IRS 4835 2021 free printable template

Show details

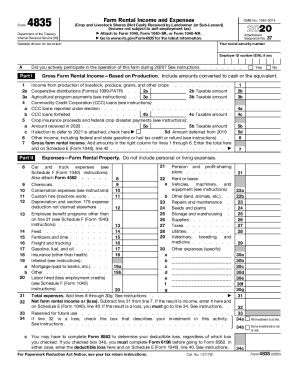

Form4835Department of the Treasury Internal Revenue Service (99)Farm Rental Income and Expenses OMB No. 154500742021(Crop and Livestock Shares (Not Cash) Received by Landowner (or Successor)) (Income

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4835

How to edit IRS 4835

How to fill out IRS 4835

Instructions and Help about IRS 4835

How to edit IRS 4835

Editing IRS form 4835 requires a careful approach to ensure the accuracy of information provided. Start by downloading a blank copy of the form from the IRS website. To edit electronically, consider using tools like pdfFiller, which allow you to fill in and modify the text easily. Review each section thoroughly before saving and finalizing your edits.

How to fill out IRS 4835

Filling out IRS form 4835 requires specific details about rental income and expenses. Begin by gathering all necessary financial documents related to your rental activities, including pass-through income and expenses incurred. Follow the form's prompts to accurately input your income, expenses, and necessary deductions. Ensure that you double-check all figures for precision to avoid potential errors.

About IRS 4 previous version

What is IRS 4835?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4835?

IRS form 4835 is used by individuals who receive income from rental properties and are actively engaged in rental activities. This form allows taxpayers to report their share of income or loss from these rental activities, particularly when they are operating as non-corporate taxpayers.

What is the purpose of this form?

The primary purpose of IRS form 4835 is to help individuals report rental income and expenses when engaged in trade or business activities. This form ensures that taxpayers accurately report their financial activities concerning the rental of real estate, which impacts their gross income and tax liabilities.

Who needs the form?

Taxpayers who earn rental income from real estate and actively participate in its management should file IRS form 4835. It is often used by those who own rental properties individually or in partnerships, and it is essential for those who report net earnings from these properties on their tax returns.

When am I exempt from filling out this form?

You may be exempt from filling out IRS form 4835 if your rental activities do not constitute a trade or business. This includes instances where your income is passive, such as receiving income from co-ownership of a rental property without active involvement in its management. Additionally, real estate professionals or those who do not meet specific income thresholds may not need this form.

Components of the form

IRS form 4835 includes several components that detail the income and expenses associated with rental activities. Key sections cover gross receipts, deductible expenses like repairs and maintenance, and the net profit or loss from rental activities. Understanding each section will assist in compiling accurate and compliant tax filings.

What payments and purchases are reported?

When filing IRS form 4835, you must report all income generated from rental properties, including payment from tenants and other related sources. Additionally, expenses such as mortgage interest, property tax, and maintenance costs that directly relate to property management must be documented accurately.

What are the penalties for not issuing the form?

Failing to file IRS form 4835 when required can result in penalties from the IRS. Penalties may include fines for late filing and potential interest on unpaid taxes. It is crucial to understand the requirements and fulfill them to avoid these financial implications.

What information do you need when you file the form?

To file IRS form 4835, you will need comprehensive information regarding your rental income and relevant expenses. This includes records of all rental payments received, expenses incurred for property management and maintenance, and details about any deductions you intend to claim. Keeping well-organized financial records will streamline the filing process.

Is the form accompanied by other forms?

IRS form 4835 may be accompanied by other documents depending on your overall tax situation. If you are part of a partnership or corporation, you might also need to submit supplementary forms, such as form 1065 for partnership income. It is important to consult IRS guidelines or a tax professional for clarity regarding required accompanying forms.

Where do I send the form?

IRS form 4835 should be submitted to the appropriate IRS address based on your location and whether you are enclosing a payment. Always verify the latest mailing address on the IRS website, as it may change yearly. Ensure that you keep a copy of the submitted form for your records.

See what our users say