Get the free Preliminary Short Form Prospectus

Show details

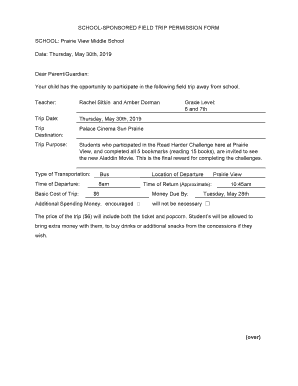

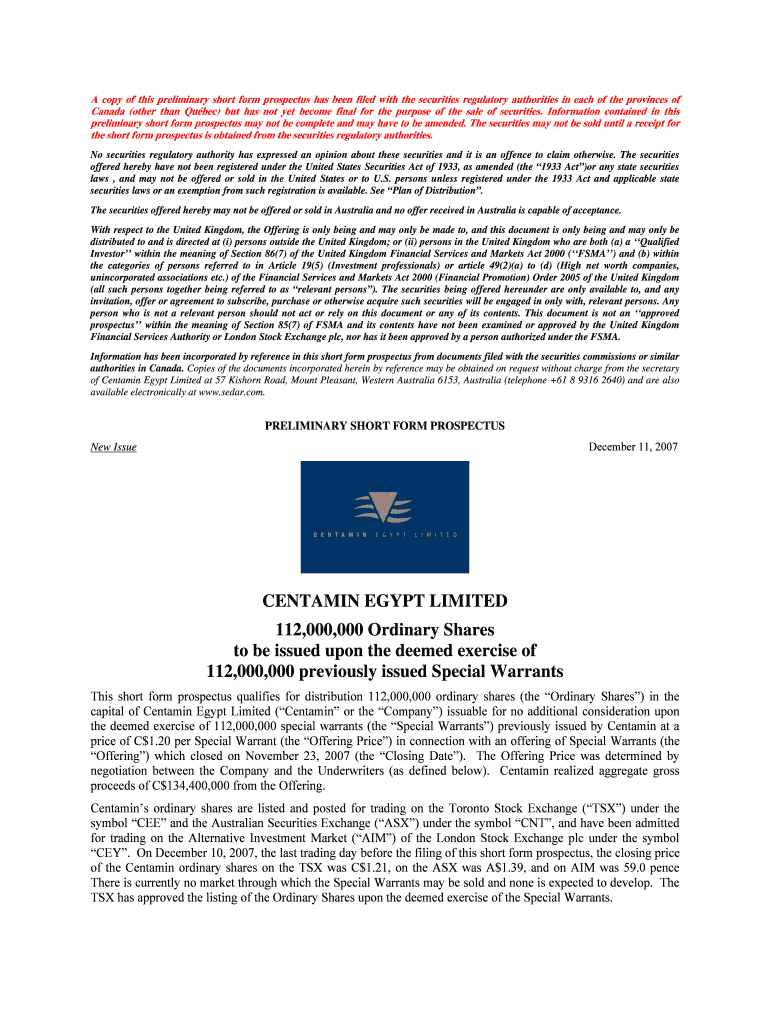

This document is a preliminary short form prospectus for the distribution of 112,000,000 Ordinary Shares to be issued upon the deemed exercise of previously issued Special Warrants by Centamin Egypt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign preliminary short form prospectus

Edit your preliminary short form prospectus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your preliminary short form prospectus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit preliminary short form prospectus online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit preliminary short form prospectus. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out preliminary short form prospectus

How to fill out Preliminary Short Form Prospectus

01

Obtain the Preliminary Short Form Prospectus template from the relevant regulatory authority.

02

Fill in the issuer's name and relevant details at the top of the form.

03

Provide a summary of the securities being offered, including the type and number of securities.

04

Include risk factors that potential investors should be aware of regarding the offering.

05

Describe the use of proceeds from the offering in clear terms.

06

Provide financial statements and other required information about the issuer.

07

Fill in the underwriting details, including who will be involved in the offering.

08

Review and ensure compliance with all regulatory requirements before submission.

09

Submit the completed Preliminary Short Form Prospectus to the relevant regulatory authority.

Who needs Preliminary Short Form Prospectus?

01

Companies planning to raise capital through public offerings.

02

Investment banks acting as underwriters for securities offerings.

03

Investors seeking to understand the details of the securities being offered.

04

Regulatory authorities overseeing public securities offerings.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a preliminary prospectus and a final prospectus?

A preliminary prospectus has most of the information that will end up in the final version of the prospectus, but may be missing certain important information such as the price or number of securities being sold.

What is a preliminary prospectus called?

A preliminary prospectus may also be referred to as a “red herring.” Sections 5 and 2(a)(3) of the Securities Act prohibit issuers from making written offers during the waiting period unless the written offer complies with Section 10.

What is a prospectus form?

In general. A prospectus is a written document that provides all material information about an offering of securities, and is the primary sales tool of the company that issues the securities (called the issuer) and broker-dealers that market the offering for the issuer (called underwriters).

What is a bought deal short form prospectus?

A bought deal is: An offering involving one or more underwriters who commit to purchase the securities of a reporting issuer that are to be offered in a distribution before a preliminary short form prospectus (or prospectus supplement) is filed.

What is a short form prospectus?

The Short-Form Prospectus Distribution System (SFPDS) is a standardized system that Canadian regulators use to distribute changes to the prospectus for each issue of security. The short-form prospectus must contain any material changes not previously reported.

What is abridged prospectus in simple words?

The abridged prospectus is a crucial document designed to communicate vital information to potential investors succinctly and effectively. It distils extensive details in the full prospectus into key elements most relevant to making informed investment decisions.

What is the short form prospectus system?

The Short-Form Prospectus Distribution System (SFPDS) is a standardized system that Canadian regulators use to distribute changes to the prospectus for each issue of security. The short-form prospectus must contain any material changes not previously reported.

What is a prep prospectus?

Title. Filing a post-receipt pricing (PREP) prospectus. Content. The post-receipt pricing (PREP) procedures allow companies to file a final prospectus that omits pricing and related information. Once pricing is determined, a supplemented PREP prospectus is filed with the OSC and provided to purchasers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Preliminary Short Form Prospectus?

A Preliminary Short Form Prospectus is a document filed with securities regulators that provides details about a new security offering, allowing potential investors to understand the investment before it becomes publicly available.

Who is required to file Preliminary Short Form Prospectus?

Companies that wish to offer securities to the public, especially in a short form offering, must file a Preliminary Short Form Prospectus to comply with regulatory requirements.

How to fill out Preliminary Short Form Prospectus?

To fill out a Preliminary Short Form Prospectus, companies must provide specific details about the offering, including the nature of the securities, offering price, use of proceeds, and information about the company and its management. It typically requires compliance with regulatory guidelines.

What is the purpose of Preliminary Short Form Prospectus?

The purpose of a Preliminary Short Form Prospectus is to inform potential investors about the securities being offered and to comply with legal requirements, thus facilitating informed investment decisions.

What information must be reported on Preliminary Short Form Prospectus?

The information that must be reported includes details about the issuer, the type of securities being offered, the total amount of the offering, risks associated with the investment, intended use of proceeds, and financial statements of the issuing company.

Fill out your preliminary short form prospectus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Preliminary Short Form Prospectus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.