UK HMRC SA700 2013 free printable template

Show details

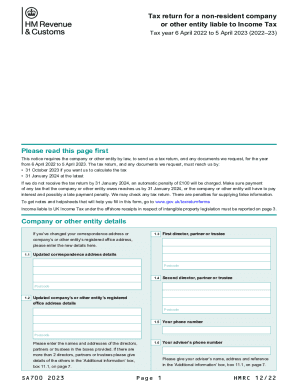

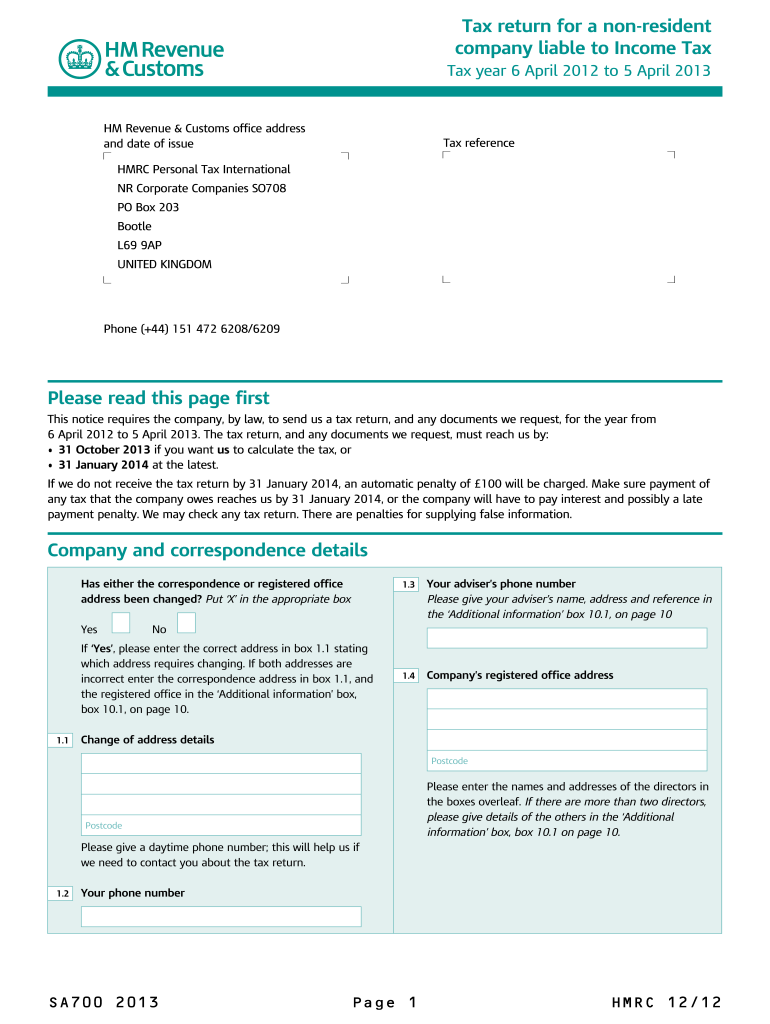

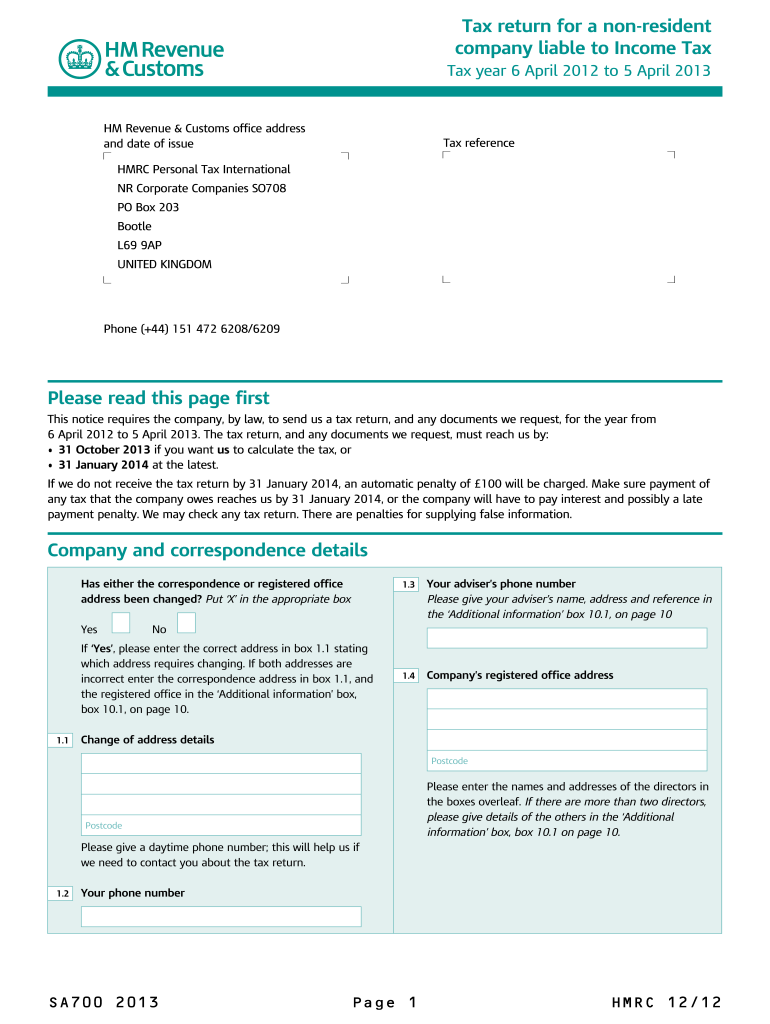

Tax return for a non-resident company liable to Income Tax Tax year 6 April 2013 to 5 April 2014 HM Revenue Customs office address and date of issue Tax reference HMRC Personal Tax International NR Corporate Compliance SO708 PO Box 203 BOOTLE L69 9AP UNITED KINGDOM Phone 44 151 472 6208/6209 Please read this page first This notice requires the company by law to send us a tax return and any documents we request for the year from 6 April 2013 to 5 April 2014. The tax return and any documents we...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2013 sa 700 form

Edit your 2013 sa 700 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 sa 700 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 sa 700 form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2013 sa 700 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC SA700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2013 sa 700 form

How to fill out UK HMRC SA700

01

Gather all necessary personal information, including your name, address, and National Insurance number.

02

Obtain your Unique Taxpayer Reference (UTR) to identify your tax records.

03

Fill out the identification section with your personal details.

04

Provide details about your income sources and the nature of your self-employment.

05

Include information about any taxable profits and losses.

06

Complete the sections on expenses and any relevant deductions.

07

Review your completed form for accuracy.

08

Submit the form to HMRC by the specified deadline.

Who needs UK HMRC SA700?

01

The UK HMRC SA700 is needed by individuals who are self-employed or have income from partnerships or other untaxed sources.

02

It is primarily intended for UK residents with income that is not taxed at source.

Fill

form

: Try Risk Free

People Also Ask about

What is the split year treatment for HMRC?

What is the effect of split-year treatment? If the special rules apply, you pay UK income tax as a UK resident for income earned in the 'UK part' of the year and you pay income tax as a non-resident for income earned in the 'overseas part' of the year.

How does split year treatment work?

What is the effect of split-year treatment? If the special rules apply, you pay UK income tax as a UK resident for income earned in the 'UK part' of the year and you pay income tax as a non-resident for income earned in the 'overseas part' of the year.

How long do you have to stay out of the UK to avoid paying tax?

You can live abroad and still be a UK resident for tax, for example if you visit the UK for more than 183 days in a tax year. Pay tax on your income and profits from selling assets (such as shares) in the normal way. You usually have to pay tax on your income from outside the UK as well.

What is the split year treatment for the UK statutory residence test?

Split Year: when split year treatment applies: If you are leaving the UK you are treated as UK resident up until the date of departure and non-UK resident for your time abroad. You must then be non-resident in the following tax year.

Do I need to complete a UK tax return if I am non-resident?

Non-residents only pay tax on their UK income - they do not pay UK tax on their foreign income. Residents normally pay UK tax on all their income, whether it's from the UK or abroad. But there are special rules for UK residents whose permanent home ('domicile') is abroad.

What is SA700 return?

Details. Use the SA700 to file a tax return for a non-resident company that's liable to Income Tax. Email HMRC to ask for this form in Welsh (Cymraeg).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2013 sa 700 form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 2013 sa 700 form and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the 2013 sa 700 form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2013 sa 700 form in minutes.

How do I fill out the 2013 sa 700 form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign 2013 sa 700 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is UK HMRC SA700?

UK HMRC SA700 is a tax return form for partnerships or limited liability partnerships (LLPs) in the United Kingdom that need to report their income and expenses to HM Revenue and Customs.

Who is required to file UK HMRC SA700?

Partnerships and limited liability partnerships (LLPs) in the UK that have income to report are required to file the UK HMRC SA700 form.

How to fill out UK HMRC SA700?

To fill out the UK HMRC SA700, individuals must provide information about the partnership's income, expenses, partners' details, and any other relevant financial information.

What is the purpose of UK HMRC SA700?

The purpose of UK HMRC SA700 is to ensure that partnerships report their taxable income accurately to HMRC in order to calculate the tax liability of the partners.

What information must be reported on UK HMRC SA700?

The UK HMRC SA700 requires reporting of the partnership's income, expenses, partner details, profit-sharing arrangements, and any other pertinent financial information.

Fill out your 2013 sa 700 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Sa 700 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.