Canada PGAA EMP5577 2011-2026 free printable template

Show details

Additional Continuous Benefits

Alberta Employment and Immigration is collecting this personal information to determine and verify your eligibility for Income Support. The collection,

use and disclosure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada PGAA EMP5577

Edit your Canada PGAA EMP5577 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada PGAA EMP5577 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada PGAA EMP5577 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada PGAA EMP5577. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

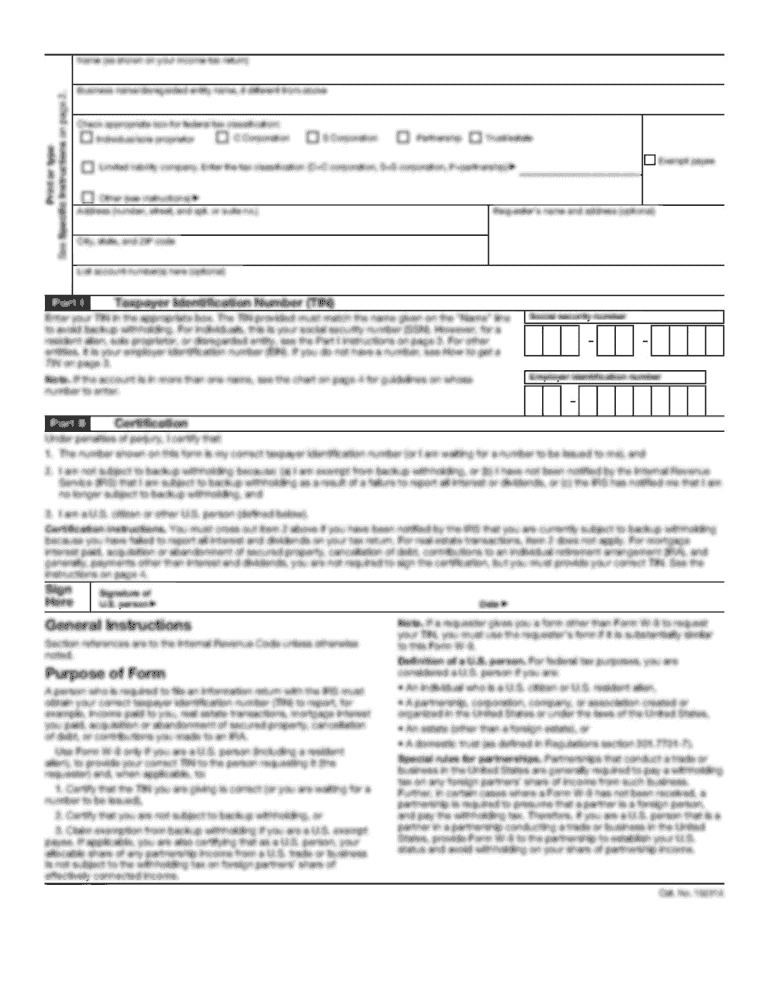

How to fill out Canada PGAA EMP5577

How to fill out Canada PGAA EMP5577

01

Obtain the Canada PGAA EMP5577 form from the official website or relevant authority.

02

Read the instructions provided with the form carefully.

03

Fill out the personal information section with your full name, address, and contact details.

04

Provide your immigration status and other required information in the designated fields.

05

If applicable, include details about your education and employment history.

06

Attach any required supporting documents as specified in the instructions.

07

Review your completed form for accuracy and completeness.

08

Submit the form via the method outlined in the instructions (online or by mail).

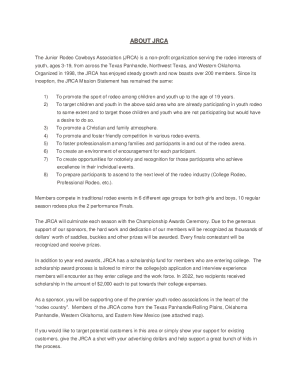

Who needs Canada PGAA EMP5577?

01

Individuals applying for immigration or residency in Canada.

02

Persons seeking to confirm their eligibility for certain programs or benefits under Canadian immigration law.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim the$ 600 Alberta affordability payments?

Individuals who did not file a tax return or who began receiving CPPD benefits on or after January 1, 2022 need to apply by calling 1-844-644-9955. Clients with dependent children under 18 will need to apply online or in-person to get an additional $600 per child (See the families with children section for details).

What is the $600 rebate in Alberta?

Albertans on core supports AISH, PDD, CPP Disability, Income Support and Seniors Benefit clients automatically get $600.

Who qualifies for Alberta inflation relief?

Families with household incomes below $180,000 are eligible to receive $100 per month for six months for each dependent child under 18. Seniors 65 or older who have household incomes below $180,000 and do not receive the Alberta Seniors Benefit can also apply.

Who is eligible for $600 in Canada?

Eligibility for Seniors: Age 65 or older by June 30, 2023. Adjusted household income is below $180,000 ing to your 2021 tax return. Alberta resident as of November 30, 2022, and remain so on the first day of each month between January and June to be eligible for each month's payment.

How do I pay Alberta?

For COVID-19 updates, visit COVID-19 info for Albertans. Overview. Electronic payment. Credit card. Interac e-transfer. Cash or debit. PayPal. Cheque or money order. Wire transfer.

Why have i not received my Alberta Affordability payment?

“If they have not received their payment, typically it's because incorrect banking information was entered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Canada PGAA EMP5577?

With pdfFiller, it's easy to make changes. Open your Canada PGAA EMP5577 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the Canada PGAA EMP5577 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your Canada PGAA EMP5577 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete Canada PGAA EMP5577 on an Android device?

Use the pdfFiller Android app to finish your Canada PGAA EMP5577 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

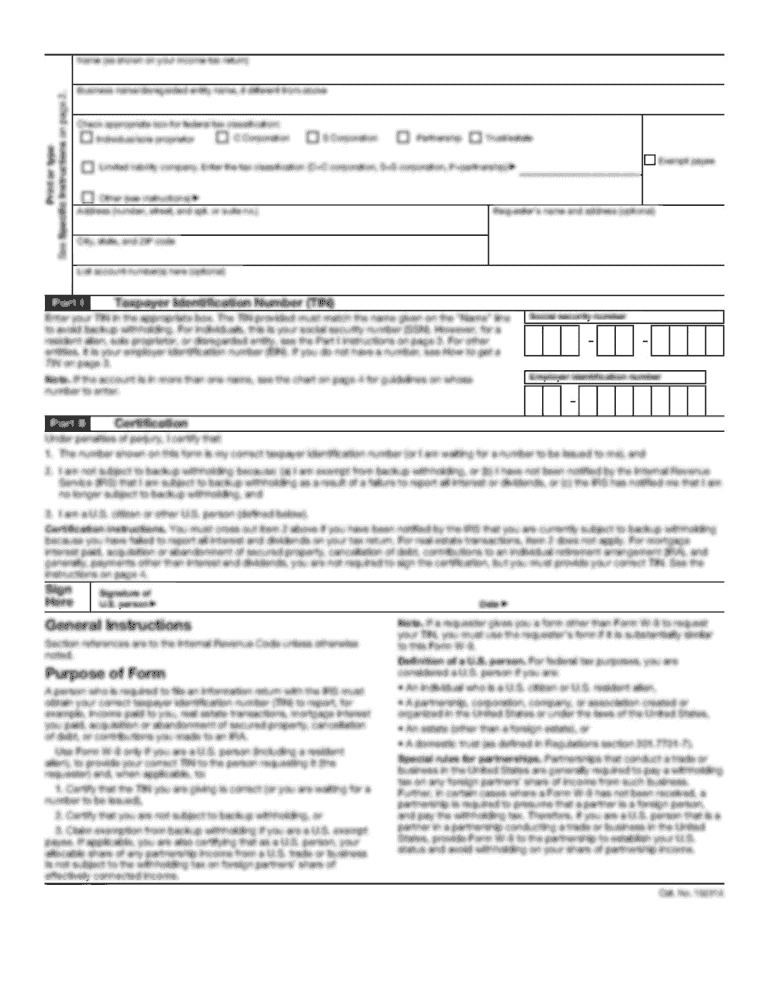

What is Canada PGAA EMP5577?

Canada PGAA EMP5577 is a tax form related to the reporting of employee benefits and allowances under the Canadian Income Tax Act.

Who is required to file Canada PGAA EMP5577?

Employers who provide benefits or allowances to their employees are required to file the Canada PGAA EMP5577 form.

How to fill out Canada PGAA EMP5577?

To fill out Canada PGAA EMP5577, employers must provide detailed information about the benefits or allowances paid to employees, ensuring that all relevant fields are accurately completed.

What is the purpose of Canada PGAA EMP5577?

The purpose of Canada PGAA EMP5577 is to ensure proper reporting of employee benefits and allowances for tax purposes, and to assist in the calculation of employee income.

What information must be reported on Canada PGAA EMP5577?

The information that must be reported on Canada PGAA EMP5577 includes the type of benefits or allowances provided, their value, and the details of the employees receiving them.

Fill out your Canada PGAA EMP5577 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada PGAA emp5577 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.