AZ ADOR A1-WP 2018 free printable template

Show details

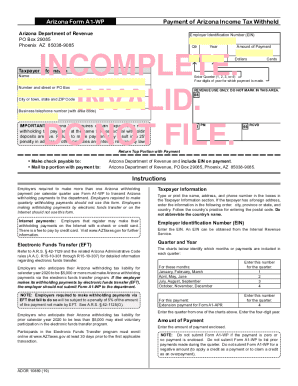

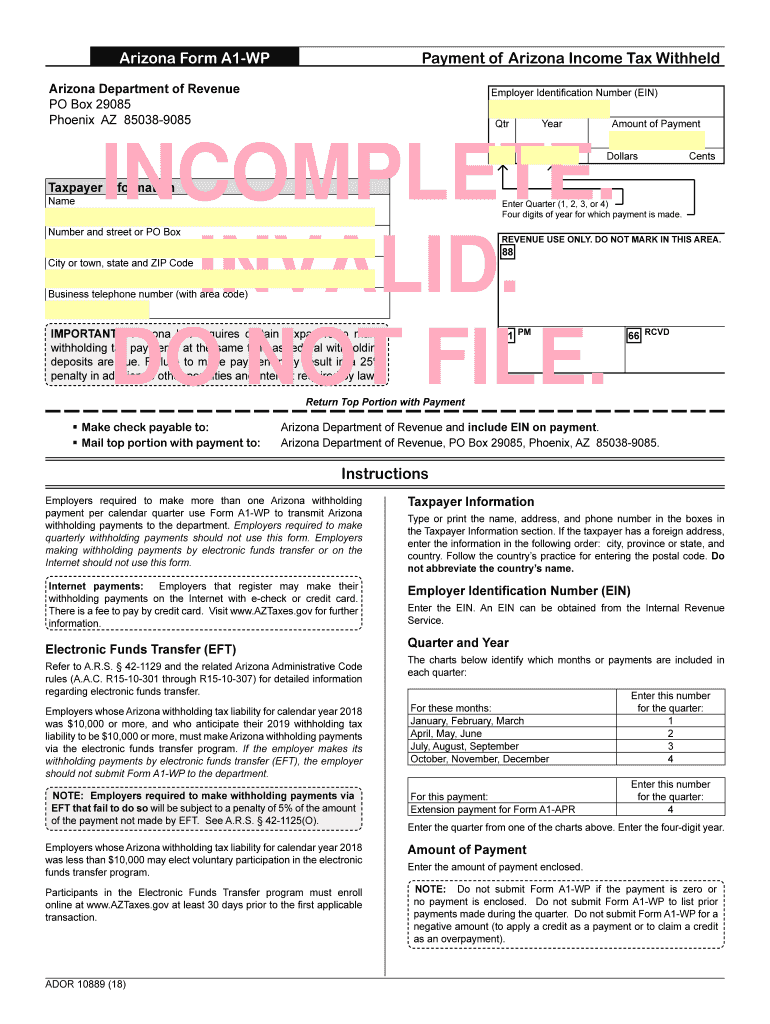

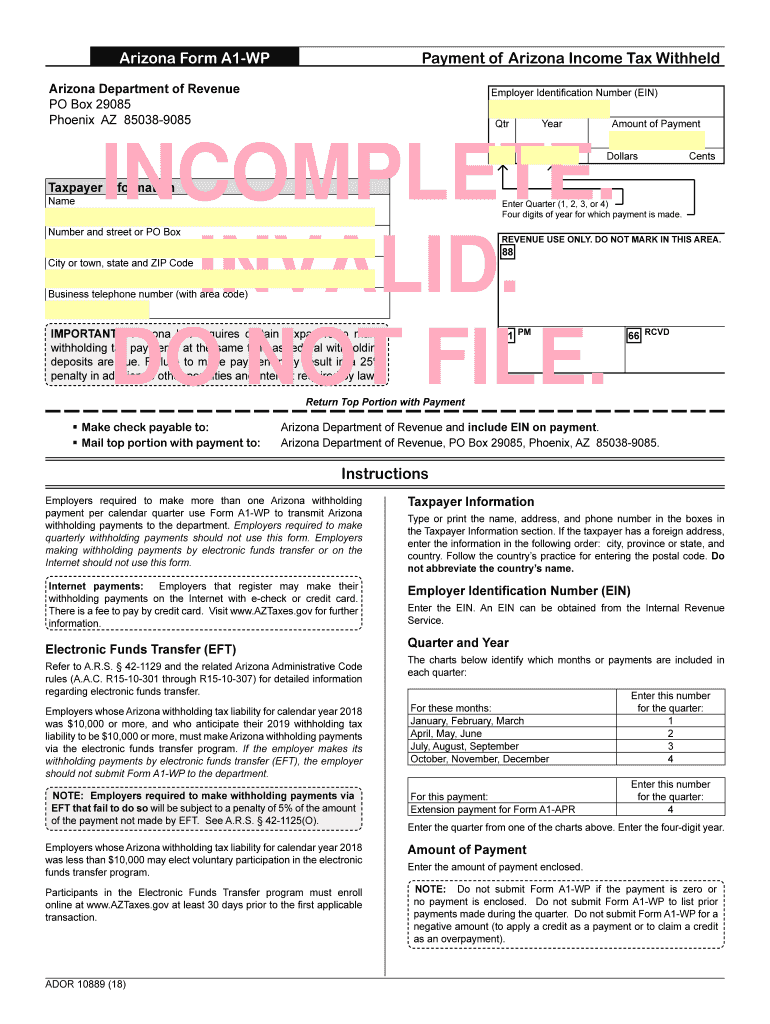

Print Return Top Portion with Payment Make check payable to Mail top portion with payment to Instructions Employers required to make more than one Arizona withholding payment per calendar quarter use Form A1-WP to transmit Arizona withholding payments to the department. Arizona Form A1-WP Payment of Arizona Income Tax Withheld Arizona Department of Revenue PO Box 29085 Phoenix AZ 85038-9085 Employer Identification Number EIN Qtr Year Q Y Y Y Y Amount of Payment Dollars Cents Taxpayer...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona a1 form

Edit your arizona a1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona a1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona a1 form online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit arizona a1 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ ADOR A1-WP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona a1 form

How to fill out AZ ADOR A1-WP

01

Obtain the AZ ADOR A1-WP form from the Arizona Department of Revenue website.

02

Fill in your name and contact information in the designated sections.

03

Provide your Social Security number or employer identification number (EIN) as required.

04

Indicate your type of income and the reason for withholding exemption if applicable.

05

Complete the tax information part, including the amount you want withheld, if any.

06

Review your entries for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form to your employer or the relevant tax authority as instructed.

Who needs AZ ADOR A1-WP?

01

Employees who wish to claim exemption from Arizona state withholding tax.

02

Independent contractors who expect to owe no income tax due to exemptions.

03

Individuals who receive periodic income and want to adjust their withholding settings.

04

Any taxpayer needing to update their withholding preferences with their employer.

Fill

form

: Try Risk Free

People Also Ask about

What is an A1-APR?

Employers and other entities that pay Arizona income tax withheld on an annual basis must file Form A1-APR to pay the income tax withheld and to reconcile their payments for the year.

What is A1 Apr form?

Employers and other entities that pay Arizona income tax withheld on an annual basis must file Form A1-APR to pay the income tax withheld and to reconcile their payments for the year.

What is the A 1 R form?

Arizona Form A1-R is an information return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended quarterly withholding tax Form(s) A1-QRT.

Does Arizona require nonresident withholding?

An employer must withhold Arizona tax from wages paid for services performed within the state regardless of whether the employee is a resident or nonresident.

What is Arizona withholding liability?

Employee Withholding Determination If the employee does not complete the form, the employer must withhold Arizona income tax at the rate of 2.0% until the employee elects a different withholding rate. Refer to the Employer's Instructions for Arizona Form A-4 for further information.

What is Arizona Form A1-R?

Arizona Form A1-R is an information return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended quarterly withholding tax Form(s) A1-QRT.

Does Arizona have a state withholding form?

Information for Employers, Employees, and Individuals To elect an Arizona withholding percentage, an employee must complete Arizona Form A-4, Arizona Withholding Percentage Election, and submit it to his/her employer. Employees may request to have an additional amount withheld by their employer.

How do I file an A1-QRT?

You may use a Payroll Service Company (PSC) to file your Form A1-QRT. If you use a PSC, that company must file your A1-QRT electronically. For Arizona income tax withholding purposes, several deposit schedules may apply. The schedule that an employer must use depends on the amount of Arizona income tax withheld.

What is A1-APR form?

Employers and other entities that pay Arizona income tax withheld on an annual basis must file Form A1-APR to pay the income tax withheld and to reconcile their payments for the year.

How do I get tax forms in the mail?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is an A-4 form in Arizona?

Arizona employers are required to make Form A-4 available to employees at all times and to inform them of Arizona's withholding election options. Arizona income tax withholding is a percentage of gross taxable wages.

What is Arizona Form A1 T?

Purpose of Form All employers or representatives that electronically file Form A1-R or Form A1-APR must file Form A1-T to transmit wage and tax statements, federal Forms W-2, W-2c, W-2G (with Arizona withholding), and/or 1099-R(with Arizona withholding). Complete Form A1-T, regardless of the number of forms you submit.

What is the A1-R form?

Arizona Form A1-R is an information return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended quarterly withholding tax Form(s) A1-QRT.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find arizona a1 form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific arizona a1 form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my arizona a1 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your arizona a1 form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete arizona a1 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your arizona a1 form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AZ ADOR A1-WP?

AZ ADOR A1-WP is a form used by the Arizona Department of Revenue for businesses to report withholding tax information.

Who is required to file AZ ADOR A1-WP?

Employers who have employees in Arizona and are required to withhold state income tax from their employees' wages must file AZ ADOR A1-WP.

How to fill out AZ ADOR A1-WP?

To fill out AZ ADOR A1-WP, businesses should provide accurate information including their tax identification number, employee details, withholding amounts, and any other requested information, as detailed in the form instructions.

What is the purpose of AZ ADOR A1-WP?

The purpose of AZ ADOR A1-WP is to report the amount of state income tax withheld from employees' wages to the Arizona Department of Revenue.

What information must be reported on AZ ADOR A1-WP?

The information that must be reported on AZ ADOR A1-WP includes the employer's name, tax identification number, wages paid, amounts withheld, and employee identification details.

Fill out your arizona a1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona a1 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.