MO MO-CRP 2019 free printable template

Get, Create, Make and Sign MO MO-CRP

How to edit MO MO-CRP online

Uncompromising security for your PDF editing and eSignature needs

MO MO-CRP Form Versions

How to fill out MO MO-CRP

How to fill out MO MO-CRP

Who needs MO MO-CRP?

Instructions and Help about MO MO-CRP

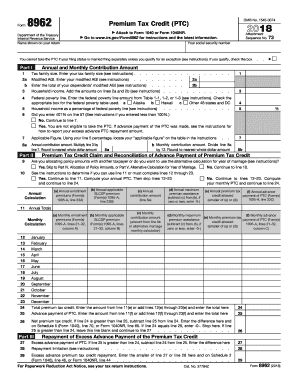

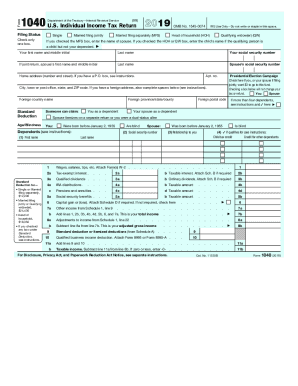

The Missouri property tax credit is a program that allows certain senior citizens and 100% disabled individuals to apply for a credit based on the real estate taxes or rent paid for the year the maximum credit amount is seven hundred and fifty dollars for renters and $1,100 for homeowners depending on the amount paid and the total household income taxable and non-taxable the property tax credit is available to taxpayers who are 65 years of age or older or whose spouse is 65 years or older and where a Missouri resident for the entire calendar year prior to filing taxpayers who are 100% disabled or whose spouse is a hundred percent disabled taxpayers who are a hundred percent disabled or whose spouse is a hundred percent disabled as a result of military service and taxpayers who are 60 years or older and are receiving surviving spouse benefits the property tax credit has restrictions based on income in order for renters and part-time owners to qualify for the property tax credit the total household income must be twenty-seven thousand five hundred dollars or fewer for single filers and twenty-nine thousand five hundred dollars or fewer for those married filing combined homeowners occupying their home for the entire year and married filing combined qualify for the credit if annual total household income is thirty-four thousand dollars or fewer single filers owning and occupying their home for the entire year may apply for the credit if total household income is thirty thousand dollars or fewer annually for taxpayers that are 100% service-connected disabled veterans VA payments should not be included in the total household income amount if you are a renter the facility that you rent from must pay property taxes in order for you to be eligible to receive the property tax credit to find out if your facility pays property tax you can speak to your landlord or ask the counting collector whether your facility is exempt from property taxes to apply for the property tax credit a completed form M o PPS must be attached to the form M o 1040 or M Oh 1040 P if you are not required to file an individual income tax return a completed form M o PP C must be submitted to apply for the credit homeowners will need to provide a copy of paid real estate tax receipt and if your home is on more than five acres, or you own a mobile home they form 948 is required renters are required to submit rent receipts or a signed statement from your landlord when applying for the credit for more information or to download the forms for the Missouri property tax credit visit the department's website at for mo gov

People Also Ask about

Is there a Missouri 1040 short form?

Does the 1040 short form still exist?

Does Missouri use 1040 or 1040A?

What is a CRP form in Minnesota?

What is a 1040 mo?

What is the Missouri PTC refund?

Who is eligible for Missouri property tax credit?

What is a mo PTC?

How do I file my personal property taxes in Missouri?

How do I pay my car property tax in Missouri?

How do I file a CRP in MN?

What is a mo cr form?

How do I declare my personal property tax in Missouri?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MO MO-CRP?

How do I edit MO MO-CRP in Chrome?

How do I edit MO MO-CRP on an Android device?

What is MO MO-CRP?

Who is required to file MO MO-CRP?

How to fill out MO MO-CRP?

What is the purpose of MO MO-CRP?

What information must be reported on MO MO-CRP?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.