MO MO-CRP 2015 free printable template

Show details

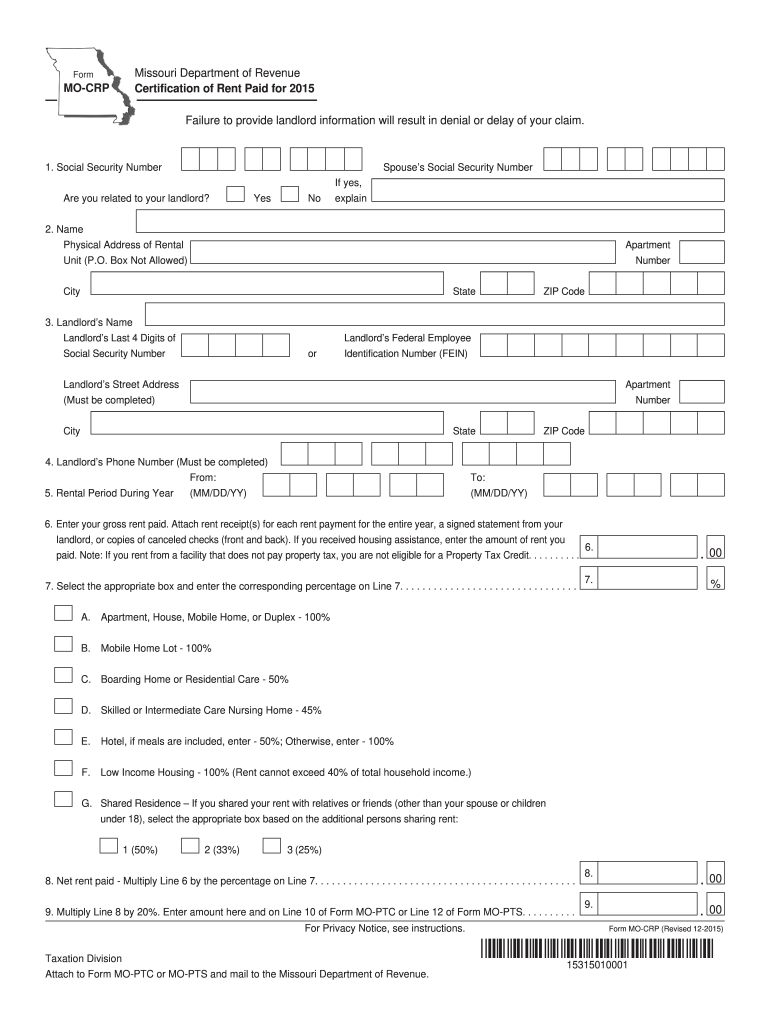

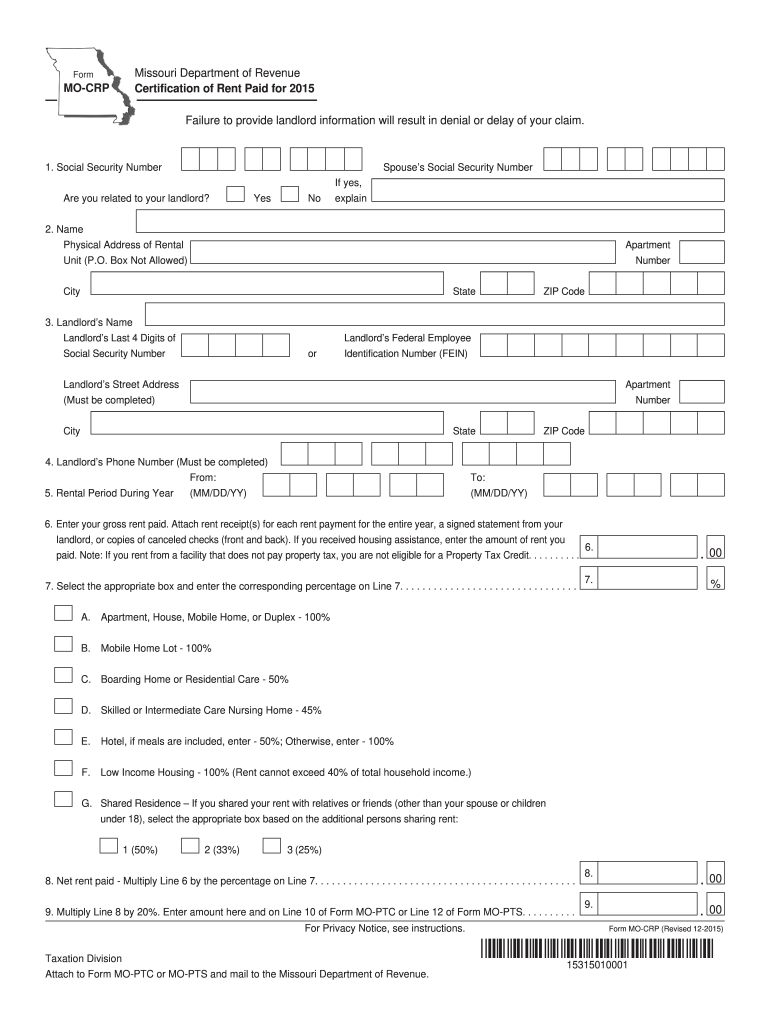

Reset Form Print Form Missouri Department of Revenue Certification of Rent Paid for 2015 Form MO-CRP Failure to provide landlord information will result in denial or delay of your claim. 1. Social Security Number Spouse s Social Security Number Are you related to your landlord No Yes If yes explain 2. Taxpayer Name Physical Address of Rental Unit P. O. Box Not Allowed Apartment Number City State 3. Landlord s Name Landlord s Last 4 Digits of ZIP Code Landlord s Federal Employee or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MO-CRP

Edit your MO MO-CRP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MO-CRP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO MO-CRP online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MO MO-CRP. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-CRP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MO-CRP

How to fill out MO MO-CRP

01

Obtain the MO MO-CRP form from the relevant state department website or office.

02

Fill in your personal information including your name, address, and contact details.

03

Provide information on your income, including any wages, unemployment benefits, or other income sources.

04

Declare any deductions or credits you are eligible for.

05

Complete the specific sections regarding any specific circumstances that apply to you.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form before submitting it.

08

Submit the completed form to the appropriate state department either online or via mail.

Who needs MO MO-CRP?

01

Individuals or families residing in Missouri who are applying for certain tax credits or assistance programs.

02

Taxpayers who meet specific income thresholds and are eligible for the credits that the MO MO-CRP addresses.

03

Residents who have experienced financial hardship and are seeking tax relief or benefits.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from paying property taxes in pa?

Applicants with an annual income of $108,046 or less are given a presumption of need for the exemption. Applicants whose gross annual income exceeds $108,046 will be considered to have a financial need for the exemption when their allowable monthly expenses exceed monthly household income.

What age do you stop paying property tax in PA?

Age requirements A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

Do senior citizens get a discount on property taxes in Pennsylvania?

Optional Information: Offers qualified senior citizen homeowners a flat 30% discount on the real estate tax on their primary residence. County Treasurer's Office provides assistance in completing the application for individuals who require help.

Is there a property tax exemption for seniors in PA?

The Property Tax/Rent Rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters.

Do I qualify for pa rent rebate?

The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded.

What is the maximum rent rebate in pa?

The Property Tax/Rent Rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MO MO-CRP from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like MO MO-CRP, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit MO MO-CRP on an iOS device?

You certainly can. You can quickly edit, distribute, and sign MO MO-CRP on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete MO MO-CRP on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your MO MO-CRP, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is MO MO-CRP?

MO MO-CRP is a tax form used in Missouri for reporting certain business income, credits, and other specific financial information.

Who is required to file MO MO-CRP?

Businesses operating in Missouri that have an obligation to report income, especially those claiming specific credits, are required to file MO MO-CRP.

How to fill out MO MO-CRP?

To fill out MO MO-CRP, gather necessary financial documents, provide accurate business income, calculate applicable credits, and follow the form's instructions step by step.

What is the purpose of MO MO-CRP?

The purpose of MO MO-CRP is to provide the state with information about business income and to claim applicable tax credits, ensuring compliance with Missouri tax laws.

What information must be reported on MO MO-CRP?

The information that must be reported on MO MO-CRP includes business income, deductions, credits claimed, and any other relevant financial data as required by the form.

Fill out your MO MO-CRP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MO-CRP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.