TX Comptroller 50-767 2023-2026 free printable template

Show details

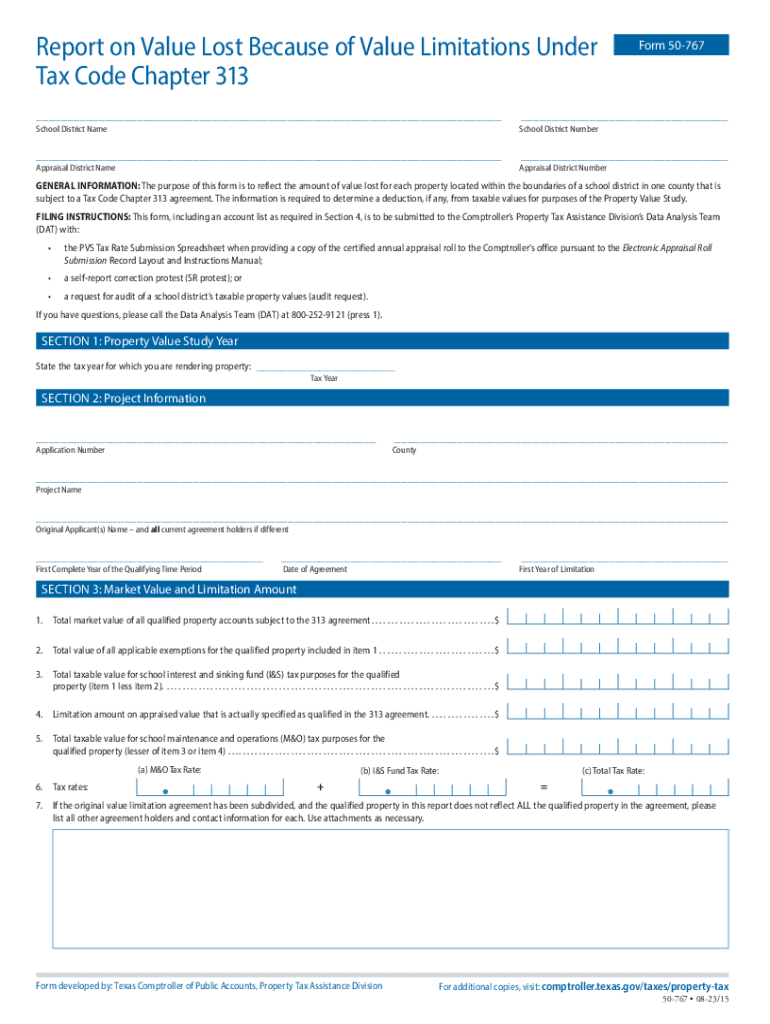

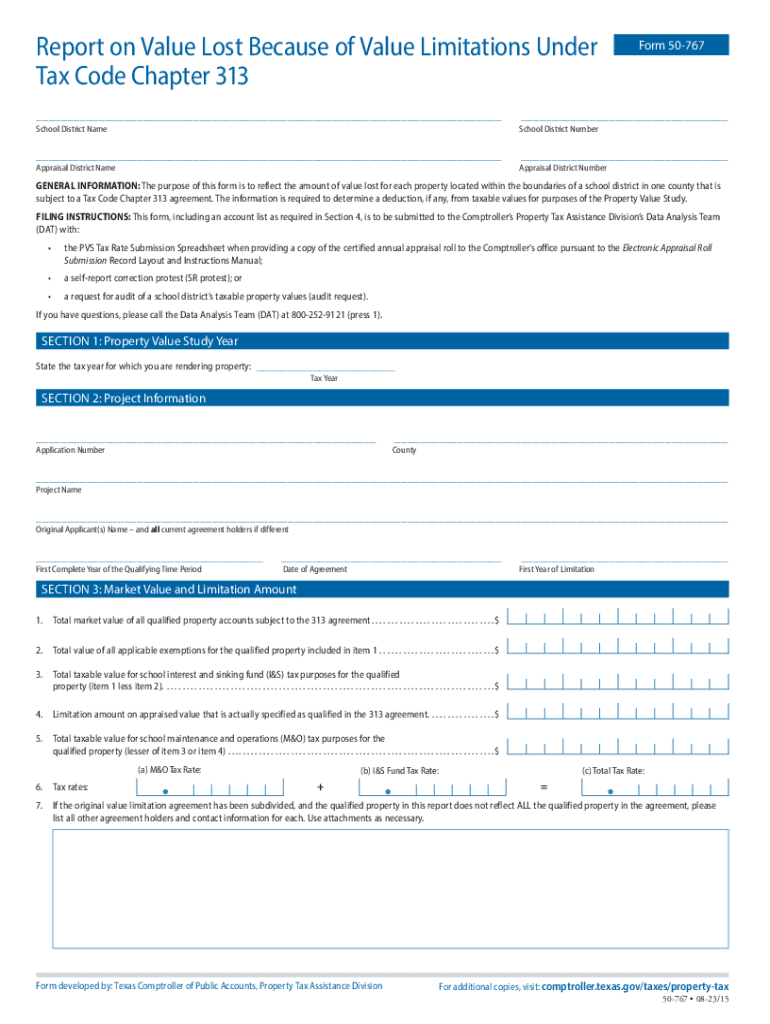

Report on Value Lost Because of Value Limitations Under

Tax Code Chapter 313Form 50767______School District NameSchool District Number______Appraisal District NameAppraisal District NumberGENERAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas form 50 767

Edit your form 50 search form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas because limitations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas because limitations under online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX Comptroller 50-767. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-767 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-767

How to fill out TX Comptroller 50-767

01

Obtain the TX Comptroller 50-767 form from the Texas Comptroller's website.

02

Read the instructions provided at the top of the form carefully.

03

Fill in the property owner’s name and contact information in the designated fields.

04

Specify the property account number and the type of property being claimed.

05

Provide a brief description of the property including its location.

06

Indicate the tax year for which you are claiming the exemption.

07

Sign and date the form to certify the information is accurate.

08

Submit the completed form to the appropriate county appraisal district office.

Who needs TX Comptroller 50-767?

01

Property owners in Texas seeking to claim an exemption for their property tax.

02

Individuals, businesses, or organizations that own property eligible for specific exemptions.

03

Taxpayers who want to ensure their property taxes are reduced based on qualifying conditions.

Fill

form

: Try Risk Free

People Also Ask about

What evidence do I need to protest property taxes in Texas?

You should gather all information about your property that may be relevant in considering the true value of your home such as: Photographs of property (yours and comparables) Receipts or estimates for repairs. Sales price documentation, such as listings, closing statements and other information.

What is the primary role of the comptroller of public accounts?

The Comptroller's office collects more than 60 state taxes, fees and assessments as well as the local sales tax we collect on behalf of more than 1,400 local governments. The tax collection function involves many tasks.

How can I reduce my property taxes in Texas?

Texas grants every property owner the right to protest their appraised value. You can file the protest on Form 50-132. Protesting your property value is the only way to lower your property tax! If you don't protest, it ain't getting lower!

What is the most important power of the Texas Comptroller of Public Accounts?

The Comptroller is state government's primary accountant, responsible for writ- ing the state's checks and monitoring all spending by state agencies. The Comptroller is also the state's official revenue estimator, providing the Legislature with anticipated state revenue information.

How to protest property taxes and win Texas?

At an informal protest, you simply need to present data on your home to your appraisal district. In most cases, you can simply visit your appraisal district office and wait to meet with an appraiser. The number one recommendation for winning an informal protest is simple – be kind.

What does the Comptroller of Public Accounts do in Texas?

As the state's cashier, the Comptroller's office receives, disburses, counts, safeguards, records, allocates, manages and reports on the state's cash. In addition, the Texas Comptroller chairs the state's Treasury Safekeeping Trust, which invests, manages and oversees more than $50 billion in assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the TX Comptroller 50-767 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your TX Comptroller 50-767 in seconds.

Can I create an electronic signature for signing my TX Comptroller 50-767 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your TX Comptroller 50-767 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out TX Comptroller 50-767 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your TX Comptroller 50-767, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is TX Comptroller 50-767?

TX Comptroller 50-767 is a form used for reporting property tax exemptions in Texas, specifically for properties owned by charitable organizations.

Who is required to file TX Comptroller 50-767?

Organizations seeking a property tax exemption in Texas, primarily non-profit and charitable organizations, are required to file TX Comptroller 50-767.

How to fill out TX Comptroller 50-767?

To fill out TX Comptroller 50-767, applicants must provide their organization's information, details about the property in question, and the nature of their exemption request. They should ensure all sections are completed accurately and submit the form to the appropriate local appraisal district.

What is the purpose of TX Comptroller 50-767?

The purpose of TX Comptroller 50-767 is to facilitate the process for charitable organizations to apply for property tax exemptions, ensuring that eligible entities can receive financial relief from property taxes.

What information must be reported on TX Comptroller 50-767?

The form requires reporting the organization's name, address, the specific property details, the reason for the exemption, and any other relevant supporting information that demonstrates eligibility for the tax exemption.

Fill out your TX Comptroller 50-767 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-767 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.