Treasury Customs 4790 1995 free printable template

Show details

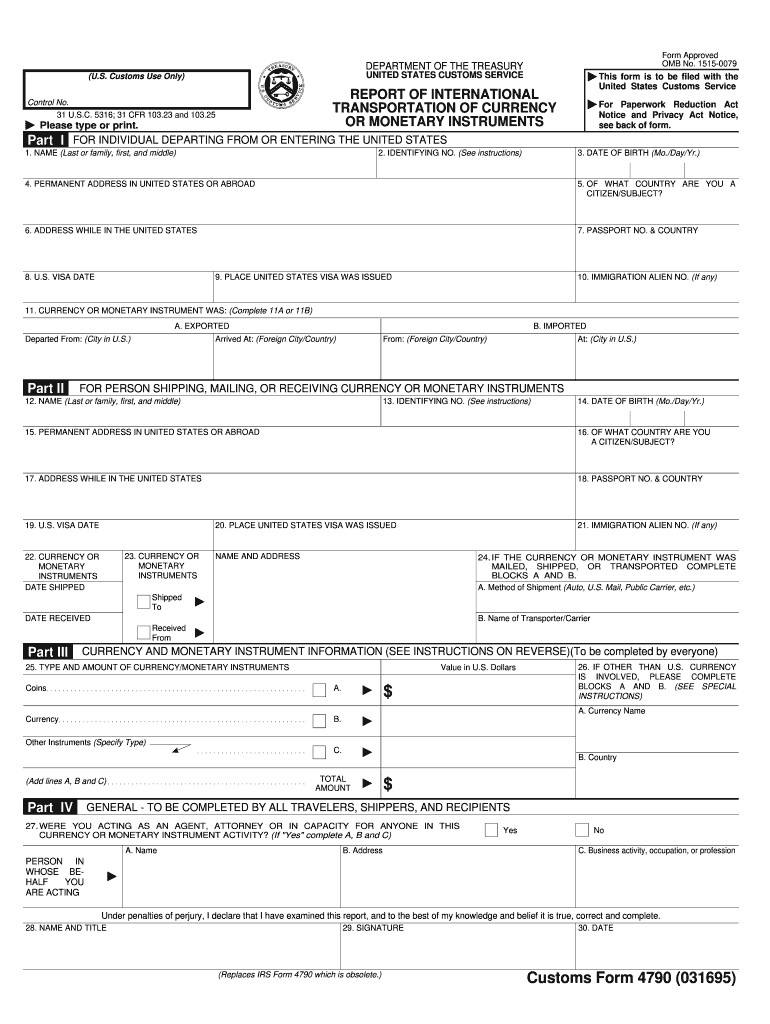

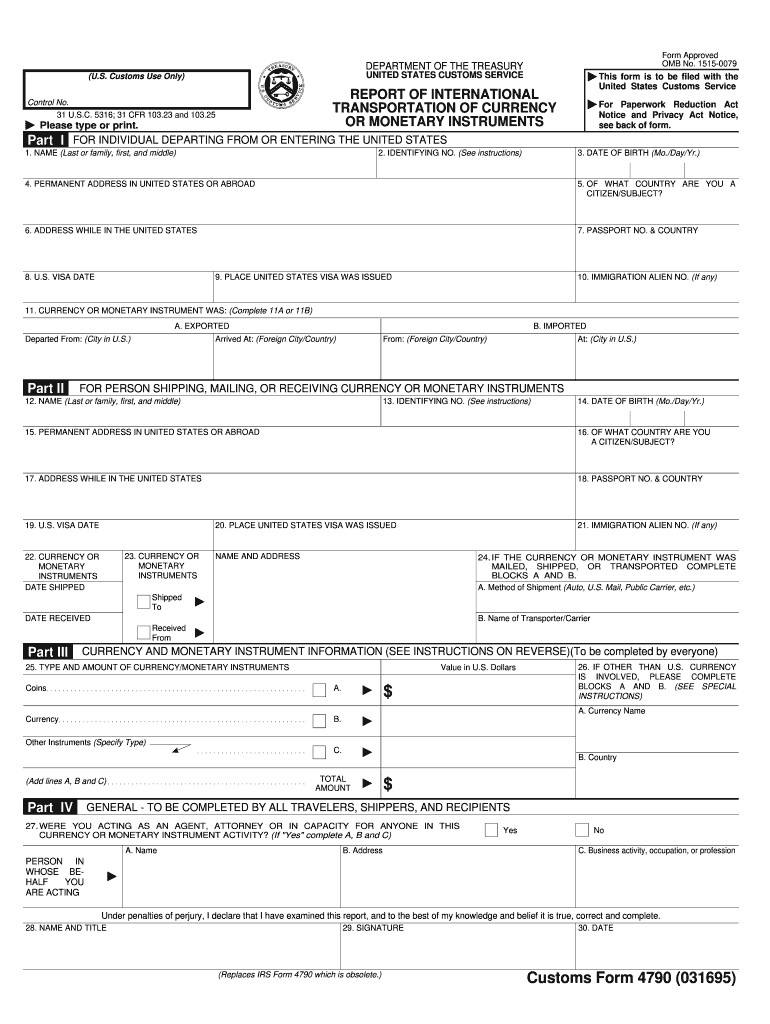

28. NAME AND TITLE 29. SIGNATURE Replaces IRS Form 4790 which is obsolete. 30. DATE Customs Form 4790 031695 GENERAL INSTRUCTIONS This report is required by Treasury Department regulations 31 Code of Federal Regulations 103. C. Travelers. --Travelers carrying currency or other monetary instruments with them shall file Form 4790 at the time of entry into the United States or at the time of departure from the United States with the Customs officer in charge at any Customs port of entry or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Treasury Customs 4790

Edit your Treasury Customs 4790 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Treasury Customs 4790 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Treasury Customs 4790 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Treasury Customs 4790. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Treasury Customs 4790 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Treasury Customs 4790

How to fill out Treasury Customs 4790

01

Obtain a copy of Treasury Customs Form 4790.

02

Fill in the required identification details such as name, address, and contact information.

03

Specify the purpose of the form in the designated section.

04

Provide any necessary financial information relevant to the declaration.

05

Complete the sections on goods or currency being declared, including values and descriptions.

06

Review all entries for accuracy and completeness.

07

Sign and date the form at the bottom.

Who needs Treasury Customs 4790?

01

Individuals or entities transporting or declaring currency or goods across U.S. borders.

02

Businesses involved in international trade that need to report financial transactions.

03

Travelers entering or leaving the United States with cash or negotiable instruments above the reporting threshold.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to fill out customs form?

Each individual arriving into the United States must complete the CBP Declaration Form 6059B. Explanations and a sample declaration form can be found on the Sample Customs Declaration Form.

How do I fill out a customs form for international shipping?

How to Fill Out a Customs Form for International Shipping Name and complete address of the sender. Complete address and name of receiver. Item description (if there are several different products in the same package, note them all separately) Quantity of items. Value of each item. Weight and dimensions of a package.

Do I need a customs form to ship to us?

10.2. U.S. Customs requires formal entry for any shipment valued at more than US$2,500.00, and you must use a customs broker to clear such shipments.

How to fill out customs form for international flight?

2:22 6:12 How to fill out US Customs Forms | Arriving in USA in 2021 - YouTube YouTube Start of suggested clip End of suggested clip Number. Then give your current street address in the united. States. At the same time if you don'tMoreNumber. Then give your current street address in the united. States. At the same time if you don't have an actual address and you're staying at a hotel it is important to mention.

How to fill out shipping customs form?

Some Items on a Customs Form Frequently Required Include: Name and address of the shipper or seller. Description of the item or items. A listing of quantity of each item in the package. Purchase prices of each item in the package. The weight of the package. Country of origin of the product.

What is form 4790 used for?

A credit union must file a report (Customs Form 4790) if it receives currency or other monetary instruments exceeding $10,000 which have been transported, mailed or shipped from outside of the U.S. The report must be filed with the U.S. Customs Service within thirty days of receipt of the currency or instrument.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Treasury Customs 4790 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your Treasury Customs 4790 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the Treasury Customs 4790 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your Treasury Customs 4790 in seconds.

How do I complete Treasury Customs 4790 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your Treasury Customs 4790. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Treasury Customs 4790?

Treasury Customs 4790 is a form used for reporting certain transactions involving currency and negotiable instruments. It is part of the compliance requirements to prevent money laundering and ensure the accuracy of financial reporting.

Who is required to file Treasury Customs 4790?

Individuals or entities that import or export currency or negotiable instruments exceeding the specified threshold are required to file Treasury Customs 4790. This includes travelers, businesses, and financial institutions.

How to fill out Treasury Customs 4790?

To fill out Treasury Customs 4790, follow these steps: 1. Provide your name and contact information. 2. Indicate the amount of currency or negotiable instruments being reported. 3. Describe the nature of the transaction. 4. Sign and date the form, ensuring all required information is accurate and complete.

What is the purpose of Treasury Customs 4790?

The purpose of Treasury Customs 4790 is to monitor and report large currency transactions to detect and prevent money laundering, terrorist financing, and other financial crimes.

What information must be reported on Treasury Customs 4790?

The information that must be reported on Treasury Customs 4790 includes the name and address of the filer, the amount and type of currency or instruments being transported, the manner of transport, the purpose of the transaction, and any other relevant details required by the form.

Fill out your Treasury Customs 4790 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Treasury Customs 4790 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.