TX Comptroller 50-767 2014 free printable template

Show details

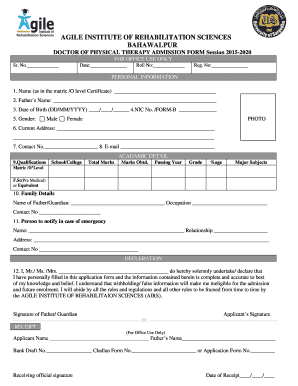

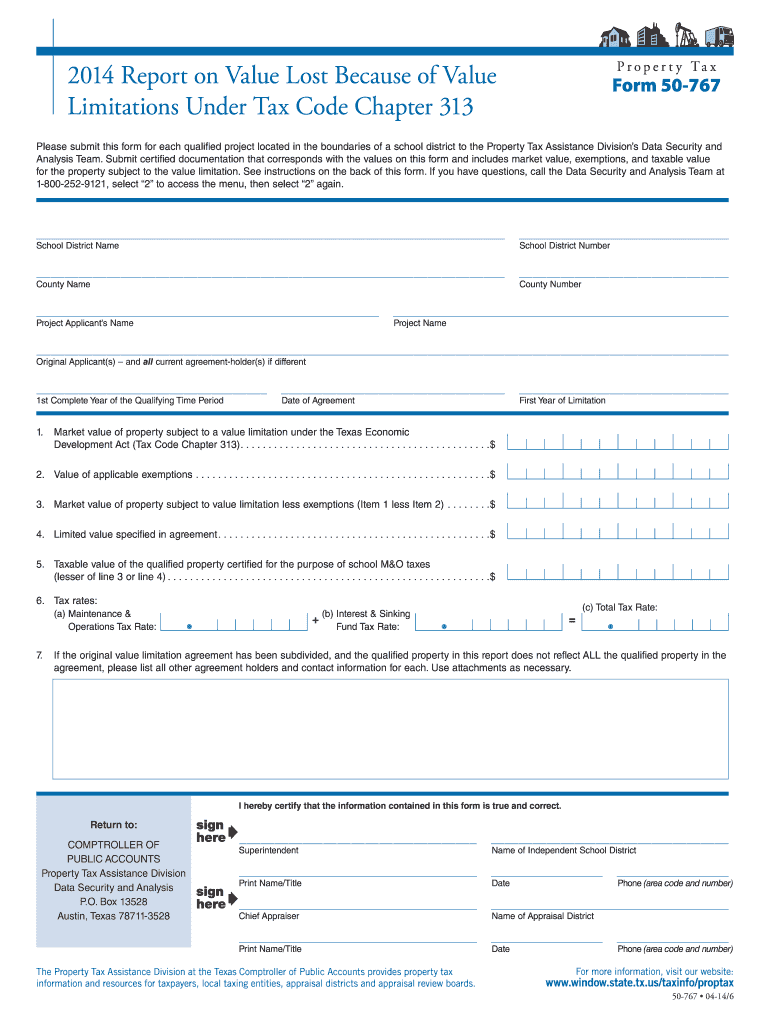

P r o p e r t y Ta x 2013 Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 Form 50-767 Please submit this form for each qualified project located in the boundaries of a

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-767

Edit your TX Comptroller 50-767 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-767 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-767 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller 50-767. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-767 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-767

How to fill out TX Comptroller 50-767

01

Obtain the TX Comptroller Form 50-767 from the official website or a local office.

02

Fill out the 'Property Owner Information' section with your name and contact details.

03

Provide the 'Property Information' including the address and account number of the property.

04

Specify the 'Type of Exemption' you are applying for by checking the appropriate box.

05

Complete any additional required sections based on the exemption type.

06

Attach any necessary supporting documents that prove eligibility for the exemption.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the local appraisal district before the specified deadline.

Who needs TX Comptroller 50-767?

01

Property owners who are seeking a tax exemption in Texas.

02

Individuals or organizations that own properties qualifying for specific exemptions like homestead or disability exemptions.

03

Real estate investors who may want to apply for exemptions on qualifying investment properties.

Fill

form

: Try Risk Free

People Also Ask about

What evidence do I need to protest property taxes in Texas?

You should gather all information about your property that may be relevant in considering the true value of your home such as: Photographs of property (yours and comparables) Receipts or estimates for repairs. Sales price documentation, such as listings, closing statements and other information.

What is the primary role of the comptroller of public accounts?

The Comptroller's office collects more than 60 state taxes, fees and assessments as well as the local sales tax we collect on behalf of more than 1,400 local governments. The tax collection function involves many tasks.

How can I reduce my property taxes in Texas?

Texas grants every property owner the right to protest their appraised value. You can file the protest on Form 50-132. Protesting your property value is the only way to lower your property tax! If you don't protest, it ain't getting lower!

What is the most important power of the Texas Comptroller of Public Accounts?

The Comptroller is state government's primary accountant, responsible for writ- ing the state's checks and monitoring all spending by state agencies. The Comptroller is also the state's official revenue estimator, providing the Legislature with anticipated state revenue information.

How to protest property taxes and win Texas?

At an informal protest, you simply need to present data on your home to your appraisal district. In most cases, you can simply visit your appraisal district office and wait to meet with an appraiser. The number one recommendation for winning an informal protest is simple – be kind.

What does the Comptroller of Public Accounts do in Texas?

As the state's cashier, the Comptroller's office receives, disburses, counts, safeguards, records, allocates, manages and reports on the state's cash. In addition, the Texas Comptroller chairs the state's Treasury Safekeeping Trust, which invests, manages and oversees more than $50 billion in assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX Comptroller 50-767 for eSignature?

When your TX Comptroller 50-767 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find TX Comptroller 50-767?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the TX Comptroller 50-767 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit TX Comptroller 50-767 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit TX Comptroller 50-767.

What is TX Comptroller 50-767?

TX Comptroller 50-767 is a form used in Texas for reporting certain property tax information and providing details about property tax exemptions.

Who is required to file TX Comptroller 50-767?

Property owners who claim or seek an exemption from property taxes are required to file TX Comptroller 50-767.

How to fill out TX Comptroller 50-767?

To fill out TX Comptroller 50-767, gather necessary property details and exemptions being claimed, then complete the form by providing accurate information in all required fields.

What is the purpose of TX Comptroller 50-767?

The purpose of TX Comptroller 50-767 is to ensure proper reporting of property tax exemptions and to facilitate the administration of Texas property tax laws.

What information must be reported on TX Comptroller 50-767?

Information that must be reported includes the property owner's name, property address, type of exemption being claimed, and any additional relevant details regarding the property.

Fill out your TX Comptroller 50-767 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-767 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.