SC DoR ST-8A 2002 free printable template

Show details

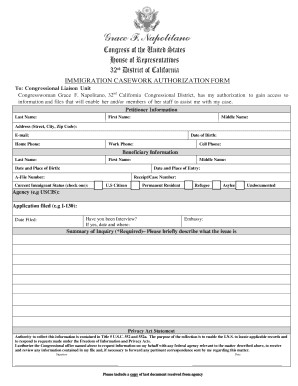

DEPARTMENT OF REVENUE ST-8A RESALE CERTIFICATE Rev. 6/4/02 STATE OF SOUTH CAROLINA Notice To Seller It is presumed that all sales are subject to the tax until the contrary is established. The burden of proof is on the seller that the sale of tangible personal property is not a retail sale.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR ST-8A

Edit your SC DoR ST-8A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR ST-8A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR ST-8A online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SC DoR ST-8A. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR ST-8A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR ST-8A

How to fill out SC DoR ST-8A

01

Obtain the SC DoR ST-8A form from the official website or relevant office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide your Social Security Number or Tax ID where required.

04

Complete the income information section, detailing all sources of income.

05

Include any deductions or credits relevant to your financial situation.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the form either electronically or by mailing it to the appropriate office as instructed.

Who needs SC DoR ST-8A?

01

Individuals or entities who are required to report and remit certain taxes or fulfill specific tax obligations.

02

Businesses that need to document and declare information related to their tax filings.

03

Taxpayers who are seeking to claim deductions or credits related to state taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the ST 10 exemption in SC?

The Application for Certificate ST-10 is the document that must be filed in South Carolina in order for a business to claim the Utility Sales Tax Exemption. In South Carolina, a detailed energy study must be performed to identify the exact percentage of utility that is exempt from sales tax.

How do I get a reseller permit in SC?

The first step you need to take in order to get a resale certificate, is to apply for a SC Retail License. This license will furnish a business with a unique Sales Tax Number, otherwise referred to as a Sales Tax ID Number. Once you have that, you are eligible to issue a resale certificate.

What is South Carolina senior sales tax exemption?

How does an individual 85 years of age or older request the 1% lower state sales and use tax rate? A. South Carolina Code Sections 12-36-2620, 12-36-2630, and 12-36-2640 provide for the 1% lower state sales and use tax rate for individuals 85 years of age or older.

How much is a reseller permit in SC?

The cost to register for a South Carolina retail license is $50 and a separate retail license is required for each location. The license is valid for as long as the same retailer operates the business at that location (unless revoked by the Department of Revenue). Separate local business licenses may also be required.

Do South Carolina exemption certificates expire?

How long is my South Carolina sales tax exemption certificate good for? There is no explicitly stated expiration period for these exemption certificate, the business the apply to must simply still be in operation.

How do I get a reseller license in South Carolina?

South Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in South Carolina? To get a resale certificate in South Carolina, you will need to fill out the South Carolina Resale Certificate (Form ST-8A).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send SC DoR ST-8A for eSignature?

Once you are ready to share your SC DoR ST-8A, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit SC DoR ST-8A online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your SC DoR ST-8A to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the SC DoR ST-8A in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your SC DoR ST-8A and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is SC DoR ST-8A?

SC DoR ST-8A is a form used in South Carolina for reporting sales and use tax information to the Department of Revenue.

Who is required to file SC DoR ST-8A?

Businesses that engage in selling goods or services subject to sales and use tax in South Carolina are required to file SC DoR ST-8A.

How to fill out SC DoR ST-8A?

To fill out SC DoR ST-8A, provide business information, report total sales, exempt sales, tax liability, and any deductions, and sign the form.

What is the purpose of SC DoR ST-8A?

The purpose of SC DoR ST-8A is to calculate and report the amount of sales and use tax a business owes to the state.

What information must be reported on SC DoR ST-8A?

Information that must be reported includes total sales, exempt sales, taxable items, tax rates, and the total tax due.

Fill out your SC DoR ST-8A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR ST-8a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.