IN Form 11274 2013 free printable template

Show details

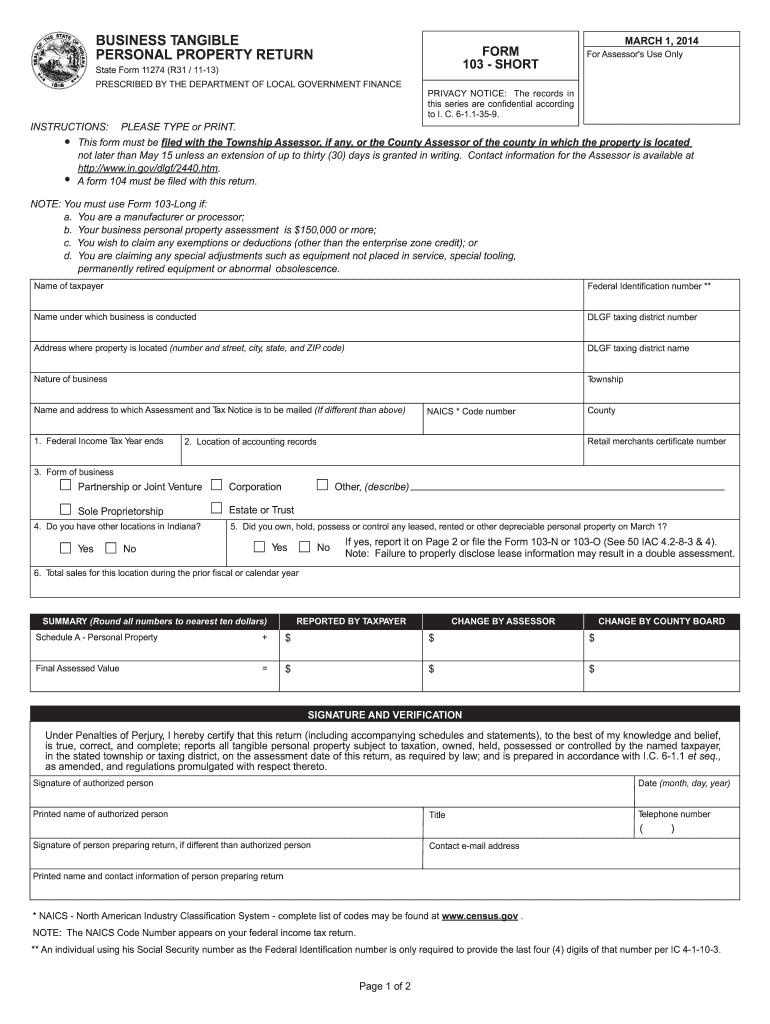

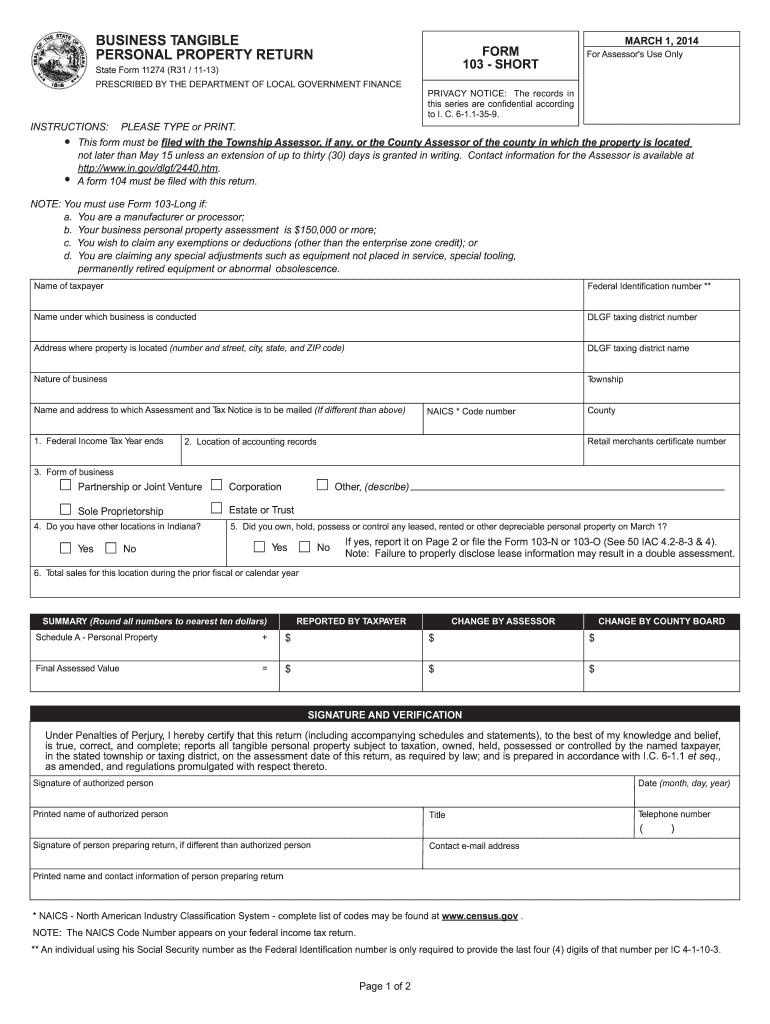

Reset Form BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 103 SHORT State Form 11274 (R31 / 11-13) PRESCRIBED BY THE DEPARTMENT OF LOCAL GOVERNMENT FINANCE MARCH 1, 2014, For Assessor's Use Only

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN Form 11274

Edit your IN Form 11274 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN Form 11274 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN Form 11274 online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IN Form 11274. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN Form 11274 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN Form 11274

How to fill out IN Form 11274

01

Obtain a copy of IN Form 11274 from the official government website or authorized sources.

02

Read the instructions carefully before filling out the form to ensure you understand what information is required.

03

Fill out your personal details in the designated sections, including your full name, contact information, and any applicable identification numbers.

04

Provide the necessary details regarding your immigration status and the purpose for submitting the form.

05

Review all entries for accuracy and completeness to avoid delays in processing.

06

Sign and date the form as required.

07

Submit the completed form through the designated channels, whether online or via mail, as per the instructions provided.

Who needs IN Form 11274?

01

Individuals who are applying for a specific immigration benefit or need to provide information related to their immigration status.

Fill

form

: Try Risk Free

People Also Ask about

How much is Indiana personal property tax?

The amount you'll pay in property taxes varies depending on where you live and how much your home is worth, but the statewide average effective property tax rate is 0.75%. Homeowners who live in their primary residence in Indiana are eligible for a number of deductions that can push rates below that average, though.

What is the definition of tangible personal property in Indiana?

Tangible personal property" means personal property that: (1) can be seen, weighed, measured, felt, or touched; or. (2) is in any other manner perceptible to the senses.

What counts as state and local personal property taxes?

Personal property tax is a tax imposed by state or local governments on certain assets that can be touched and moved, such as cars, livestock, or equipment. Generally, personal property means assets other than land or permanent structures, such as houses, which are considered real property.

Where do I mail my Indiana Form 103?

Drop it off in person at 200 E. Washington St., Suite 1360, Indianapolis, IN 46204.

What is the state and local personal property tax?

Personal property tax is a tax imposed by state or local governments on certain assets that can be touched and moved, such as cars, livestock, or equipment. Generally, personal property means assets other than land or permanent structures, such as houses, which are considered real property.

What is an Indiana ST 103?

IN ST-103 Information All Businesses in Indiana must file for any sales activities include retail, wholesale, manufacturing, and out?of- state sales. Use tax is due on any purchase(s) where no sales tax was paid and the property was not held for resale or for another exempt purpose.

How do I appeal property taxes in Indiana?

An appeal begins with filing a Form 130 – Taxpayer's Notice to Initiate an Appeal with the local assessing official. The appeal should detail the pertinent facts of why the assessed value is being disputed. A taxpayer may only request a review of the current year's assessed valuation.

What are the pools for personal property in Indiana?

The pools to be utilized for Indiana property tax purposes are as follows: (1) Pool No. 1: All assets that have a life of one (1) through four (4) years for federal income tax purposes. (2) Pool No. 2: All assets that have a life of five (5) through eight (8) years for federal income tax purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IN Form 11274?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the IN Form 11274. Open it immediately and start altering it with sophisticated capabilities.

How do I edit IN Form 11274 online?

The editing procedure is simple with pdfFiller. Open your IN Form 11274 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the IN Form 11274 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IN Form 11274 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IN Form 11274?

IN Form 11274 is a tax form used in India for the purpose of filing income tax returns for individuals and entities under certain categories.

Who is required to file IN Form 11274?

Individuals and entities whose total income exceeds the specified threshold limit set by the income tax department are required to file IN Form 11274.

How to fill out IN Form 11274?

To fill out IN Form 11274, one must provide personal details, income details, deductions, and tax computation as per the guidelines provided by the income tax department.

What is the purpose of IN Form 11274?

The purpose of IN Form 11274 is to collect information regarding income and taxes paid by individuals and entities for the assessment year, ensuring compliance with tax laws.

What information must be reported on IN Form 11274?

Information that must be reported includes personal identification details, sources of income, deductions claimed, and any taxes already paid or due.

Fill out your IN Form 11274 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN Form 11274 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.