Get the free 250 broker checklist

Show details

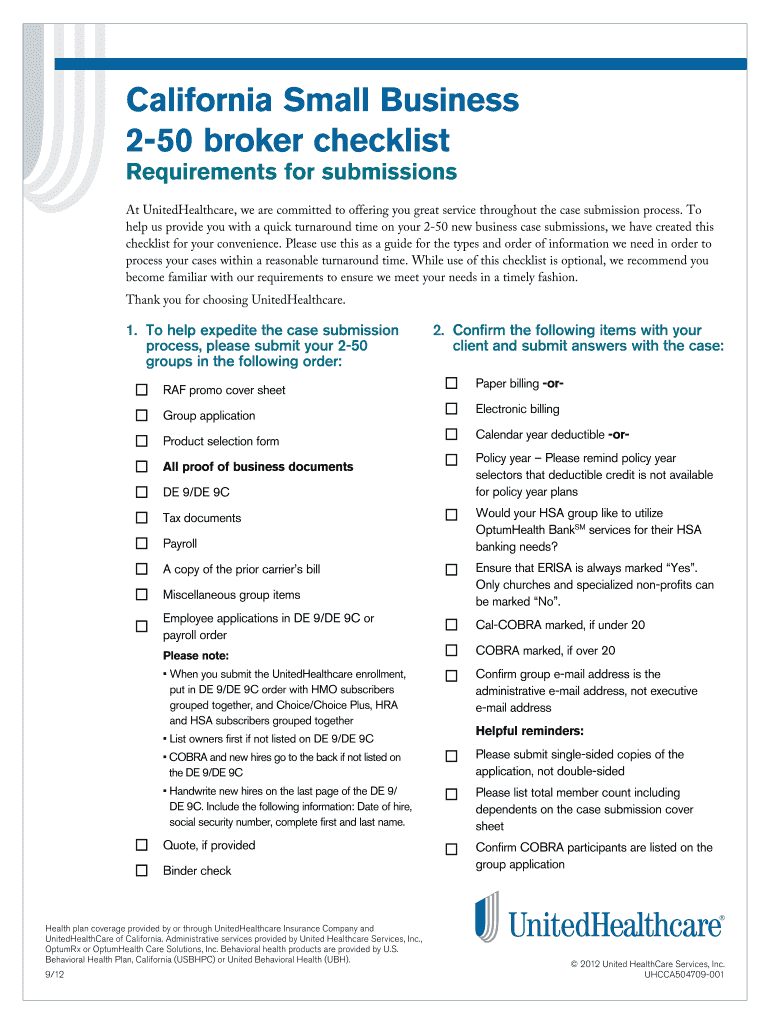

California Small Business 250 broker checklist Requirements for submissions At UnitedHealthcare, we are committed to offering you great service throughout the case submission process. To help us provide

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 250 broker checklist

Edit your 250 broker checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 250 broker checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 250 broker checklist online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 250 broker checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 250 broker checklist

01

The 250 broker checklist is essential for any individual or organization seeking to evaluate and select a broker for their needs. Whether you are a professional investor, a business looking to outsource its brokerage services, or simply an individual looking for the right broker to handle your investments, this checklist can serve as a helpful tool in the decision-making process.

02

Start by gathering all the necessary information about the brokers you are considering. This includes their background, experience, and qualifications. Look for brokers who are licensed and regulated, with a strong track record of successful transactions and satisfied clients.

03

Evaluate the range of services each broker offers. Consider whether they specialize in the specific type of investments or financial products you are interested in. Determine if they have the necessary expertise and resources to meet your unique requirements.

04

Review the broker's fee structure and pricing. Compare the commissions or fees they charge for different types of transactions or services. Ensure that their pricing aligns with your budget and financial goals.

05

Look into the broker's technology and trading platforms. Assess their capabilities in terms of order execution, research tools, access to market data, and any additional features or benefits they may provide. Make sure their technology is reliable, user-friendly, and compatible with your own preferences and devices.

06

Consider the broker's reputation and customer service. Read reviews, seek recommendations, and explore their customer support options. Look for brokers who have a strong reputation for responsiveness, reliability, and professionalism.

07

Assess the broker's risk management practices and compliance measures. Evaluate their policies on data protection, privacy, and regulatory compliance to ensure that your investments and personal information are adequately safeguarded.

08

Consult with experts or seek advice from professionals in the financial industry. You may consider hiring a financial advisor or consulting with an investment professional who can provide insights into the particularities and nuances of selecting a broker.

09

Once you have gathered all the necessary information, thoroughly analyze and compare the brokers based on the checklist criteria. Consider each point listed and assign it a weight that reflects its importance to your specific needs and goals.

10

Finally, make an informed decision based on your analysis and the information obtained. Choose the broker that best meets your requirements and aligns with your investment objectives.

In conclusion, the 250 broker checklist serves as a comprehensive guide for anyone in need of selecting a broker. It helps in organizing and prioritizing the important factors to consider when evaluating and choosing a broker that aligns with one's investment goals and preferences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 250 broker checklist in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 250 broker checklist and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find 250 broker checklist?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 250 broker checklist and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit 250 broker checklist on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 250 broker checklist.

What is 250 broker checklist?

The 250 broker checklist is a form used to report information about brokers who handled 250 or more transactions during the calendar year.

Who is required to file 250 broker checklist?

Any broker who handled 250 or more transactions during the calendar year is required to file the 250 broker checklist.

How to fill out 250 broker checklist?

The 250 broker checklist can be filled out electronically or by hand. Brokers must provide information about their transactions, including the number of transactions and the total value of those transactions.

What is the purpose of 250 broker checklist?

The purpose of the 250 broker checklist is to provide the government with information about brokers who handle a large number of transactions. This helps regulators monitor the activities of these brokers and detect any suspicious or fraudulent behavior.

What information must be reported on 250 broker checklist?

Brokers must report the number of transactions they handled during the calendar year, the total value of those transactions, and any other relevant information requested on the checklist.

Fill out your 250 broker checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

250 Broker Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.