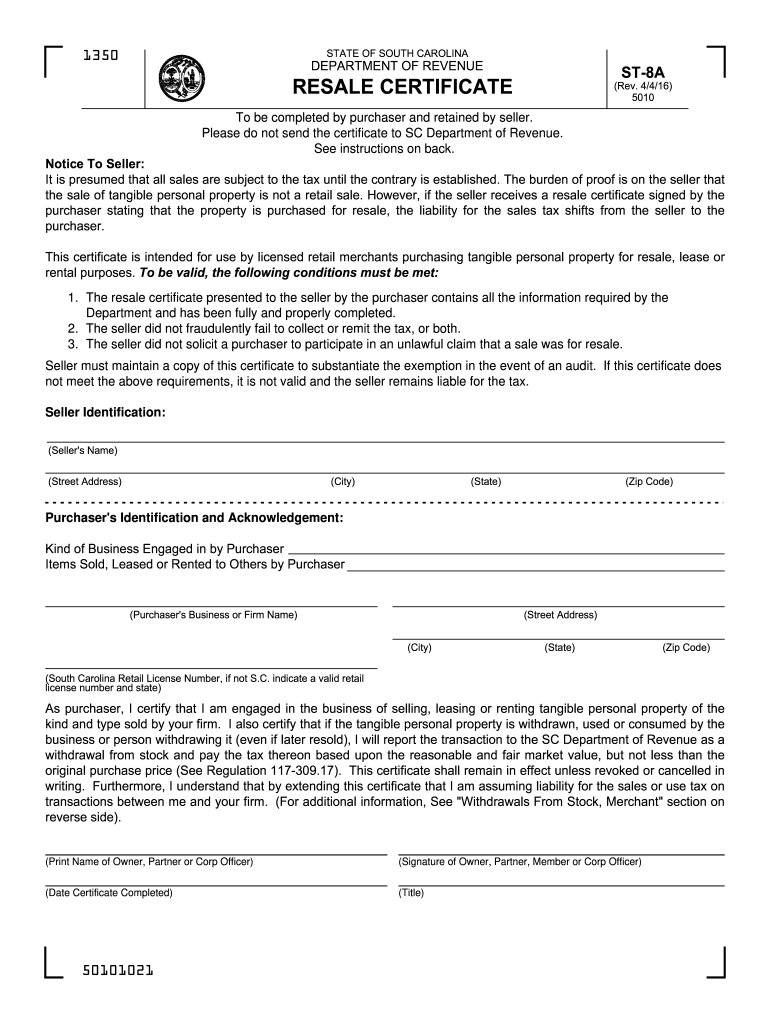

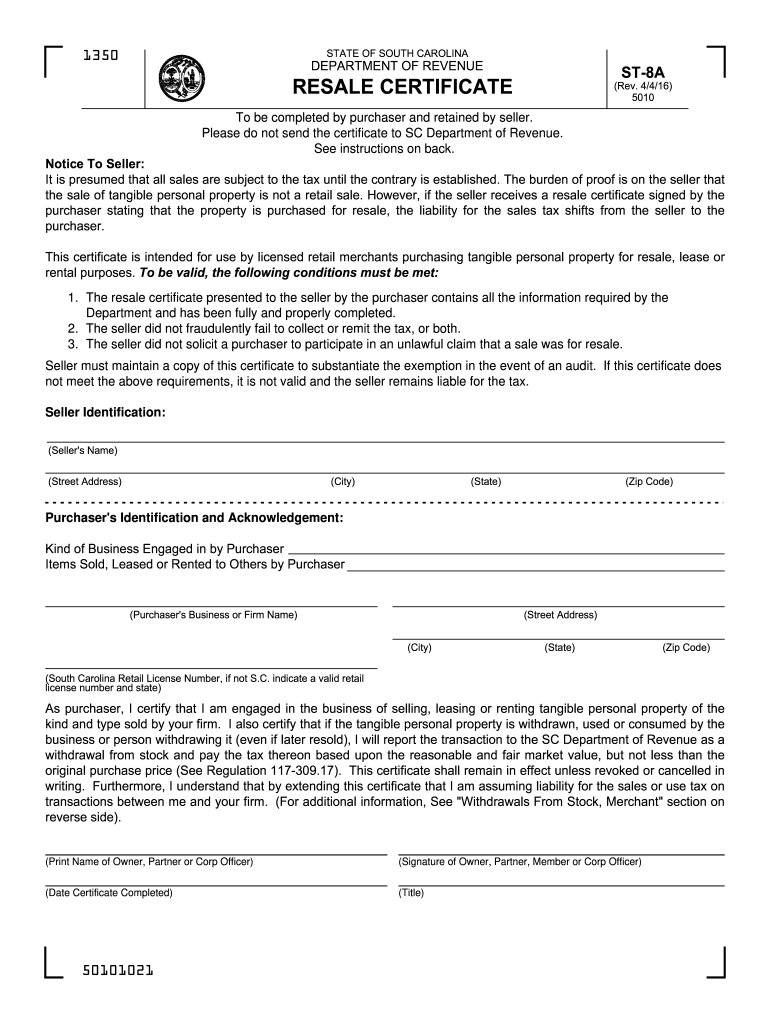

STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST-8A RESALE CERTIFICATE (Rev. 4/4/16) 5010 To be completed by purchaser and retained by seller. Please do not send the certificate to SC Department

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR ST-8A

Edit your SC DoR ST-8A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR ST-8A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR ST-8A online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SC DoR ST-8A. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR ST-8A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR ST-8A

How to fill out SC DoR ST-8A

01

Visit the official website of the SC Department of Revenue.

02

Download the SC DoR ST-8A form or access it online.

03

Fill in the taxpayer information, including name, address, and identification number.

04

Specify the type of exemption being claimed.

05

Provide details regarding the items or services for which the exemption is requested.

06

Review the completed form for accuracy.

07

Submit the form either online or by mail to the appropriate department.

Who needs SC DoR ST-8A?

01

Businesses or organizations seeking tax exemptions in South Carolina.

02

Individuals or entities involved in transactions that qualify for exemption.

03

Tax professionals assisting clients with exemption claims.

Fill

form

: Try Risk Free

People Also Ask about

Does South Carolina require a resale certificate?

South Carolina does not require registration with the state for a resale certificate.

Is a retail license the same as a resale certificate in South Carolina?

The Retail License allows a business to sell and collect sales tax from taxable products and services in the state, while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

What is SC 12 36 2120 17?

South Carolina Code §12-36-2120(17) and South Carolina Regulation 117-302.6 classify pollution control machines as machines used in mining, quarrying, compounding, processing, agricultural packaging, or manufacturing of tangible personal property when installed and operated for compliance with an order of an agency of

What is the difference between a w9 and resale certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

Does SC accept out of state resale certificates?

Another state's resale certificate and number is acceptable in this State. Indicate the other state's number on the front when using this form. A wholesaler's exemption number may be applicable in lieu of a retail license number.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC DoR ST-8A from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your SC DoR ST-8A into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send SC DoR ST-8A to be eSigned by others?

SC DoR ST-8A is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit SC DoR ST-8A on an iOS device?

Use the pdfFiller mobile app to create, edit, and share SC DoR ST-8A from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is SC DoR ST-8A?

SC DoR ST-8A is a specific form used for reporting purposes related to certain transactions or activities as mandated by the South Carolina Department of Revenue.

Who is required to file SC DoR ST-8A?

Individuals or businesses that are engaged in the activities specified by the South Carolina Department of Revenue and meet the filing criteria are required to file SC DoR ST-8A.

How to fill out SC DoR ST-8A?

To fill out SC DoR ST-8A, individuals or businesses should follow the instructions provided by the South Carolina Department of Revenue, ensuring that all required information is entered accurately and completely before submission.

What is the purpose of SC DoR ST-8A?

The purpose of SC DoR ST-8A is to collect specific data that assists the South Carolina Department of Revenue in monitoring and regulating certain financial activities.

What information must be reported on SC DoR ST-8A?

The information that must be reported on SC DoR ST-8A includes details about the taxpayer, the nature of the transactions, amounts involved, and any other relevant information required by the form's guidelines.

Fill out your SC DoR ST-8A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR ST-8a is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.