UK HMRC SA700 2014 free printable template

Show details

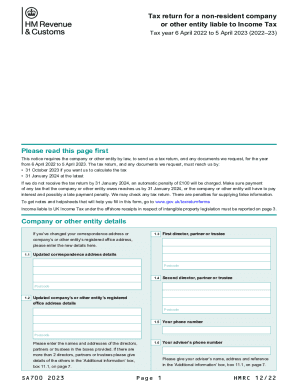

1 on page 10. SA700 2014 Please give your adviser s name address and reference in the Additional information box 10. Tax return for a non-resident company liable to Income Tax Tax year 6 April 2013 to 5 April 2014 HM Revenue Customs office address and date of issue Tax reference HMRC Personal Tax International NR Corporate Compliance SO708 PO Box 203 BOOTLE L69 9AP UNITED KINGDOM Phone 44 151 472 6208/6209 Please read this page first This notice requires the company by law to send us a tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form sa 700 2014-2019

Edit your form sa 700 2014-2019 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form sa 700 2014-2019 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form sa 700 2014-2019 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form sa 700 2014-2019. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC SA700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form sa 700 2014-2019

How to fill out UK HMRC SA700

01

Gather your personal information: Ensure you have your name, address, and National Insurance number.

02

Obtain the SA700 form: You can download it from the HMRC website or request a physical copy.

03

Complete the identification section: Fill in your personal details accurately as they appear on official documentation.

04

Provide income information: Include all income sources for the tax year you are reporting.

05

Declare any business activities: If applicable, provide details about any businesses you've operated.

06

Fill in expenses: Deduct any allowable expenses related to your businesses or income.

07

Include any accountant details: If you have an accountant, list their details.

08

Review your information: Double-check for accuracy and completeness to avoid errors.

09

Sign and date the form: Ensure you sign the declaration and provide the date.

10

Submit the form: Send the completed SA700 form to HMRC by the deadline.

Who needs UK HMRC SA700?

01

Individuals or businesses that have received income from foreign sources or who need to report an overseas income to HMRC.

02

Those who are considered non-UK residents but have UK tax obligations.

03

Individuals who have received income from partnerships or have completed a non-resident trading or rental activity.

Instructions and Help about form sa 700 2014-2019

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my tax return online?

The only way you can obtain copies of your tax return from the IRS is by filing Form 4506 with the IRS. You can download this form from the IRS website.

How do I get copies of old tax returns?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

How do I get a copy of my tax return UK?

So, how can you access this information? HM Revenue & Customs (HMRC) provides the information online. or paper originals will continue to be acceptable if you do not have access to the internet. These can be ordered by you (or your Accountant) by calling 0300 200 3310.

Can I view my tax return online UK?

You can also use the online service to: view returns you've made before. check your details. print your tax calculation.

What is a non resident company UK?

Register as a non-resident company for the Construction Industry Scheme. If you're a construction company working in the UK without a permanent establishment or agency office you do not need to register for Corporation Tax. You need to register for the Construction Industry Scheme.

How do I print my tax return UK?

Printing your Tax Calculation (SA302) Log in to your online account. Follow the link 'tax return options'. Choose the year from the drop down menu and click the 'Go' button. Select the 'view return' button. Follow the link 'view calculation' from the left hand navigation menu.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form sa 700 2014-2019 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form sa 700 2014-2019 in minutes.

How can I fill out form sa 700 2014-2019 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your form sa 700 2014-2019. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out form sa 700 2014-2019 on an Android device?

Use the pdfFiller mobile app and complete your form sa 700 2014-2019 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is UK HMRC SA700?

The UK HMRC SA700 is a tax return form used by partnerships and non-resident companies to report their income and expenses to HM Revenue and Customs (HMRC).

Who is required to file UK HMRC SA700?

The UK HMRC SA700 must be filed by partnerships, non-resident companies, and any individuals who are partners in a partnership trading in the UK, as well as those with foreign income.

How to fill out UK HMRC SA700?

To fill out the UK HMRC SA700, you must gather your financial information, including income and expenses, and complete each section of the form systematically. It involves providing partnership details, income sources, and other necessary financial information.

What is the purpose of UK HMRC SA700?

The purpose of the UK HMRC SA700 is to report taxable income and expenses of partnerships and non-resident companies to HMRC to assess the tax liabilities appropriately.

What information must be reported on UK HMRC SA700?

The information that must be reported on the UK HMRC SA700 includes details of the partnership, income from various sources, expenses incurred, and personal details of the partners involved.

Fill out your form sa 700 2014-2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Sa 700 2014-2019 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.