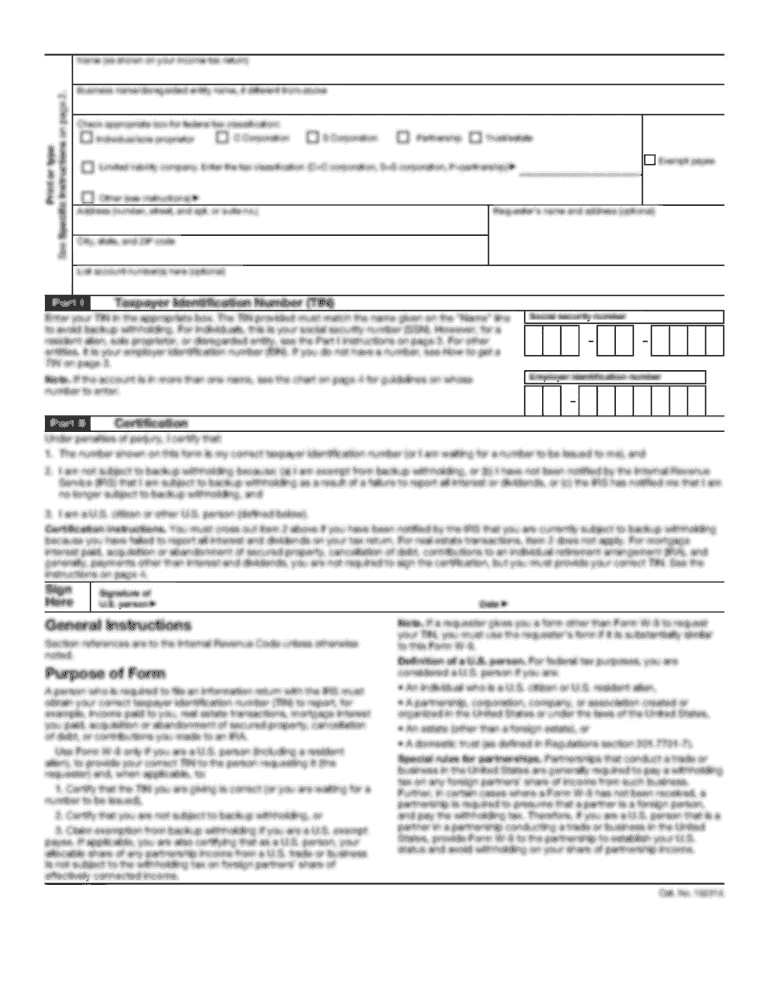

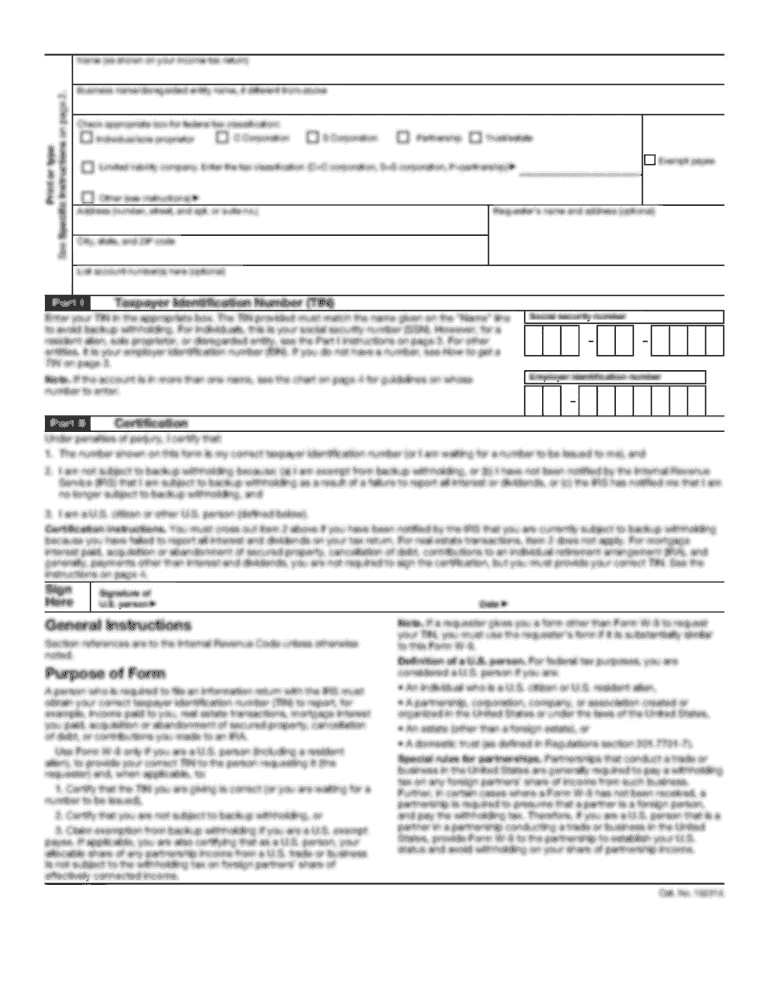

AZ ADOR A1-WP 2017 free printable template

Show details

Print Return Top Portion with Payment Make check payable to Mail top portion with payment to Instructions Employers required to make more than one Arizona withholding payment per calendar quarter use Form A1-WP to transmit Arizona withholding payments to the department. Arizona Form A1-WP Payment of Arizona Income Tax Withheld Arizona Department of Revenue PO Box 29085 Phoenix AZ 85038-9085 Employer Identification Number EIN Qtr Year Q Y Y Y Y Amount of Payment Dollars Cents Taxpayer...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona a1 wp form

Edit your arizona a1 wp form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona a1 wp form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona a1 wp form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit arizona a1 wp form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ ADOR A1-WP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona a1 wp form

How to fill out AZ ADOR A1-WP

01

Obtain the AZ ADOR A1-WP form from the Arizona Department of Revenue website or local office.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your employer’s name and Employer Identification Number (EIN).

04

Select the appropriate withholding allowances you are claiming.

05

Complete the additional information section as needed, such as marital status and any exemptions.

06

Review the completed form for accuracy.

07

Sign and date the form at the bottom.

08

Submit the form to your employer, not to the Arizona Department of Revenue.

Who needs AZ ADOR A1-WP?

01

Employees who work in Arizona and need to adjust their state withholding tax.

02

Individuals who want to claim exemptions or additional withholding allowances.

03

New employees of Arizona-based businesses who need to set up their state withholding.

Fill

form

: Try Risk Free

People Also Ask about

What is an A1-APR?

Employers and other entities that pay Arizona income tax withheld on an annual basis must file Form A1-APR to pay the income tax withheld and to reconcile their payments for the year.

What is A1 Apr form?

Employers and other entities that pay Arizona income tax withheld on an annual basis must file Form A1-APR to pay the income tax withheld and to reconcile their payments for the year.

What is the A 1 R form?

Arizona Form A1-R is an information return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended quarterly withholding tax Form(s) A1-QRT.

Does Arizona require nonresident withholding?

An employer must withhold Arizona tax from wages paid for services performed within the state regardless of whether the employee is a resident or nonresident.

What is Arizona withholding liability?

Employee Withholding Determination If the employee does not complete the form, the employer must withhold Arizona income tax at the rate of 2.0% until the employee elects a different withholding rate. Refer to the Employer's Instructions for Arizona Form A-4 for further information.

What is Arizona Form A1-R?

Arizona Form A1-R is an information return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended quarterly withholding tax Form(s) A1-QRT.

Does Arizona have a state withholding form?

Information for Employers, Employees, and Individuals To elect an Arizona withholding percentage, an employee must complete Arizona Form A-4, Arizona Withholding Percentage Election, and submit it to his/her employer. Employees may request to have an additional amount withheld by their employer.

How do I file an A1-QRT?

You may use a Payroll Service Company (PSC) to file your Form A1-QRT. If you use a PSC, that company must file your A1-QRT electronically. For Arizona income tax withholding purposes, several deposit schedules may apply. The schedule that an employer must use depends on the amount of Arizona income tax withheld.

What is A1-APR form?

Employers and other entities that pay Arizona income tax withheld on an annual basis must file Form A1-APR to pay the income tax withheld and to reconcile their payments for the year.

How do I get tax forms in the mail?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is an A-4 form in Arizona?

Arizona employers are required to make Form A-4 available to employees at all times and to inform them of Arizona's withholding election options. Arizona income tax withholding is a percentage of gross taxable wages.

What is Arizona Form A1 T?

Purpose of Form All employers or representatives that electronically file Form A1-R or Form A1-APR must file Form A1-T to transmit wage and tax statements, federal Forms W-2, W-2c, W-2G (with Arizona withholding), and/or 1099-R(with Arizona withholding). Complete Form A1-T, regardless of the number of forms you submit.

What is the A1-R form?

Arizona Form A1-R is an information return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended quarterly withholding tax Form(s) A1-QRT.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona a1 wp form for eSignature?

To distribute your arizona a1 wp form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get arizona a1 wp form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific arizona a1 wp form and other forms. Find the template you need and change it using powerful tools.

How do I complete arizona a1 wp form online?

Filling out and eSigning arizona a1 wp form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is AZ ADOR A1-WP?

AZ ADOR A1-WP is a form used in Arizona for reporting withholding payments, specifically for businesses and employers to report amounts withheld from employee wages.

Who is required to file AZ ADOR A1-WP?

Employers who withhold income tax from employee wages and other payers who are required to withhold taxes must file the AZ ADOR A1-WP form.

How to fill out AZ ADOR A1-WP?

To fill out AZ ADOR A1-WP, gather all relevant withholding information, including employee names, wages, and amounts withheld. Then, complete the form by providing accurate data in the specified fields and ensure to sign and date the form before submission.

What is the purpose of AZ ADOR A1-WP?

The purpose of AZ ADOR A1-WP is to report and remit state income tax withheld from employees' pay, ensuring compliance with Arizona tax laws.

What information must be reported on AZ ADOR A1-WP?

The AZ ADOR A1-WP requires reporting of the employer's identification details, total wages paid, total tax withheld, and specific information for each employee for whom tax has been withheld.

Fill out your arizona a1 wp form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona a1 Wp Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.