AZ DoR JT-1/UC-001 2006 free printable template

Show details

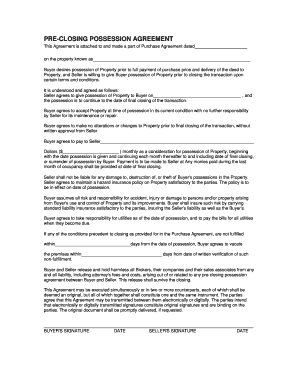

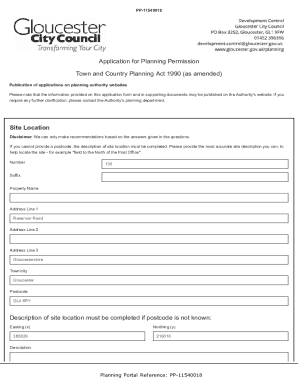

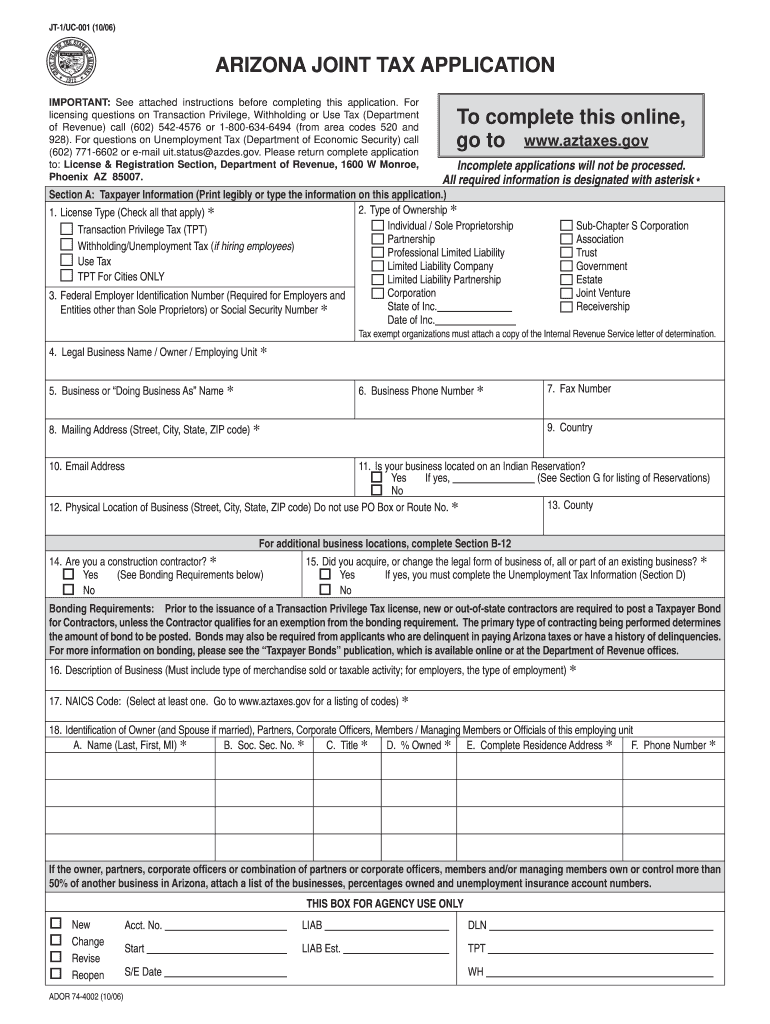

JT-1/UC-001 (10/06) ARIZONA JOINT TAX APPLICATION IMPORTANT: See attached instructions before completing this application. For licensing questions on Transaction Privilege, Withholding or Use Tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona joint tax application

Edit your arizona joint tax application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona joint tax application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona joint tax application online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit arizona joint tax application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DoR JT-1/UC-001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona joint tax application

How to fill out AZ DoR JT-1/UC-001

01

Obtain the AZ DoR JT-1/UC-001 form from the Arizona Department of Revenue website or office.

02

Fill in the taxpayer information section, including name, address, and identification number.

03

Indicate the type of return you are filing and the relevant reporting period.

04

List all income sources and amounts as required on the form.

05

Complete any applicable deductions or credits sections.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed form online, by mail, or in-person according to the instructions provided.

Who needs AZ DoR JT-1/UC-001?

01

Individuals or businesses required to report and pay transaction privilege taxes in Arizona.

02

Taxpayers seeking to claim deductions or credits related to transaction privilege taxes.

03

Those involved in activities subject to Arizona's transaction privilege tax laws.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to get a business license in Arizona?

The price of a business license or permit can vary depending on the type of license, business location, processing fees and recurring fees. Phoenix charges an application fee from $24 up to $1,665 and a license/permit fee between $10 and $360, depending on the type of business.

What is the EIN number in Arizona?

Federal Tax ID (EIN) Number Obtainment Most Arizona businesses will need to get a federal tax ID number. This is a 9-digit number issued by the federal government when you register your business with it. It's also known as an employer identification number, or EIN.

What Arizona state tax form should I use?

The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

How do I get a Arizona tax ID number?

You must have a federal tax ID number, or EIN, in order to get an Arizona state tax ID number. You can go to a local Internal Revenue Service to apply or call the IRS directly. The exception to this is if you are a sole proprietor with no employees.

What is JT 1 form Arizona?

This form is used to apply for transaction privilege tax, use tax, and Employer Withholding and Unemployment Insurance. The Application is called “Joint” because it is used by both the Arizona Department of Revenue and Economic Security. JT-1. TPT Forms. Other Forms.

What is the Arizona sales tax exemption form?

Arizona Forms 5000 are used to claim Arizona TPT (sales tax) exemptions from vendors. Arizona Forms 5000A are used to claim Arizona TPT (sales tax) exemptions from vendors when making purchases for resale where tax will be collected on the retail sale to the end user.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete arizona joint tax application online?

Completing and signing arizona joint tax application online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for the arizona joint tax application in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your arizona joint tax application in minutes.

How do I complete arizona joint tax application on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your arizona joint tax application. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is AZ DoR JT-1/UC-001?

AZ DoR JT-1/UC-001 is a form used by the Arizona Department of Revenue for reporting various tax-related information.

Who is required to file AZ DoR JT-1/UC-001?

Businesses and individuals in Arizona that have tax obligations or engage in transactions that necessitate reporting to the Department of Revenue are required to file AZ DoR JT-1/UC-001.

How to fill out AZ DoR JT-1/UC-001?

To fill out AZ DoR JT-1/UC-001, start by providing your taxpayer identification number, then complete the required sections with financial details, tax calculations, and any relevant signed declarations.

What is the purpose of AZ DoR JT-1/UC-001?

The purpose of AZ DoR JT-1/UC-001 is to collect essential tax information to ensure compliance with state tax laws and assist in the accurate assessment of tax liabilities.

What information must be reported on AZ DoR JT-1/UC-001?

The information that must be reported on AZ DoR JT-1/UC-001 includes taxpayer identification, income details, deductions claimed, tax credits, and any other pertinent tax-related data.

Fill out your arizona joint tax application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Joint Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.