TX Comptroller 50-767 2017 free printable template

Show details

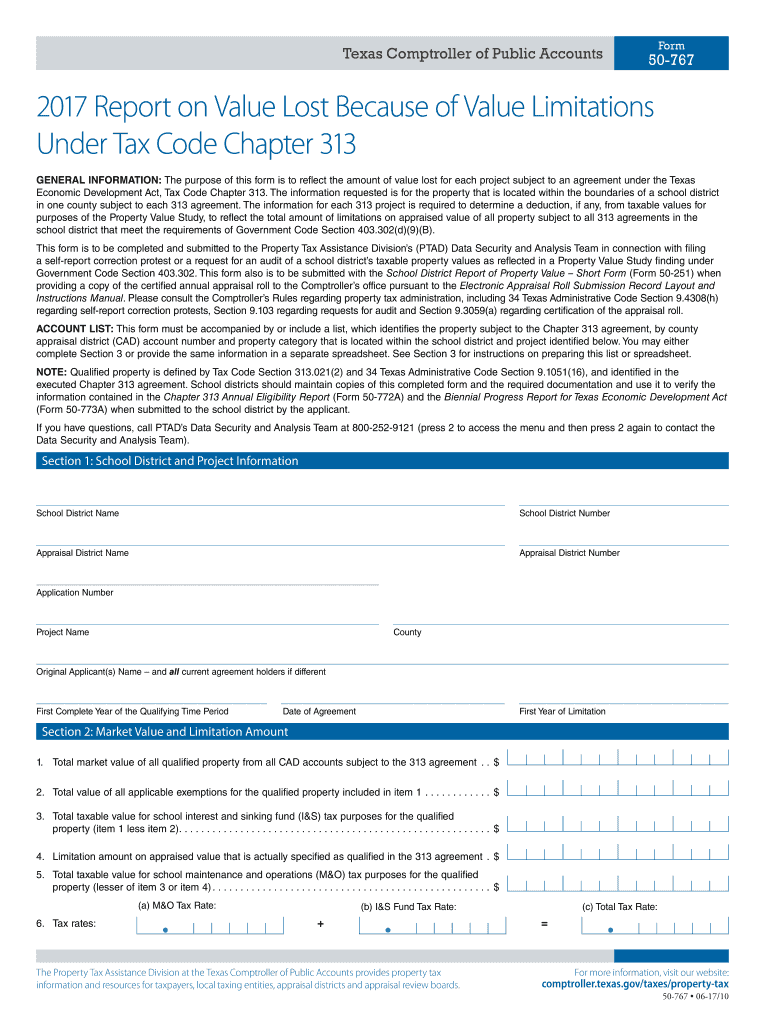

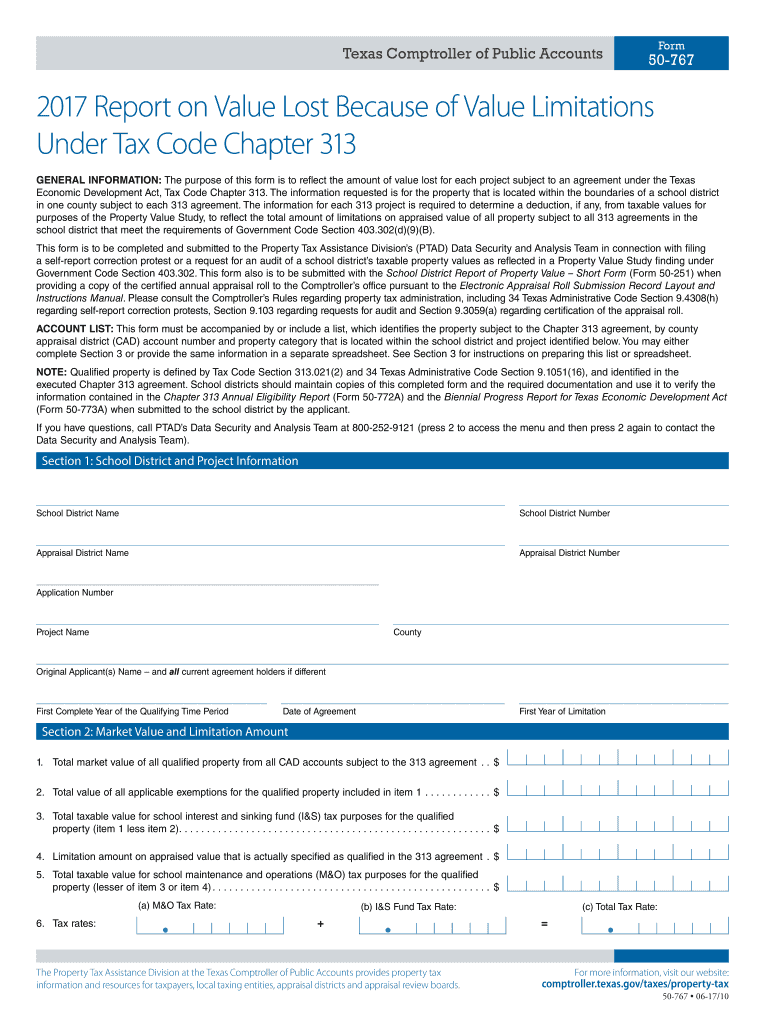

Texas Comptroller of Public Accounts Form 50-767 2017 Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 GENERAL INFORMATION The purpose of this form is to reflect the amount of value lost for each project subject to an agreement under the Texas Economic Development Act Tax Code Chapter 313. The information requested is for the property that is located within the boundaries of a school district in one county subject to each 313 agreement. The information for each 313...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-767

Edit your TX Comptroller 50-767 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-767 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-767 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TX Comptroller 50-767. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-767 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-767

How to fill out TX Comptroller 50-767

01

Begin by downloading the TX Comptroller 50-767 form from the official website.

02

Write the name of the property owner at the top of the form.

03

Provide the mailing address of the property owner.

04

Enter the property's legal description, including the county and property identification number.

05

Indicate the type of exemption you are applying for, checking the appropriate box.

06

Fill in the required financial information, such as gross income.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate Texas county appraisal district office by the deadline.

Who needs TX Comptroller 50-767?

01

Property owners seeking tax exemptions in Texas.

02

Individuals or entities that own property used for certain exemptions, such as charitable organizations.

03

Businesses that qualify for specific tax exemptions as defined by Texas tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What evidence do I need to protest property taxes in Texas?

You should gather all information about your property that may be relevant in considering the true value of your home such as: Photographs of property (yours and comparables) Receipts or estimates for repairs. Sales price documentation, such as listings, closing statements and other information.

What is the primary role of the comptroller of public accounts?

The Comptroller's office collects more than 60 state taxes, fees and assessments as well as the local sales tax we collect on behalf of more than 1,400 local governments. The tax collection function involves many tasks.

How can I reduce my property taxes in Texas?

Texas grants every property owner the right to protest their appraised value. You can file the protest on Form 50-132. Protesting your property value is the only way to lower your property tax! If you don't protest, it ain't getting lower!

What is the most important power of the Texas Comptroller of Public Accounts?

The Comptroller is state government's primary accountant, responsible for writ- ing the state's checks and monitoring all spending by state agencies. The Comptroller is also the state's official revenue estimator, providing the Legislature with anticipated state revenue information.

How to protest property taxes and win Texas?

At an informal protest, you simply need to present data on your home to your appraisal district. In most cases, you can simply visit your appraisal district office and wait to meet with an appraiser. The number one recommendation for winning an informal protest is simple – be kind.

What does the Comptroller of Public Accounts do in Texas?

As the state's cashier, the Comptroller's office receives, disburses, counts, safeguards, records, allocates, manages and reports on the state's cash. In addition, the Texas Comptroller chairs the state's Treasury Safekeeping Trust, which invests, manages and oversees more than $50 billion in assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find TX Comptroller 50-767?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the TX Comptroller 50-767 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in TX Comptroller 50-767?

With pdfFiller, the editing process is straightforward. Open your TX Comptroller 50-767 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the TX Comptroller 50-767 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign TX Comptroller 50-767. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is TX Comptroller 50-767?

TX Comptroller 50-767 is a form used in Texas for reporting unclaimed property establishments and reporting the status of such properties to the state comptroller.

Who is required to file TX Comptroller 50-767?

Any entity that holds unclaimed property, such as businesses and institutions, is required to file TX Comptroller 50-767.

How to fill out TX Comptroller 50-767?

To fill out TX Comptroller 50-767, you must provide details about the unclaimed properties, including the holder's information, property descriptions, and the applicable amounts.

What is the purpose of TX Comptroller 50-767?

The purpose of TX Comptroller 50-767 is to ensure proper reporting and remittance of unclaimed property to the Texas state, facilitating the return of these properties to their rightful owners.

What information must be reported on TX Comptroller 50-767?

TX Comptroller 50-767 must report information such as the holder's name and address, a description of the unclaimed property, the owner's name, last known address, and the amount of property.

Fill out your TX Comptroller 50-767 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-767 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.