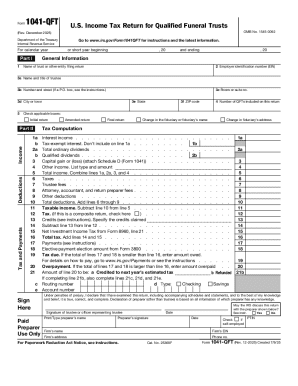

IRS 1041-QFT 2012 free printable template

Instructions and Help about IRS 1041-QFT

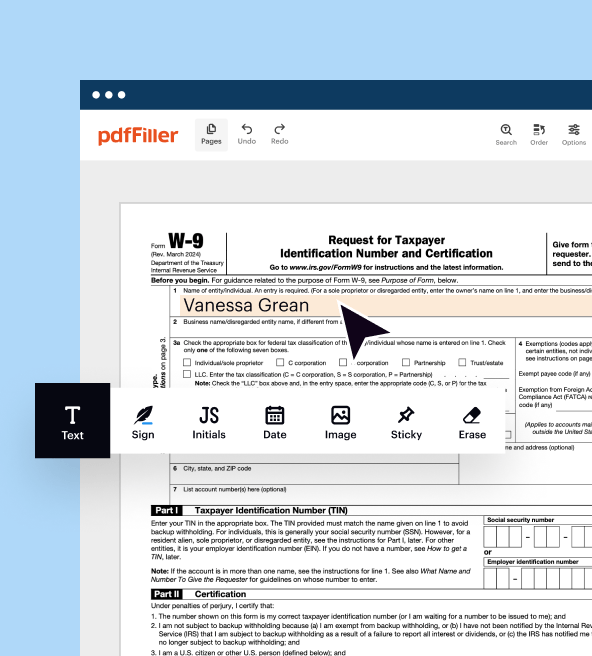

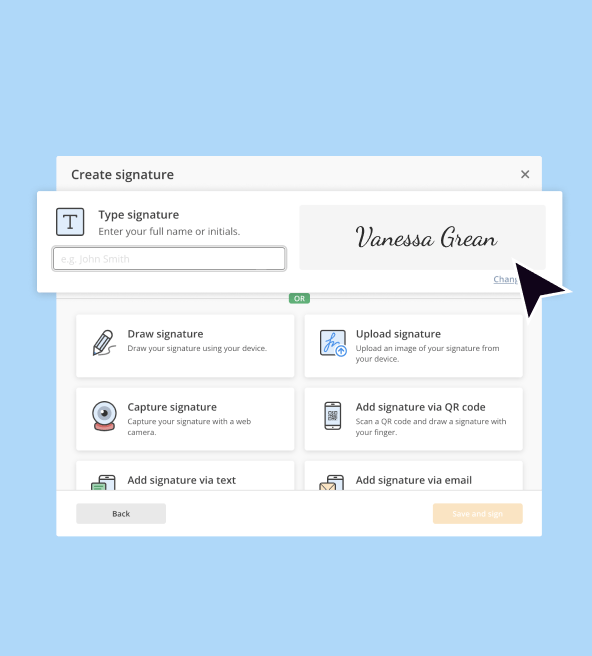

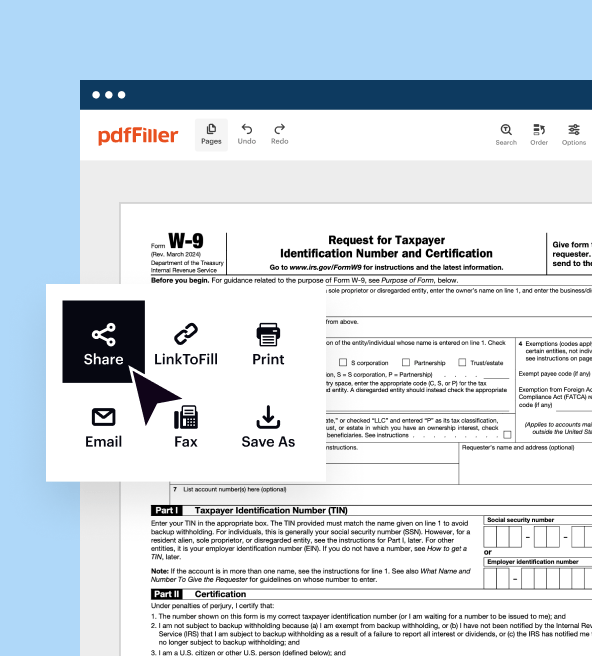

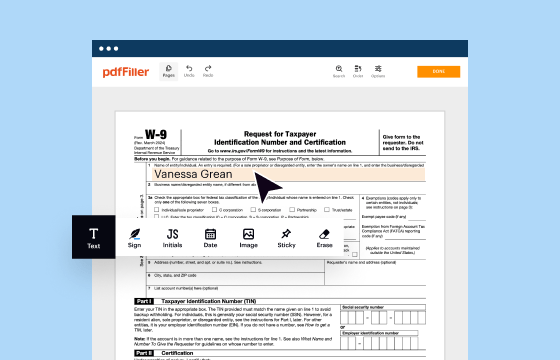

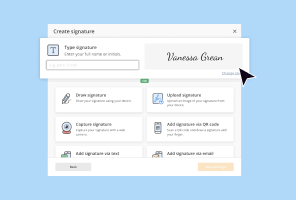

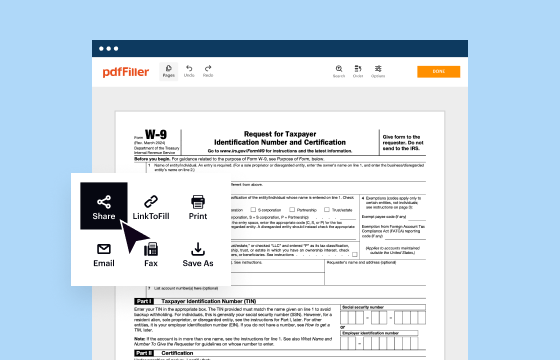

How to edit IRS 1041-QFT

How to fill out IRS 1041-QFT

About IRS 1041-QFT 2012 previous version

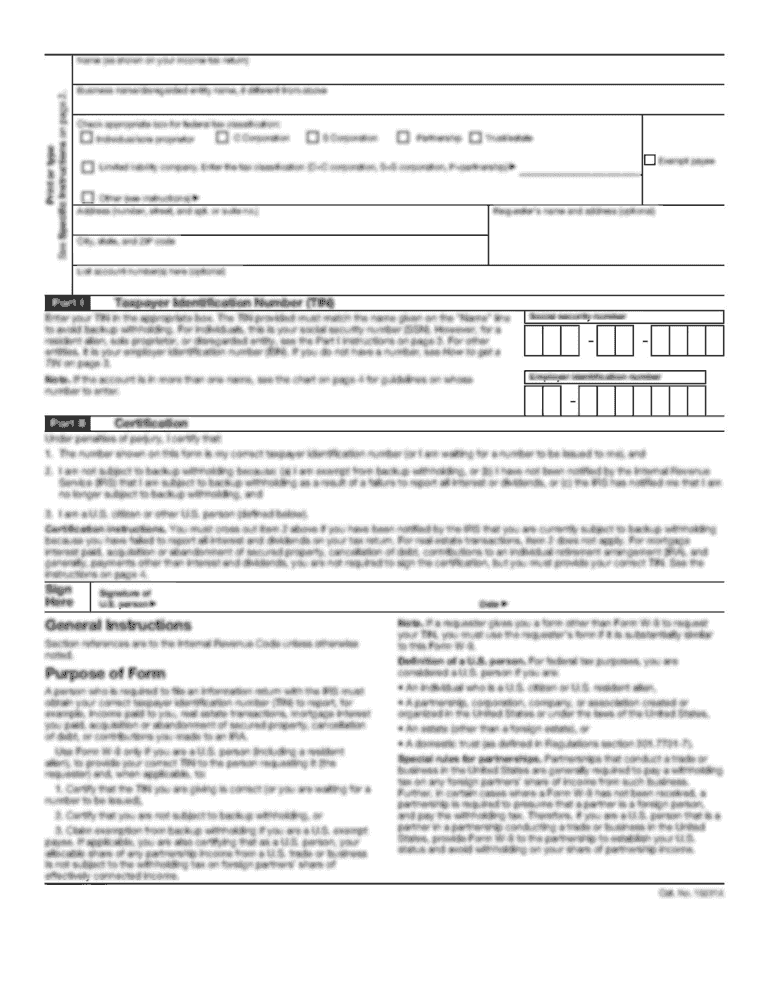

What is IRS 1041-QFT?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

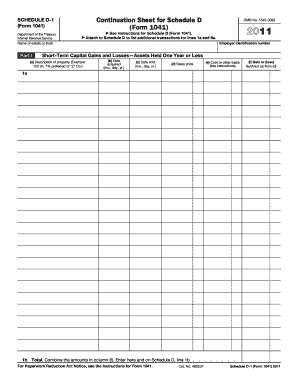

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041-QFT

What should I do if I realize there's a mistake in my name of trust or after submission?

If you discover an error in your name of trust or after filing, you should promptly prepare an amended version to correct the mistake. Depending on the nature of the error, consulting a legal professional may be beneficial. Ensure that you keep documentation of both the original and amended forms for your records.

How can I check the status of my name of trust or after submission?

To verify the status of your name of trust or, you can use the tracking system available on the official filing platform. If you encounter rejection codes, refer to the provided guidelines to understand the specific issues and how to rectify them.

What are some common errors filers make with the name of trust or?

Common mistakes include incorrect information such as spelling errors in names or addresses and failing to sign the document. To avoid these issues, double-check all entries and ensure that all required fields are completed before submission.

Are there any service fees associated with e-filing the name of trust or?

Yes, e-filing of the name of trust or may incur service fees depending on the platform used. It's advisable to review the fee structure before filing and be aware of any potential refunds if your submission gets rejected.

What should I do if I receive a notice related to my name of trust or?

If you receive a notice regarding your name of trust or, first read it carefully to understand the issue. Gather any required documentation and consider responding in a timely manner to address the concerns raised, possibly with legal assistance.