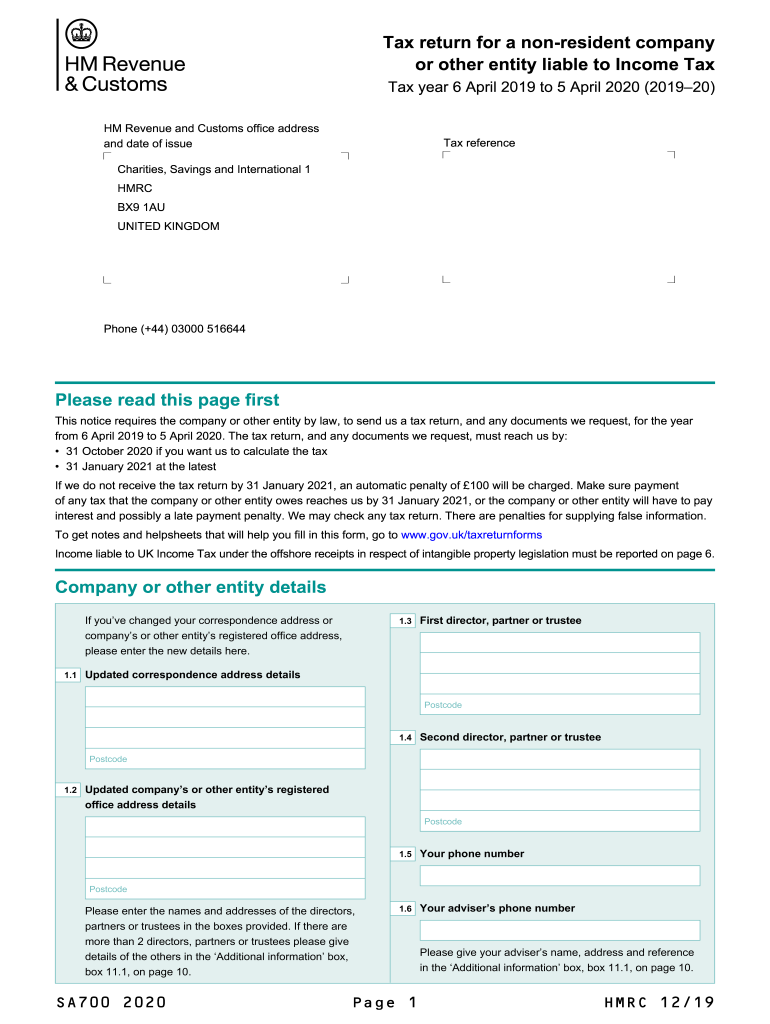

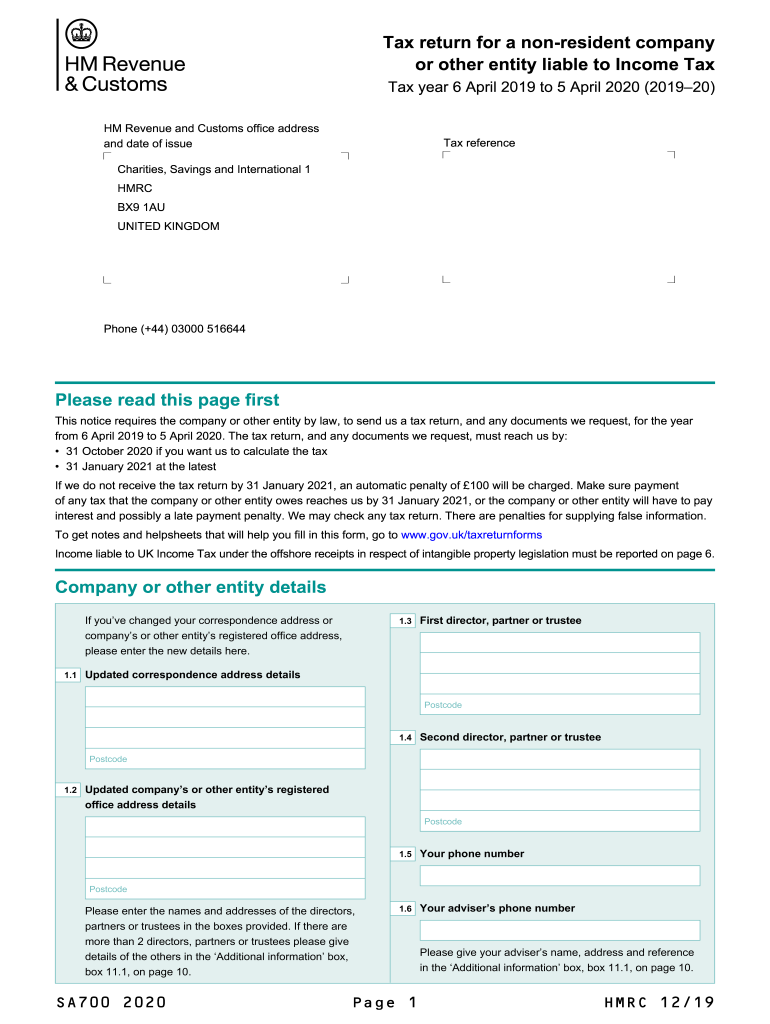

UK HMRC SA700 2020 free printable template

Get, Create, Make and Sign sa700

Editing sa700 online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC SA700 Form Versions

How to fill out sa700

How to fill out UK HMRC SA700

Who needs UK HMRC SA700?

Instructions and Help about sa700

Applause — beeping do you see Miss Java is that uniform us from Central College of Commerce Maggie right filaments are the contents of India presently working his father and the former alma mater orders for the past ten years you have seen steeper and instead of China mountains badminton other professional colleges an active participant in the provisional government and continuing education program, so I see a member of expert committee on England and state taxation manager of Interstate Commerce x-men Asian and station, so I make it very quick anybody I know what it is not the most by system enjoy possible okay so as you can see the topic that's geared to me is already report form and content, so it basically comes down to whatever you have studied in the last early sessions it finally comes down to this they can either put all of this in the audit report and find it I'm not the one little balance in that true and exactly in terms of the work to invest in it is tied so this are they you know what if I like to get it in anime google it only thing that came up was that its be bought over the course by obviously English it so excited with the interior of English and is defined it's not with money so he is based on judgments is been well put over 2000 know mentioned in legal terms and concepts leap into the permission probably late 18-hundreds so since then we had this two favorite words to and head, and they always like to be different like how about Mrs humphreys so first 2018 is starting from this year this is not a key is in the spectrum of the races from 7 onwards this new standard is about 7 1 7 or 5 some not 6 and 7 2011 device will go to that so the main facets of all it is going concern yeah this is not specifically bought out as part about the pudding and come to a little later so these are new updates as well as new essay itself it is 0-1 made some few changes because I was finding them in their presentation as last minute, so I made some changes over the beginning okay so what is falling key audit matters and that sounds like that is something this is very new to India in fact this is relatable you will know, and we seem to be nothing is cancer it was put up last year into post one by one so it's going to be active from the self so before they are just go to learn you have is just been published last month so some of the findings I take not only in aspect of the audit report of the 700 to 750 they're violated some finest thing is a order to put it specific format, so the format is of utmost importance okay so that's the first line in there the format is on it start to where this is format is ever witness it it's not that income visa so this is their belief this Sanders has already either speak to thats what the opening is missing in many other the puts were violated set it down the third part is the most tricky part which is called the information of inconsistency in other information so there's a Charlotte deals with this course at...

People Also Ask about

What is the split year treatment for HMRC?

How does split year treatment work?

How long do you have to stay out of the UK to avoid paying tax?

What is the split year treatment for the UK statutory residence test?

Do I need to complete a UK tax return if I am non-resident?

What is SA700 return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute sa700 online?

How do I edit sa700 straight from my smartphone?

How do I fill out sa700 using my mobile device?

What is UK HMRC SA700?

Who is required to file UK HMRC SA700?

How to fill out UK HMRC SA700?

What is the purpose of UK HMRC SA700?

What information must be reported on UK HMRC SA700?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.