Get the Tax-Free Savings Account (TFSA)

Show details

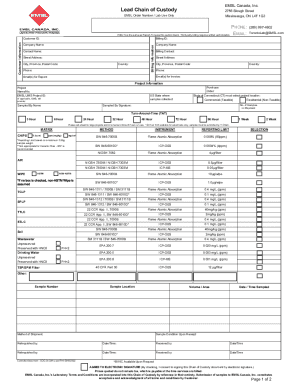

This document is a tax return form for the Tax-Free Savings Account (TFSA) in Canada, outlining how to calculate taxes on excess contributions, non-resident contributions, non-qualified investments,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax- savings account tfsa

Edit your tax- savings account tfsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax- savings account tfsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax- savings account tfsa online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax- savings account tfsa. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax- savings account tfsa

How to fill out Tax-Free Savings Account (TFSA)

01

Determine your eligibility: You must be a Canadian resident, at least 18 years old, and have a valid Social Insurance Number (SIN).

02

Decide on your contribution amount: Know the annual limit for TFSA contributions (check for any changes each year).

03

Choose a financial institution: Research and select a bank, credit union, or investment firm that offers TFSA accounts.

04

Complete the application: Fill out the necessary forms provided by the financial institution. This may be done online or in person.

05

Provide identification: Show proof of identity and your SIN to the financial institution.

06

Fund your account: Transfer money or assets into your TFSA, either through contributions or rollovers.

07

Select your investments: Choose from various investment options like savings accounts, mutual funds, stocks, or bonds available within the TFSA.

08

Keep track of contributions: Monitor your contributions to avoid over-contributing, as this can incur penalties.

09

Review and adjust as needed: Regularly assess your investments and make adjustments to align with your financial goals.

Who needs Tax-Free Savings Account (TFSA)?

01

Individuals looking to save for short-term or long-term goals without incurring taxes on earnings.

02

Those who want to supplement retirement savings while keeping funds accessible.

03

Residents who have maxed out their Registered Retirement Savings Plans (RRSP) contributions.

04

Young savers starting their financial journey who want to grow their savings tax-free.

05

Individuals with varying incomes seeking flexible savings options.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I put more than 7000 in my TFSA?

At any time in the year, if you contribute more than your available TFSA contribution room, you will have to pay a tax equal to 1% of the highest excess TFSA amount in the month, for each month that the excess amount remains in your account.

What is a TFSA and how does it work?

The TFSA program began in 2009. It is a way for individuals who are 18 and older and who have a valid social insurance number (SIN) to set money aside tax-free throughout their lifetime. Contributions to a TFSA are not deductible for income tax purposes.

What are the 5 mistakes you must avoid in a TFSA?

Here are the eight most costly TFSA mistakes to avoid. Over-contributing, by accident. Over-contributing, on purpose. Withdrawals and deposits between institutions. Contributions made while outside Canada. Prohibited and non-qualified investments. Foreign dividend earners. Too many low-yield investments. Day trading in a TFSA.

What are the pros and cons of a TFSA?

The comparison TFSA What are the tax advantages? Your money grows tax-free; you pay no tax on withdrawals. What are the tax disadvantages? Contributions are not tax deductible. What are the withdrawal rules? Tax-free, at any time and for any purpose10 more rows

Can I contribute to TFSA if I live abroad?

If you become a non-resident, you are able to maintain your TFSA and will not be taxed on any earnings or withdrawals in the account. However, you will not be allowed to contribute additional funds and no contribution room will accrue for the years in which you are a non-resident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax-Free Savings Account (TFSA)?

A Tax-Free Savings Account (TFSA) is a Canadian savings account that offers tax benefits, where contributions are not tax-deductible, but investment income is tax-free, even when withdrawn.

Who is required to file Tax-Free Savings Account (TFSA)?

Individuals who open a TFSA and contribute to it are required to file information regarding their contributions, withdrawals, and investment income as part of their annual tax returns.

How to fill out Tax-Free Savings Account (TFSA)?

To fill out a TFSA, individuals must complete the appropriate forms provided by their financial institution and report any contributions or withdrawals on their tax returns, ensuring they do not exceed the annual contribution limit.

What is the purpose of Tax-Free Savings Account (TFSA)?

The purpose of a TFSA is to encourage Canadians to save by allowing them to earn investment income tax-free, providing flexibility in accessing funds without tax penalties.

What information must be reported on Tax-Free Savings Account (TFSA)?

Individuals must report their total contributions, withdrawals, and any capital gains or interest earned in their TFSA on their tax return, as well as ensure they stay within the designated contribution limits.

Fill out your tax- savings account tfsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax- Savings Account Tfsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.