AZ DoR JT-1/UC-001 2009 free printable template

Show details

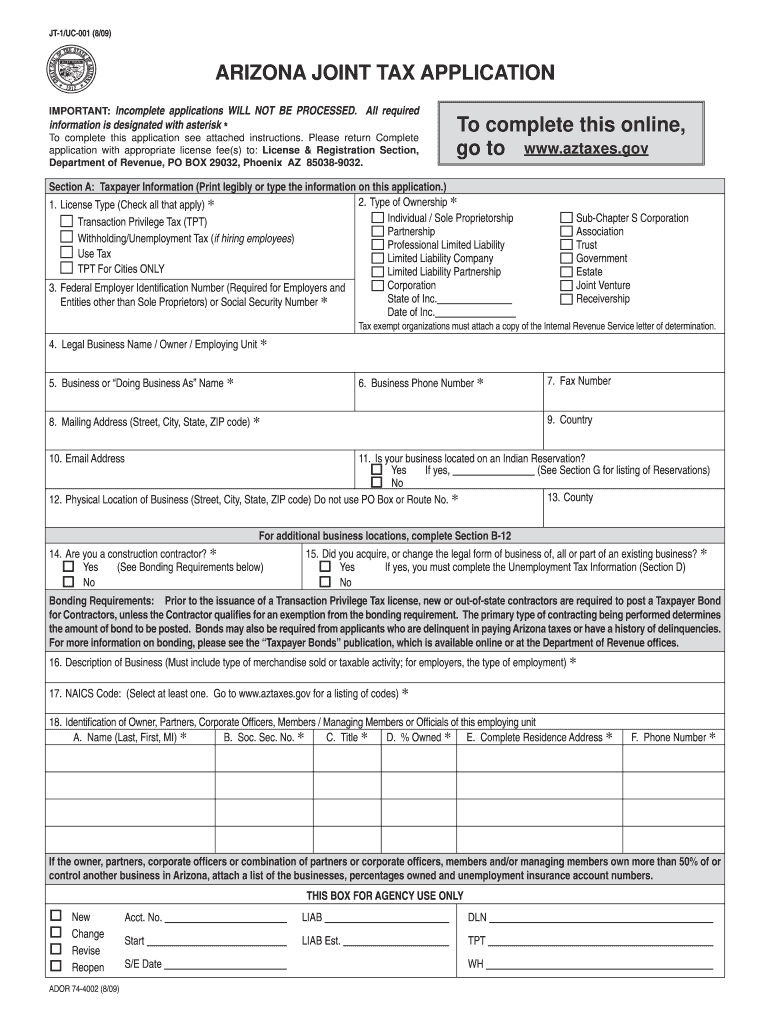

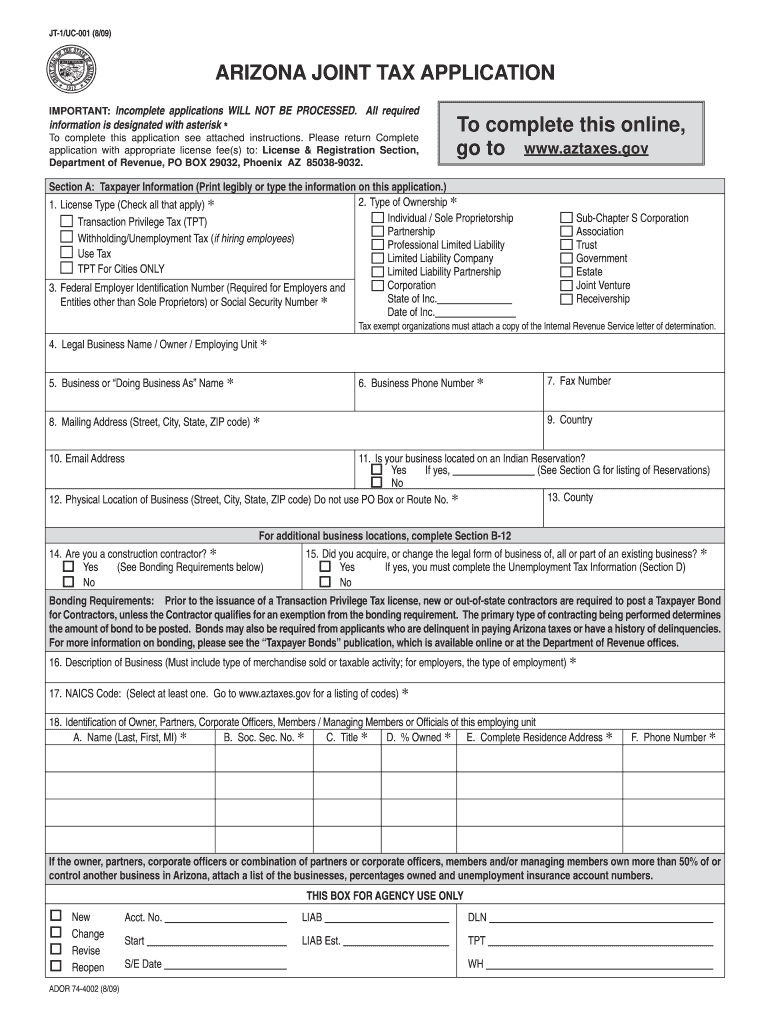

JT-1/UC-001 8/09 ARIZONA JOINT TAX APPLICATION IMPORTANT Incomplete applications WILL NOT BE PROCESSED. Tohono O Odham Maricopa Tohono O Odham Pima MAN PMN MAO GLP GRP PNP COQ MAT PMT Use Tax - Utilities Rental Occupancy Tax Use Tax Purchases Use Tax from Inventory Telecommunications Devices 911 Wireless Contracting - Owner Builder Municipal Water Membership Camping Tonto Apache Gila White Mtn Apache Apache Yavapai Apache Yavapai Yavapai Prescott Yavapai PNT GLU APD GLD GRD NAD YAW YAX Jet...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona joint tax application

Edit your arizona joint tax application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona joint tax application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona joint tax application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit arizona joint tax application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DoR JT-1/UC-001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona joint tax application

How to fill out AZ DoR JT-1/UC-001

01

Obtain the AZ DoR JT-1/UC-001 form from the Arizona Department of Revenue website or local office.

02

Begin by filling out your personal information in the designated fields, including your name, address, and contact details.

03

Input your business information if applicable, including the business name, entity type, and employer identification number (EIN).

04

Specify the relevant tax period for which you are filing.

05

Clearly indicate the nature of your request or purpose for filing the form.

06

Ensure that you review all entries for accuracy and completeness before submission.

07

Sign and date the form where required.

08

Submit the completed form via the designated submission method, which may include online, via mail, or in person.

Who needs AZ DoR JT-1/UC-001?

01

Individuals who need to report business income, request tax exemptions, or make corrections to previously filed tax documents.

02

Businesses operating in Arizona that require to report or update their tax information.

03

Tax professionals assisting clients with tax filings related to Arizona Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

How do I file sales tax in Arizona?

You have two options for filing and paying your Arizona sales tax: File online – File online at the Arizona Department of Revenue. You can remit your payment through their online system.

Is TPT tax the same as sales tax?

Arizona transaction privilege tax (TPT), commonly referred to as a sales tax, is a tax on vendors for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

How much is the TPT tax in Arizona?

Arizona originally adopted TPT in 1933 when the rate for selling tangible personal property at retail was 2 percent. That rate is currently 5.6 percent.

What is the TPT 2 form?

If your filing has more jurisdictions and/or deductions than these, you must file the TPT-2. The TPT-2 form separates the state/county transactions, city transactions, and Schedule A deductions pages into separate pages.

What is a JT-1?

This form is used to apply for transaction privilege tax, use tax, and Employer Withholding and Unemployment Insurance. The Application is called “Joint” because it is used by both the Arizona Department of Revenue and Economic Security. JT-1.

Do I need a TPT in Arizona?

Licensing Requirements If a business is selling a product or engaging in a service subject to TPT, that business will likely need a license from the Arizona Department of Revenue (ADOR) and a TPT, or business/occupational license, from the city or cities in which the business has a base or operation.

What is Arizona TPT?

Although commonly referred to as a sales tax, the Arizona transaction privilege tax (TPT) is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

What is a JT 1 form?

Share. INSTRUCTIONS: ARIZONA JOINT TAX APPLICATION (Form JT-1) To license a new business in Arizona or change ownership on an existing business, file a form JT-1. This document can be obtained from the website of the Arizona Department of Revenue.

Who is subject to Arizona TPT tax?

Transaction privilege tax (TPT) is a tax on a vendor for the privilege of doing business in the state of Arizona. Arizona originally adopted TPT in 1933 when the rate for selling tangible personal property at retail was 2 percent.

Do I need to file W 2 for Arizona?

Arizona W-2 State Filing Requirements The Form W-2, Wage and Tax Statement should be filed with the State of Arizona. The State of Arizona also mandates the filing of Form A1-R, Withholding Reconciliation Return.

What is an Arizona transaction privilege tax license?

Although commonly referred to as a sales tax, the Arizona transaction privilege tax (TPT) is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

What is Arizona Joint tax Application?

This form is used to apply for transaction privilege tax, use tax, and Employer Withholding and Unemployment Insurance. The Application is called “Joint” because it is used by both the Arizona Department of Revenue and Economic Security.

How is the TPT calculated in Arizona?

TPT filing frequency is determined by the amount of a business' total estimated annual combined Arizona, county and municipal TPT liability. Businesses who would like to change their filing frequency can download and complete the Business Account Update Form and mail it to the address on the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit arizona joint tax application straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit arizona joint tax application.

How can I fill out arizona joint tax application on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your arizona joint tax application, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete arizona joint tax application on an Android device?

Complete your arizona joint tax application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is AZ DoR JT-1/UC-001?

AZ DoR JT-1/UC-001 is a form used in Arizona for reporting unemployment compensation and related information to the Department of Revenue.

Who is required to file AZ DoR JT-1/UC-001?

Employers in Arizona who have employees that receive unemployment compensation or are subject to unemployment insurance laws are required to file AZ DoR JT-1/UC-001.

How to fill out AZ DoR JT-1/UC-001?

To fill out AZ DoR JT-1/UC-001, employers need to provide accurate employee and compensation information as specified in the form's instructions, ensuring that all sections are completed fully.

What is the purpose of AZ DoR JT-1/UC-001?

The purpose of AZ DoR JT-1/UC-001 is to collect data regarding unemployment compensation for accurate tracking and management of unemployment insurance claims and benefits.

What information must be reported on AZ DoR JT-1/UC-001?

The information that must be reported on AZ DoR JT-1/UC-001 includes employee names, Social Security numbers, wages, and other relevant employment details specified in the form.

Fill out your arizona joint tax application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Joint Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.