IRS 4835 2020 free printable template

Show details

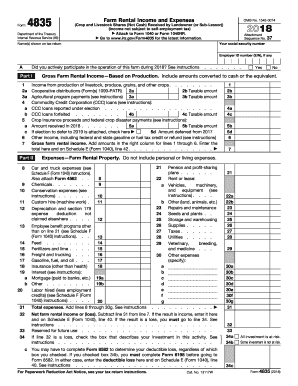

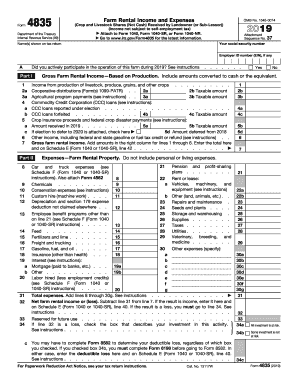

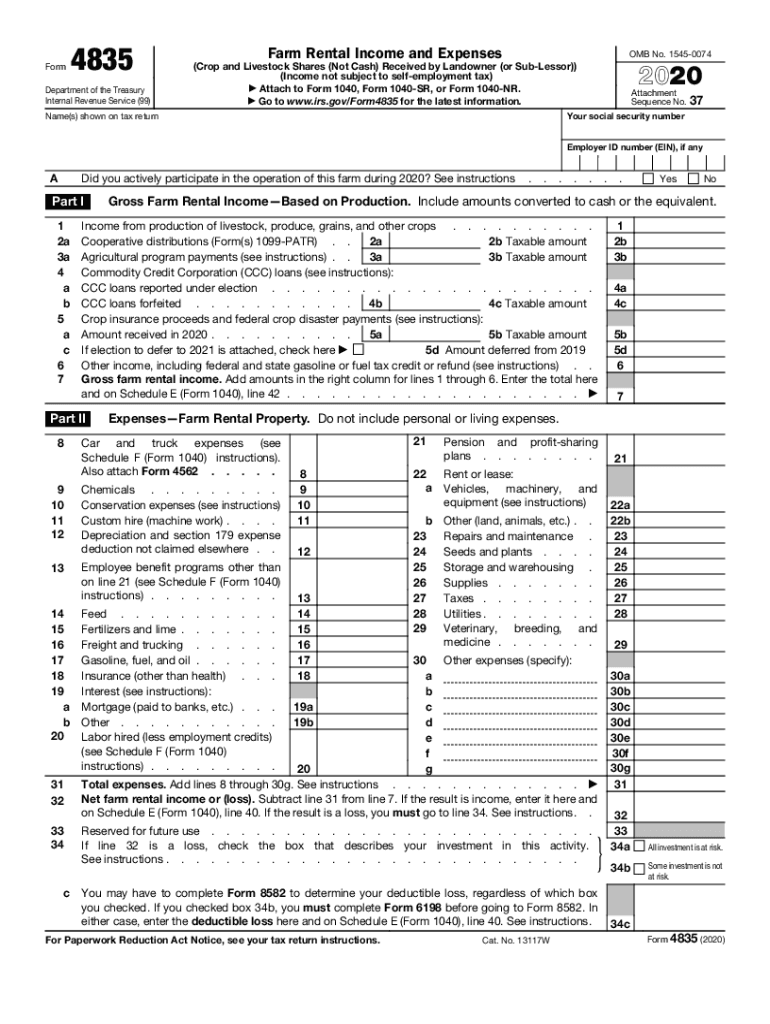

Form4835Department of the Treasury Internal Revenue Service (99)Farm Rental Income and Expenses OMB No. 154500742020(Crop and Livestock Shares (Not Cash) Received by Landowner (or Successor)) (Income

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4835

How to edit IRS 4835

How to fill out IRS 4835

Instructions and Help about IRS 4835

How to edit IRS 4835

To edit IRS 4835, users can utilize pdfFiller’s features for filling out and modifying tax forms. Begin by uploading the form to the platform. Once uploaded, you can use editing tools to add or change information as needed. Be sure to save your changes before downloading or submitting the edited form.

How to fill out IRS 4835

To fill out IRS 4835, gather necessary information about income and expenses related to your farming activities or rental property. Start with the identifying information, such as your name and Social Security Number. Then, document all earnings and expenses accurately in the designated sections. Review for any inaccuracies and then ensure a clear understanding of which sections to complete based on your specific situation.

About IRS 4 previous version

What is IRS 4835?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4835?

IRS 4835 is the "Farm Rental Income and Expenses" form used by individuals receiving income from renting out farm land. This form allows taxpayers to report their rental income while providing details on related expenses incurred during the tax year.

What is the purpose of this form?

The primary purpose of IRS 4835 is to ensure that farm rental income and its associated costs are accurately reported to the IRS. It allows for the accounting of earnings from renting farmland and helps taxpayers claim deductions for expenses, thus potentially reducing their taxable income.

Who needs the form?

Any individual who earns income from renting farm land must file IRS 4835. This includes anyone who receives payments for the rental of land used for farming purposes, regardless of their primary source of income. It's especially pertinent for landlords who do not materially participate in farm operations.

When am I exempt from filling out this form?

You may be exempt from filing IRS 4835 if you do not receive rental income from farming activities or if the rental income is reported on another tax form. Additionally, if your rental activities do not result in net earnings, you should assess whether filing this form is necessary.

Components of the form

IRS 4835 consists of several sections. The first part collects tax filer information, including name, address, and taxpayer identification numbers. The subsequent sections require details on gross rental income, specific expenses related to the rental land, and any depreciation claimed. These components work together to determine the net income from farm rentals.

What are the penalties for not issuing the form?

Failing to file IRS 4835 when required may result in penalties. The IRS may charge a failure-to-file penalty based on the amount of tax owed and the duration of the delay. Additionally, if the IRS determines underreporting of income, further penalties may apply, resulting in higher tax liabilities and interest accruement.

What information do you need when you file the form?

To file IRS 4835, you will need your Social Security Number or Employer Identification Number, details of the rental income, and comprehensive records of related expenses such as repairs, property taxes, and any allowable depreciation. Securing these documents before you fill out the form will facilitate accurate and efficient completion.

Is the form accompanied by other forms?

While IRS 4835 is a standalone form, it might be accompanied by Form 1040 or 1040-SR if filed as part of your individual income tax return. Additionally, if there are other income sources, you may need to include other schedules or forms as part of your overall tax filing.

Where do I send the form?

IRS 4835 should be submitted to the IRS along with your federal income tax return. The filing address varies based on the state you reside in and whether you are including a payment or expecting a refund. Always consult the latest instructions provided by the IRS for the correct mailing address.

See what our users say