AZ DoR JT-1/UC-001 2015 free printable template

Show details

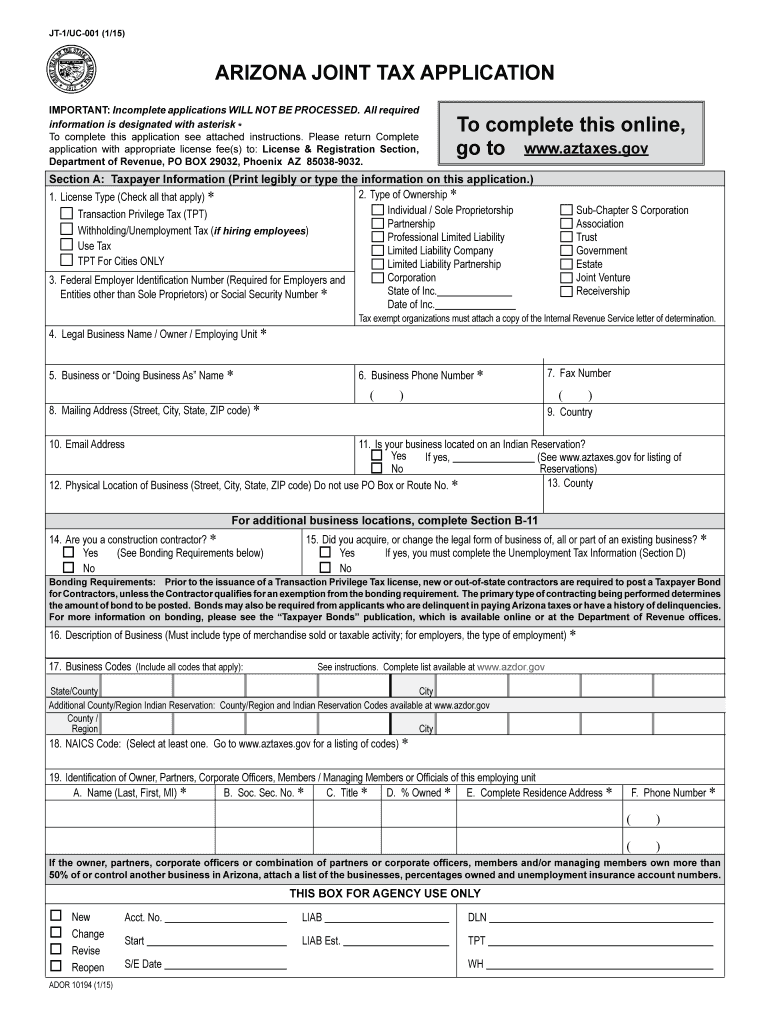

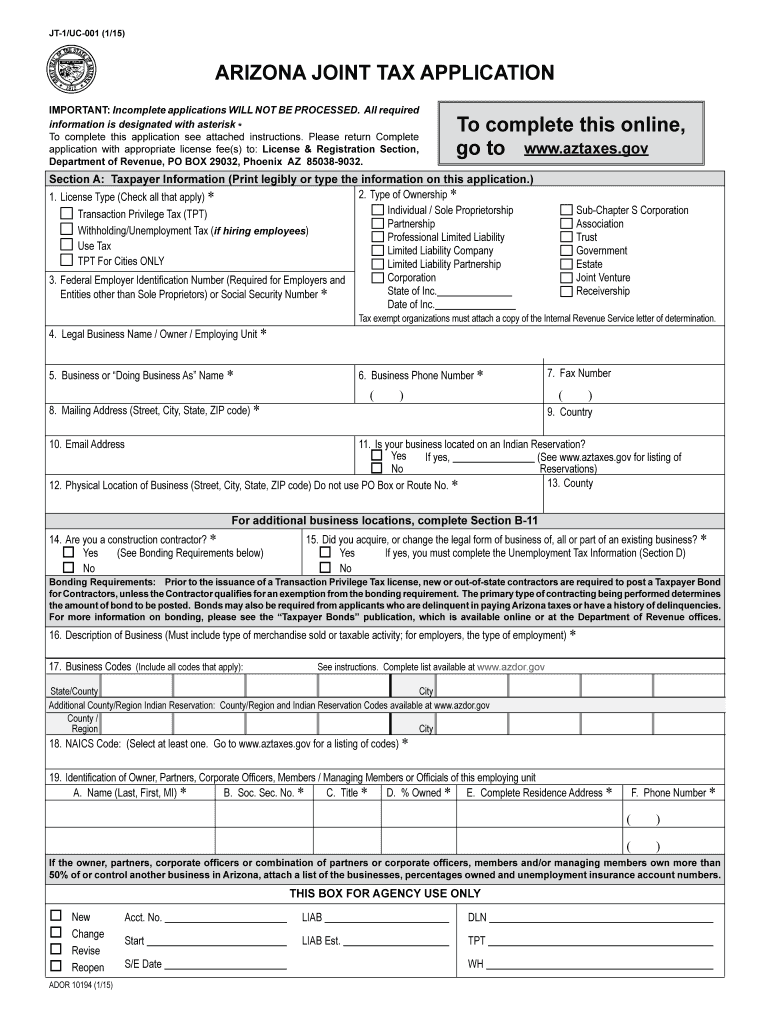

JT-1/UC-001 1/15 ARIZONA JOINT TAX APPLICATION IMPORTANT Incomplete applications WILL NOT BE PROCESSED. Page 5 INSTRUCTIONS FOR ARIZONA JOINT TAX APPLICATION IMPORTANT You must complete each of the following sections or your application will be returned For licensing questions on Transaction Privilege Withholding or Use Tax Department of Revenue call 602 542-4576 For Unemployment Tax Department of Economic Security call 602 771-6602 or e-mail uit. Make checks payable to the Arizona with your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona joint tax application

Edit your arizona joint tax application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona joint tax application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arizona joint tax application online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit arizona joint tax application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DoR JT-1/UC-001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona joint tax application

How to fill out AZ DoR JT-1/UC-001

01

Download the AZ DoR JT-1/UC-001 form from the official Arizona Department of Revenue website.

02

Fill in the top section with your name, address, and contact information.

03

Provide your taxpayer identification number or Social Security number.

04

Indicate the type of tax return you are filing by checking the appropriate box.

05

Complete the income section with your total earnings, deductions, and applicable tax credits.

06

Review the instructions on the form for any specific entries based on your tax situation.

07

Double-check all your entries for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the completed form according to the instructions, either electronically or by mailing it to the appropriate address.

Who needs AZ DoR JT-1/UC-001?

01

Individuals and businesses required to file a tax return in Arizona.

02

Taxpayers looking to report and pay state income taxes.

03

Anyone claiming a refund, credit, or exemption on their state taxes.

04

Residents and non-residents earning income in Arizona.

Fill

form

: Try Risk Free

People Also Ask about

How do I file sales tax in Arizona?

You have two options for filing and paying your Arizona sales tax: File online – File online at the Arizona Department of Revenue. You can remit your payment through their online system.

Is TPT tax the same as sales tax?

Arizona transaction privilege tax (TPT), commonly referred to as a sales tax, is a tax on vendors for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

How much is the TPT tax in Arizona?

Arizona originally adopted TPT in 1933 when the rate for selling tangible personal property at retail was 2 percent. That rate is currently 5.6 percent.

What is the TPT 2 form?

If your filing has more jurisdictions and/or deductions than these, you must file the TPT-2. The TPT-2 form separates the state/county transactions, city transactions, and Schedule A deductions pages into separate pages.

What is a JT-1?

This form is used to apply for transaction privilege tax, use tax, and Employer Withholding and Unemployment Insurance. The Application is called “Joint” because it is used by both the Arizona Department of Revenue and Economic Security. JT-1.

Do I need a TPT in Arizona?

Licensing Requirements If a business is selling a product or engaging in a service subject to TPT, that business will likely need a license from the Arizona Department of Revenue (ADOR) and a TPT, or business/occupational license, from the city or cities in which the business has a base or operation.

What is Arizona TPT?

Although commonly referred to as a sales tax, the Arizona transaction privilege tax (TPT) is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

What is a JT 1 form?

Share. INSTRUCTIONS: ARIZONA JOINT TAX APPLICATION (Form JT-1) To license a new business in Arizona or change ownership on an existing business, file a form JT-1. This document can be obtained from the website of the Arizona Department of Revenue.

Who is subject to Arizona TPT tax?

Transaction privilege tax (TPT) is a tax on a vendor for the privilege of doing business in the state of Arizona. Arizona originally adopted TPT in 1933 when the rate for selling tangible personal property at retail was 2 percent.

Do I need to file W 2 for Arizona?

Arizona W-2 State Filing Requirements The Form W-2, Wage and Tax Statement should be filed with the State of Arizona. The State of Arizona also mandates the filing of Form A1-R, Withholding Reconciliation Return.

What is an Arizona transaction privilege tax license?

Although commonly referred to as a sales tax, the Arizona transaction privilege tax (TPT) is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

What is Arizona Joint tax Application?

This form is used to apply for transaction privilege tax, use tax, and Employer Withholding and Unemployment Insurance. The Application is called “Joint” because it is used by both the Arizona Department of Revenue and Economic Security.

How is the TPT calculated in Arizona?

TPT filing frequency is determined by the amount of a business' total estimated annual combined Arizona, county and municipal TPT liability. Businesses who would like to change their filing frequency can download and complete the Business Account Update Form and mail it to the address on the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the arizona joint tax application electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your arizona joint tax application in minutes.

How do I complete arizona joint tax application on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your arizona joint tax application. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out arizona joint tax application on an Android device?

Use the pdfFiller mobile app and complete your arizona joint tax application and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is AZ DoR JT-1/UC-001?

AZ DoR JT-1/UC-001 is a specific form used for reporting and compliance purposes by the Arizona Department of Revenue, typically related to tax obligations or business activities.

Who is required to file AZ DoR JT-1/UC-001?

Businesses and entities operating in Arizona that meet certain criteria set by the Department of Revenue are required to file AZ DoR JT-1/UC-001.

How to fill out AZ DoR JT-1/UC-001?

To fill out AZ DoR JT-1/UC-001, one must provide accurate information as required by the form, which usually includes details about the business, income, deductions, and tax calculations, and must ensure to follow the specific instructions provided by the Arizona Department of Revenue.

What is the purpose of AZ DoR JT-1/UC-001?

The purpose of AZ DoR JT-1/UC-001 is to ensure compliance with state tax laws and to provide the Arizona Department of Revenue with the necessary information to correctly assess tax obligations.

What information must be reported on AZ DoR JT-1/UC-001?

The information that must be reported on AZ DoR JT-1/UC-001 generally includes business identification details, income reports, deductions claimed, and other relevant financial information as required by the form.

Fill out your arizona joint tax application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Joint Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.