MO MO-CRP 2005 free printable template

Show details

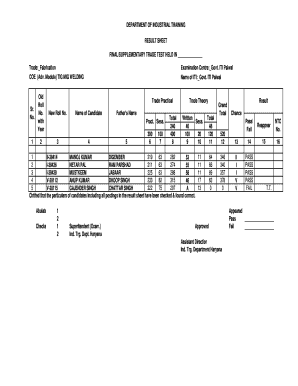

DO NOT file this claim if you are going to file a Missouri income tax return! AMENDED CLAIM 2005 FORM MO-PTC MISSOURI DEPARTMENT OF REVENUE PROPERTY TAX CREDIT CLAIM SOCIAL SECURITY NO. FIRST NAME

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MO-CRP

Edit your MO MO-CRP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MO-CRP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO MO-CRP online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MO MO-CRP. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-CRP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MO-CRP

How to fill out MO MO-CRP

01

Obtain the MO MO-CRP form from the appropriate state or local agency.

02

Carefully read the instructions provided with the form.

03

Begin filling out the form with your personal information, including your name, address, and Social Security Number.

04

Fill in the required financial information accurately, including income and expenses.

05

Review the eligibility criteria for the specific program and ensure you meet them.

06

Sign and date the form at the designated section.

07

Submit the completed form by the specified deadline through the recommended submission method.

Who needs MO MO-CRP?

01

Individuals or families seeking financial assistance or benefits from the MO MO-CRP program.

02

Those who meet the eligibility criteria set forth by the program, usually based on income and residency.

03

Applicants who require support due to specific circumstances that qualify them for this assistance.

Fill

form

: Try Risk Free

People Also Ask about

Does Missouri have renters rebate?

Missouri's version of the “circuit breaker,” known as the Missouri Property Tax Credit, is available to both homeowners and renters and is based on the amount of property tax or rent paid and household income. The maximum credit is $750 for renters and $1,100 for owners.

What is the Missouri PTC refund?

The Missouri Property Tax Credit Claim gives back a portion of the rent or real estate tax paid for that year by persons 65 and older, or persons 18-64 that receive SSI, SSD, or Veterans Disability. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

What is a mo PTC?

To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2021 real estate tax in calendar year 2022, you must file a 2021 Property Tax Credit Claim (Form MO-PTC).

How do I check the status of my rent rebate in Missouri?

You may also call 573-751-3505.

What is the difference between Mo PTC and Mo PTS?

If you are required to file a Missouri Individual Income Tax Return, you must use Form MO-1040 or Form MO-1040P with Property Tax Schedule (MO-PTS) attached. If you are not required to file a Missouri Individual Income Tax Return, then you may file the Missouri Property Tax Credit Claim (MO-PTC).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MO MO-CRP?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific MO MO-CRP and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete MO MO-CRP online?

With pdfFiller, you may easily complete and sign MO MO-CRP online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit MO MO-CRP online?

With pdfFiller, it's easy to make changes. Open your MO MO-CRP in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is MO MO-CRP?

MO MO-CRP refers to the Missouri Corporate Franchise Tax Return, which is a form used by corporations doing business in Missouri to report their tax obligations.

Who is required to file MO MO-CRP?

All corporations operating in Missouri, including both domestic and foreign entities, are required to file the MO MO-CRP if they are subject to corporate franchise tax.

How to fill out MO MO-CRP?

To fill out the MO MO-CRP, corporations need to provide their financial information, including income, deductions, and any applicable credits, while ensuring all fields are completed accurately.

What is the purpose of MO MO-CRP?

The purpose of MO MO-CRP is to calculate and report the franchise tax obligations of a corporation to the state of Missouri.

What information must be reported on MO MO-CRP?

The MO MO-CRP requires reporting of financial data, such as total income, gross receipts, taxable income, deductions, and other relevant financial metrics necessary for determining tax liability.

Fill out your MO MO-CRP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MO-CRP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.