AZ ADOR A1-WP 2004 free printable template

Show details

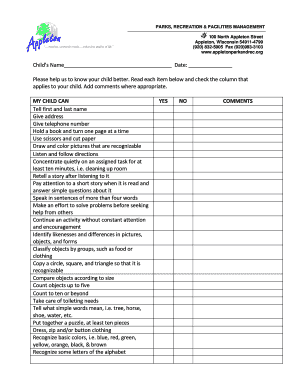

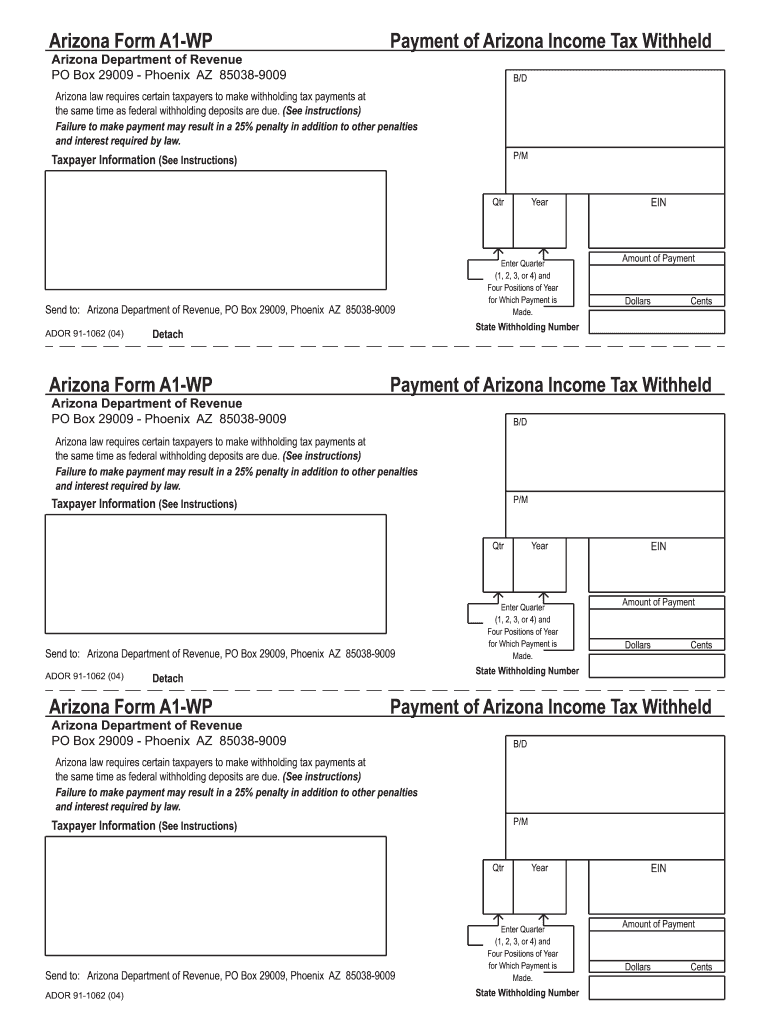

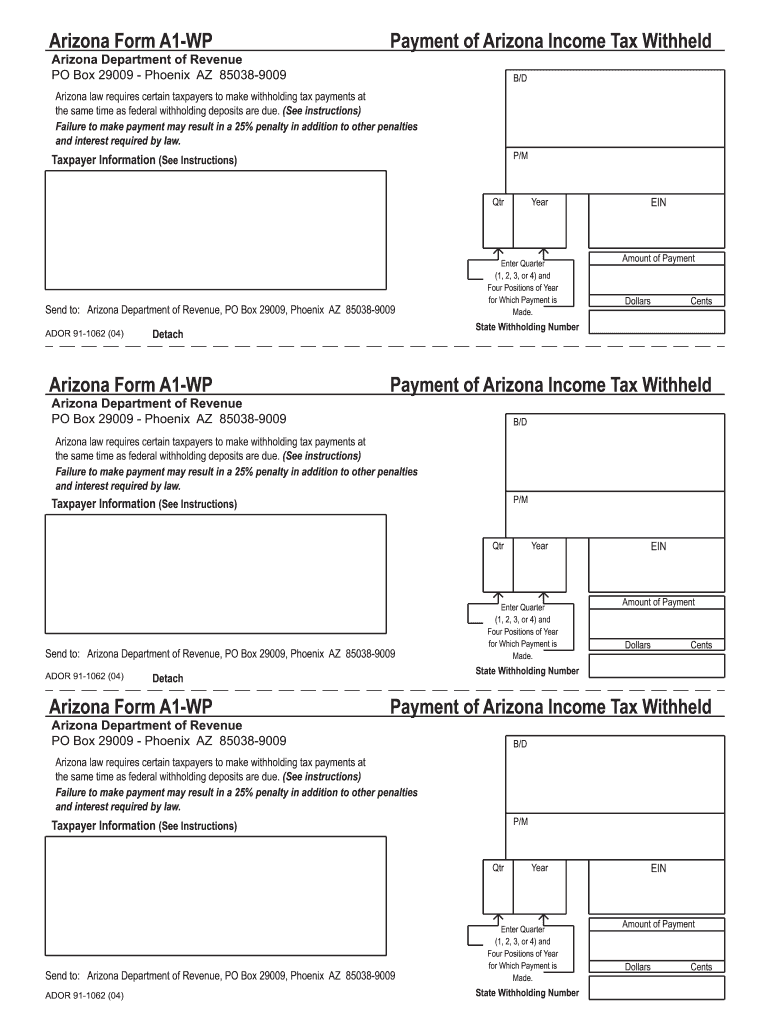

Arizona Form A1-WP Arizona Department of Revenue PO Box 29009 - Phoenix AZ 85038-9009 Payment of Arizona Income Tax Withheld B/D Arizona law requires certain taxpayers to make withholding tax payments at the same time as federal withholding deposits are due.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona form a1 wp

Edit your arizona form a1 wp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona form a1 wp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona form a1 wp online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit arizona form a1 wp. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ ADOR A1-WP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona form a1 wp

How to fill out AZ ADOR A1-WP

01

Start by downloading the AZ ADOR A1-WP form from the official Arizona Department of Revenue website.

02

Fill in your name, address, and contact information in the designated sections.

03

Indicate your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

04

Specify the type of withholding tax you are requesting, such as employee wages or pension distributions.

05

Complete the sections regarding the amount to withhold, including any exemptions you may be claiming.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the completed form according to the instructions provided, either by mailing or online submission.

Who needs AZ ADOR A1-WP?

01

Arizona employers who need to report and remit income tax withheld from employees.

02

Businesses that provide certain payments subject to withholding, such as pensions or annuities.

03

Any individual or entity that is required by law to withhold taxes from payments made to employees or contractors in Arizona.

Fill

form

: Try Risk Free

People Also Ask about

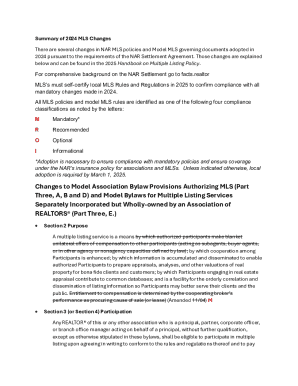

What percentage should I withhold for Arizona taxes 2023?

If hiring a new employee prior to January 1, 2023, should the employer withhold 2.0% in the first pay period following January 1, 2023? Employeer may implement the new Form A-4 immediately, but may choose to default to 2.7% within the two first pay period after January 31, 2023.

What is A1 WP form?

Employers required to make more than one Arizona withholding payment per calendar quarter, but not required to pay by Electronic Funds Transfer (EFT), use Form A1-WP to transmit Arizona withholding payments to the department.

What should I put for my Arizona withholding percentage?

PLEASE BE AWARE: To ensure compliance with AZDOR requirements, on 12/30/22, the State will change ALL employee records to the default rate of 2.0%. Any existing additional dollar amounts an employee had chosen to be withheld will not be changed. On 12/30/2022: ALL employees are defaulted to 2.0% rate.

How do I choose my Arizona state withholding?

To change the amount of Arizona income tax withheld, an employee must complete Arizona Form A-4 and submit to his or her employer to choose a different withholding percentage option. Employees may request to have an additional amount withheld by their employer.

What withholding percentage should I choose?

Generally, you want about 90% of your estimated income taxes withheld and sent to the government.

What should my Arizona tax withholding be?

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona form a1 wp for eSignature?

When you're ready to share your arizona form a1 wp, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the arizona form a1 wp in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your arizona form a1 wp and you'll be done in minutes.

How do I complete arizona form a1 wp on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your arizona form a1 wp, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is AZ ADOR A1-WP?

AZ ADOR A1-WP is a form used by employers in Arizona to report withholding taxes from employees' wages.

Who is required to file AZ ADOR A1-WP?

Employers who pay wages to employees in Arizona and withhold state income tax from those wages are required to file the AZ ADOR A1-WP.

How to fill out AZ ADOR A1-WP?

To fill out AZ ADOR A1-WP, employers must provide their Arizona tax identification number, employee wage details, and the amount of state tax withheld for the reporting period.

What is the purpose of AZ ADOR A1-WP?

The purpose of AZ ADOR A1-WP is to enable the Arizona Department of Revenue to track and collect income tax withholdings from employee wages.

What information must be reported on AZ ADOR A1-WP?

The information that must be reported on AZ ADOR A1-WP includes the employer's tax identification number, total wages paid, and total state income tax withheld.

Fill out your arizona form a1 wp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Form a1 Wp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.