Get the free tax return routing pdf

Show details

Project Routing Sheet Client Records: Client: Jones, Ron & Jenny (JONES) Due Date: Project: Individual Income Tax Return (491) Project Information Update Client Information Contact Name: Ron Jones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample tax return pdf form

Edit your tax return routing pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax return routing pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax return routing pdf online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax return routing pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax return routing pdf

How to fill out tax return routing pdf:

01

Start by obtaining the tax return routing pdf form from the appropriate source. This could be the official government website or a trusted tax resource.

02

Open the downloaded form using a compatible PDF reader or software. Make sure you have the necessary tools to fill out the form electronically.

03

Begin filling out the form by providing your personal information. This typically includes your name, address, social security number, and other identifying details.

04

Proceed to the income section of the form. Here, you will need to accurately report your earnings from various sources such as employment, self-employment, investments, and any other relevant income.

05

Deductions and credits come next. Determine if you qualify for any deductions or credits and provide the required information accordingly. This could include expenses related to education, healthcare, or homeownership.

06

Double-check all the entered information to ensure accuracy and completeness. Any mistakes or missing details could lead to complications in the tax filing process.

07

Once the form is filled out correctly, save a copy of the completed form for your records. It is always a good practice to keep a copy of your tax returns for future reference.

Who needs tax return routing pdf:

01

Individuals who are required to file income taxes in their respective countries or jurisdictions may need the tax return routing pdf. This could include employed individuals, self-employed individuals, and those with certain types of income or investments that fall under tax regulations.

02

Business owners and entrepreneurs who are responsible for filing business tax returns may also require the tax return routing pdf.

03

Tax professionals, accountants, or tax preparation services may use the tax return routing pdf to provide assistance to their clients in filling out and submitting their tax returns accurately.

Note: The specific requirements for tax return forms may vary depending on the country and tax laws applicable to the individual or business. It is important to consult with a tax professional or utilize trusted resources to ensure compliance with all relevant regulations.

Fill

form

: Try Risk Free

People Also Ask about

Can you upload PDF tax return?

From the Main Menu of the tax return (Form 1040) select: Personal Information. Attach PDF Document. New - navigate to the document, select it, then click Open.

How do I download or print a copy of my tax return?

To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2022, the IRS charges $43 for each return you request.

How do I get a PDF of my tax return?

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return. Refer to the form for instructions and for the processing fee.

Can I print tax forms off the Internet?

Can I Print Tax Forms Online? Yes, you can print the tax forms you download for free from the IRS website. You can also print forms from other sites that offer free downloads. If you use an online filing software, you can usually print the forms after you use the software to complete all the information.

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

How do I get a $10000 tax refund 2023?

CAEITC Be 18 or older or have a qualifying child. Have earned income of at least $1.00 and not more than $30,000. Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children. Living in California for more than half of the tax year.

What is the best way to send documents to IRS?

Use a Secure Method To Mail Your Return Always use a secure method, such as certified mail return receipt requested, when you're sending returns and other documents to the IRS. This will provide confirmation that the IRS has actually received your documents or payment.

How can I get a copy of my tax return from a PDF?

The only way you can obtain copies of your tax return from the IRS is by filing Form 4506 with the IRS. You can download this form from the IRS website.

Can I send a copy of my tax return to IRS?

If you need a photocopy of a previously processed tax return and attachments, complete Form 4506, “Request for Copy of Tax Form” and mail it to the IRS address listed on the form for your area. There is a fee of $39.00 for each tax period requested.

Which routing number do I use for IRS?

On the sample check above, the routing number is 250250025. The Bank Account Number can be up to 17 digits.

How do I create an IRS fillable PDF form?

Visit the Free File Site. Select "Free File Fillable Forms Now” and then hit “Leave IRS Site” after reading the disclaimer. Start the Process. Select “Start Free File Fillable Forms” and hit “Continue.” Get Registered. Select Your 1040. Fill Out Your Tax Forms. E-File Your Tax Form. CREATE AN ACCOUNT. Complete Your Account.

Can you fill out tax forms digitally?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online. Electronically sign and file your return.

Does the IRS have fillable PDF forms?

Yes. You can use Free File Fillable Forms to e-file your federal return. This means you are filing your return electronically over the Internet.

How do I correct my routing number on my tax return?

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax return routing pdf?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tax return routing pdf to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out tax return routing pdf using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tax return routing pdf and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out tax return routing pdf on an Android device?

Use the pdfFiller app for Android to finish your tax return routing pdf. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

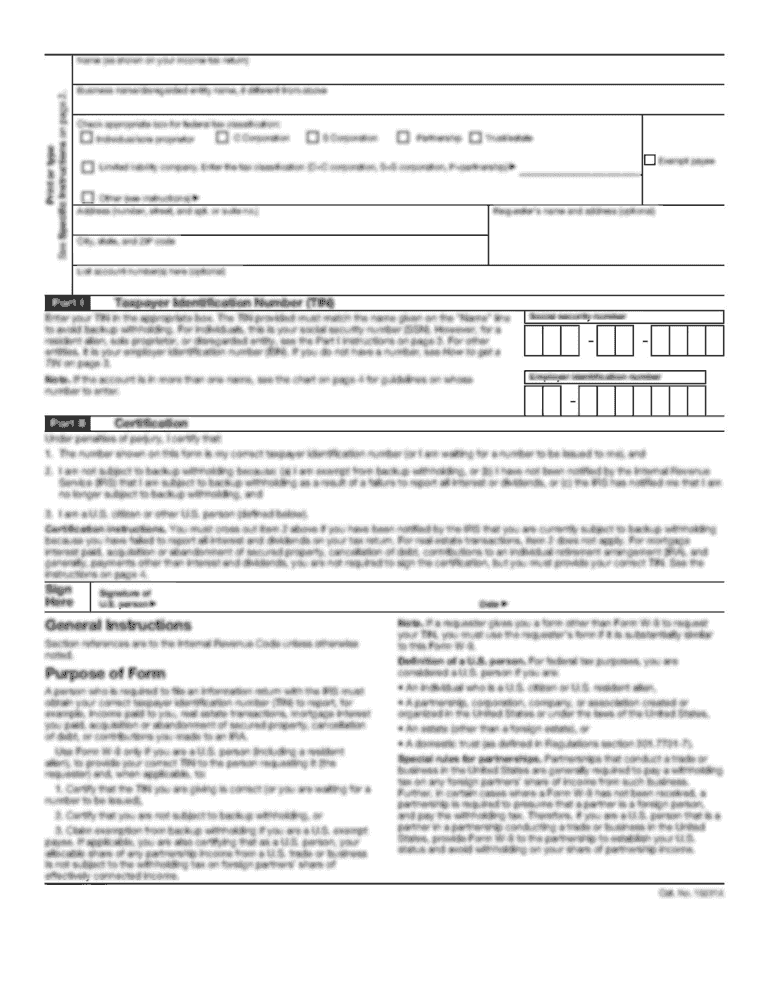

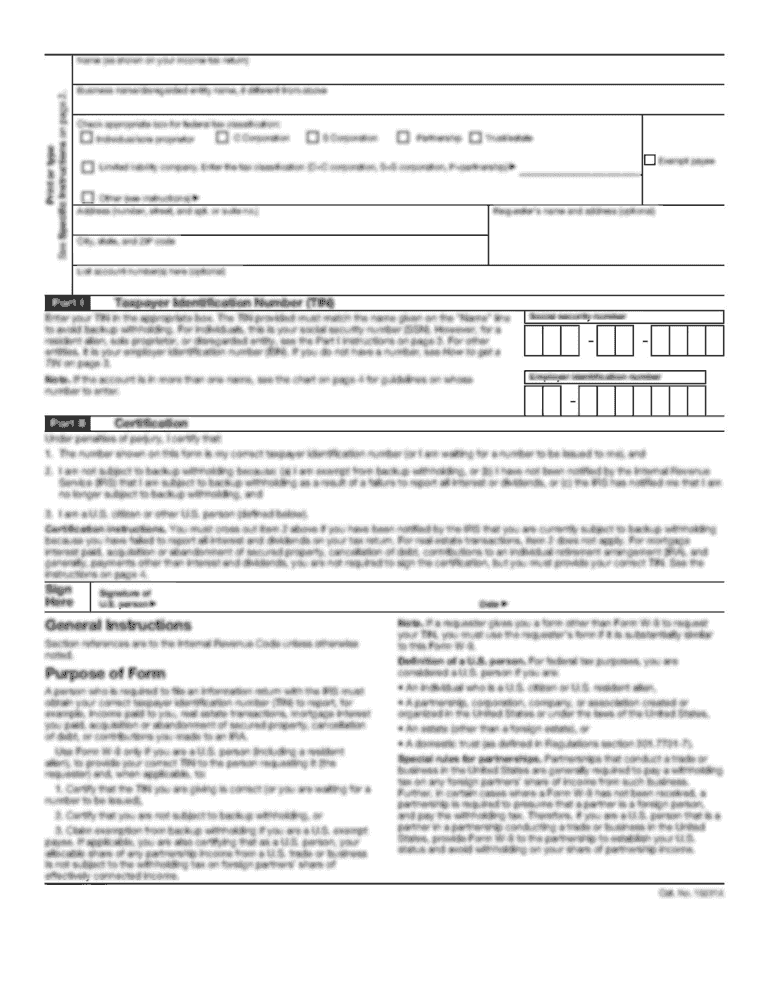

What is tax return routing pdf?

A tax return routing PDF is a specific document format used to organize and guide the submission of tax returns, often providing instructions on how to properly route the completed forms to the appropriate tax authorities.

Who is required to file tax return routing pdf?

Individuals and businesses that need to submit their tax returns to the relevant tax authorities are required to use tax return routing PDFs, especially if they are mandated by specific tax regulations or if their tax software provides this format.

How to fill out tax return routing pdf?

To fill out a tax return routing PDF, download the document, enter your personal and financial information accurately into the specified fields, review the information for correctness, and save or print the completed form according to the submission guidelines.

What is the purpose of tax return routing pdf?

The purpose of a tax return routing PDF is to facilitate the organization and submission of tax documents, ensuring that they are directed to the correct tax office and processed efficiently.

What information must be reported on tax return routing pdf?

The information that must be reported on a tax return routing PDF typically includes taxpayer identification details, income information, deductions and credits, and any additional required documentation that supports the tax return.

Fill out your tax return routing pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Return Routing Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.