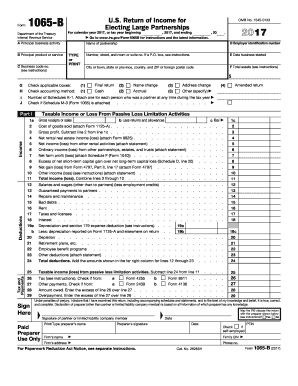

IRS 1065-B 2012 free printable template

Show details

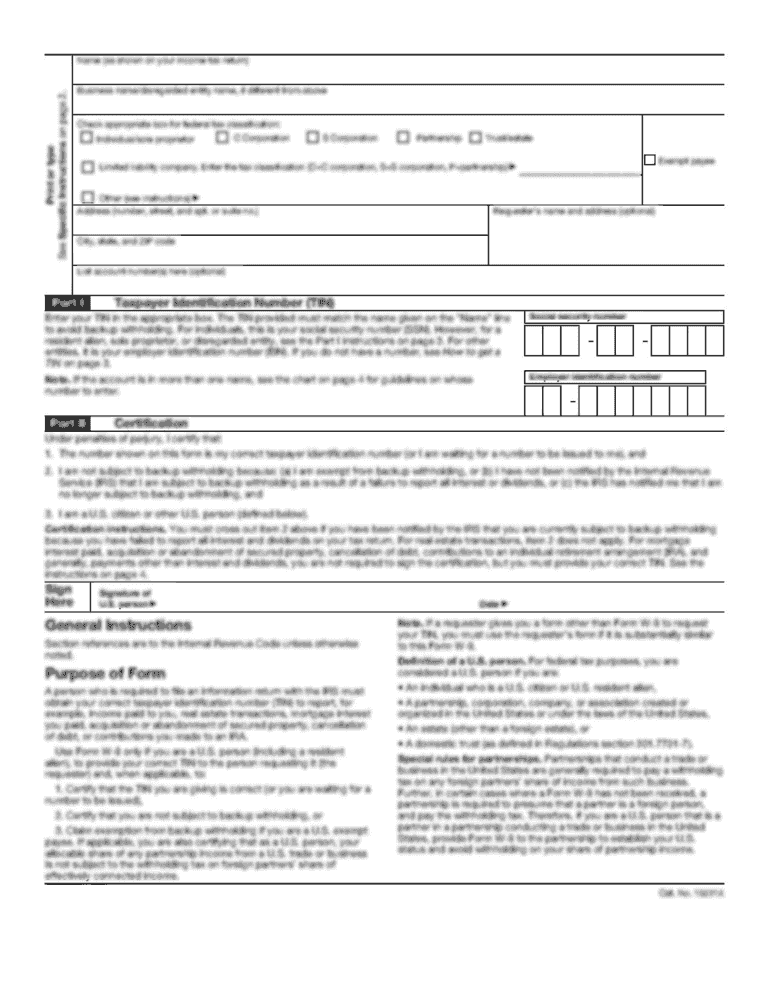

Form 1065B Department of the Treasury Internal Revenue Service A Principal business activity B Principal product or service C Business code no. (see instructions) U.S. Return of Income for Electing

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065-B

How to edit IRS 1065-B

How to fill out IRS 1065-B

Instructions and Help about IRS 1065-B

How to edit IRS 1065-B

To edit IRS 1065-B, you will need a physical or digital copy of the form. Use a pen to manually correct entries on printed forms. If you are using a digital version, open it in a PDF editor or form-filling software. Ensure that any corrections do not obscure required information.

How to fill out IRS 1065-B

Fill out IRS 1065-B by providing the identifying information of the partnership, including the name, address, and Employer Identification Number (EIN). Complete the income and deductions sections accurately, as these will determine the taxable income of the partnership. Review each line for accuracy before submission.

About IRS 1065-B 2012 previous version

What is IRS 1065-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1065-B 2012 previous version

What is IRS 1065-B?

IRS 1065-B is a tax return form used by certain partnerships that elect to be treated as an "electing large partnership." This form allows these partnerships to report their income, deductions, and credits to the IRS. Unlike the standard Form 1065, Form 1065-B is specifically designed for larger entities that meet specific criteria.

What is the purpose of this form?

The purpose of IRS 1065-B is to provide the IRS with necessary information about the financial activities of electing large partnerships. It helps the IRS assess the tax obligations of these entities and ensures compliance with federal tax regulations. Completing this form accurately is crucial for avoiding penalties.

Who needs the form?

Partnerships that qualify as "electing large partnerships" must file IRS 1065-B. Generally, this designation applies to partnerships with 100 or more partners or those that meet other IRS criteria. Partners in such partnerships benefit from the simplicity and efficiency the form provides regarding reporting income and distributions.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1065-B if your partnership does not meet the requirements to elect large partnership status. Additionally, if the partnership’s total income falls below a designated threshold or if it qualifies for another exception defined by IRS regulations, you will not need to file this form.

Components of the form

IRS 1065-B includes several key components, such as the partnership’s income, deductions, credits, and information about the partners. Each section is organized to allow for clear reporting of financial transactions throughout the tax year. Thoroughly understanding these components is essential for accurate completion.

What are the penalties for not issuing the form?

Failing to file IRS 1065-B can result in significant penalties. The IRS typically imposes fines for late filings, which can accumulate daily until the form is submitted. Additionally, the partnership may face scrutiny or audits if it does not comply with filing requirements, potentially leading to further financial consequences.

What information do you need when you file the form?

When filing IRS 1065-B, you will need the partnership’s identifying details, including its name, address, and EIN. Detailed records of income, deductions, and other relevant financial data must also be gathered to complete the form accurately. Ensuring all information is readily available can streamline the filing process.

Is the form accompanied by other forms?

IRS 1065-B may need to be accompanied by additional schedules or forms, such as Schedule K-1, which reports each partner’s share of income, deductions, and credits. Ensuring all necessary forms are included with the submission will help facilitate processing and reduce the chance of delays or penalties.

Where do I send the form?

The completed IRS 1065-B form should be mailed to the address designated for partnerships on the IRS website or in the form instructions. It is crucial to verify the current mailing address, as this can change over time. Mail the form well before the deadline to ensure timely receipt by the IRS.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.