IRS 4835 2011 free printable template

Show details

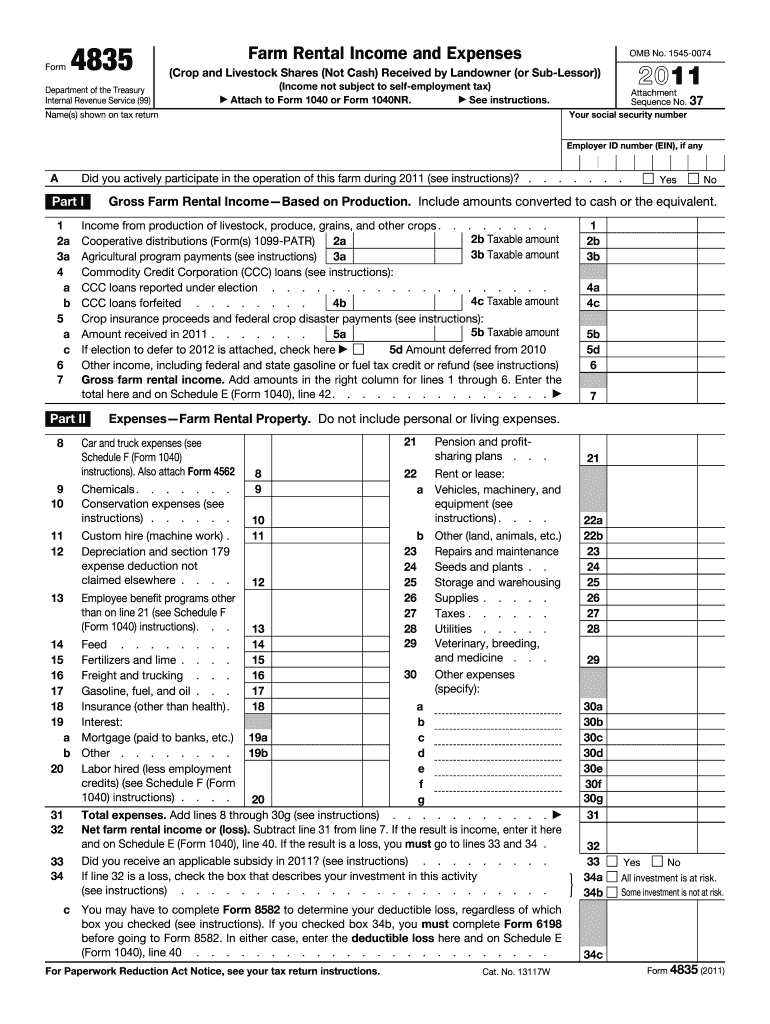

The IRS has created a page on IRS.gov for information about Form 4835 and its instructions at www.irs.gov/form4835. 34c Form 4835 2011 This Page Intentionally Left Blank Page 3 General Instructions What s New Future developments. Limitation on excess farm losses. If you received an applicable subsidy in 2011 you will now need to check Yes on line 33. Certain subsidies that you receive may reduce or eliminate your farm rental losses. See page 4 an...

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4835

How to edit IRS 4835

How to fill out IRS 4835

Instructions and Help about IRS 4835

How to edit IRS 4835

To edit the IRS 4835 form, first download a copy of the document. Use a PDF editor such as pdfFiller to make changes, including filling out necessary fields and correcting any errors. Ensure that all information is accurate before finalizing the form.

How to fill out IRS 4835

Filling out IRS 4835 involves reporting income and expenses related to farming. Begin by entering personal details such as your name and taxpayer identification number at the top of the form. Next, proceed to report income from farm rental activities and document all allowable expenses. Maintain accurate records to support the entries you make on the form.

About IRS 4 previous version

What is IRS 4835?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4835?

IRS 4835, officially named "IRS Farm Rental Income and Expenses," is a tax form used by individuals who rent out land used for farming. This form collects information regarding income earned from renting farm property and the expenses incurred in relation to that income.

What is the purpose of this form?

The purpose of IRS 4835 is to enable taxpayers to report income from farm rentals, allowing them to detail both income received and any related expenses for accurate tax reporting. This ensures compliance with U.S. tax regulations and facilitates appropriate tax calculation on rental income.

Who needs the form?

Individuals who rent out land for farming purposes must complete IRS 4835. This includes landowners who lease their property to farmers and report rental income as part of their taxable income. Additionally, any entity that meets these criteria may also need to file this form.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 4835 if your farm rental income is below the filing threshold for the tax year. Also, if you do not have any farm-related expenses to report, or if you are not renting out land used for farming, you would not need to submit this form.

Components of the form

The main components of IRS 4835 include sections for reporting gross income, various expense categories, and net income or loss calculation. Taxpayers must provide detailed accounts of rental income, as well as deductible expenses like depreciation, repairs, and taxes paid.

What are the penalties for not issuing the form?

Failing to issue IRS 4835 when required may result in penalties imposed by the IRS, including monetary fines or interest on unpaid taxes. Accurate and timely filing is essential to avoid these repercussions and ensure compliance with tax laws.

What information do you need when you file the form?

When filing IRS 4835, gather several pieces of information including personal identification details, records of rental income received, and documentation of expenses related to the farm rental. Having accurate and thorough records will facilitate the completion of the form.

Is the form accompanied by other forms?

IRS 4835 can sometimes be accompanied by other forms depending on the individual taxpayer's situation, such as Schedule E, which is used to report supplemental income and loss. Review your specific circumstances to determine if additional documentation is necessary.

Where do I send the form?

The completed IRS 4835 form should be mailed to the address listed in the instructions accompanying the form, which may vary based on the taxpayer's location and whether taxes are being filed electronically or by mail. Always check for the most recent mailing address for the IRS to ensure proper submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Great features separating documents, editing, downloading, etc. Very user-friendly. Thanks.

too expensive but extremely useful

now i don't have to print in order to sign a document.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.