IRS 1065-B 2016 free printable template

Show details

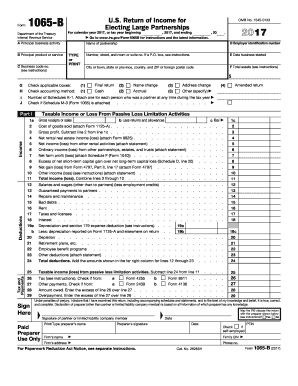

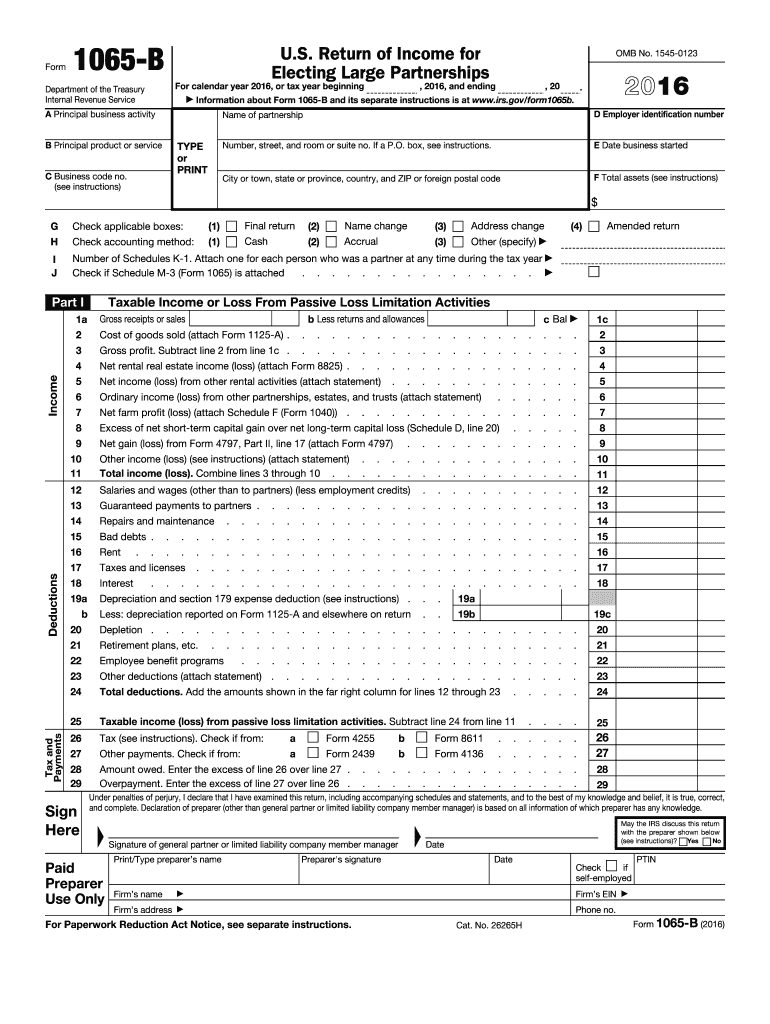

Form 1065-B Department of the Treasury Internal Revenue Service U.S. Return of Income for Electing Large Partnerships For calendar year 2016, or tax year beginning C Business code no. (see instructions),

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065-B

How to edit IRS 1065-B

How to fill out IRS 1065-B

Instructions and Help about IRS 1065-B

How to edit IRS 1065-B

To edit IRS 1065-B, access a PDF editor that supports form modifications. Begin by uploading the form to the editing tool. Then, input the required information in the necessary fields while ensuring accuracy and compliance with IRS guidelines. After editing, save the document properly to maintain the updated version.

How to fill out IRS 1065-B

To fill out IRS 1065-B, you should start by gathering all pertinent financial documents related to your business. Review each section of the form carefully. Input your business name, address, and identification details accurately. Report income and deductions precisely, ensuring you support all entries with proper documentation to meet IRS standards.

About IRS 1065-B 2016 previous version

What is IRS 1065-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1065-B 2016 previous version

What is IRS 1065-B?

IRS 1065-B is the tax form designated for electing large partnerships to report their income, deductions, gains, losses, and other pertinent financial information. This form enables partnerships that qualify under specific IRS criteria to streamline their filing process, reflecting their unique accounting needs.

What is the purpose of this form?

The primary purpose of IRS 1065-B is to provide a tax reporting mechanism for large partnerships that choose to opt out of the standard partnership tax filing. It allows these partnerships to present their financial activities comprehensively, ensuring clarity in income distribution among partners.

Who needs the form?

Only eligible large partnerships must file IRS 1065-B. A large partnership is defined by the IRS as any partnership that has at least 100 partners and elects to be treated under this specific tax reporting procedure. Moreover, the partnership must have made the election to use this form by the appropriate deadline, ensuring compliance with IRS regulations.

When am I exempt from filling out this form?

Partnerships that do not qualify as large partnerships or do not elect to file under IRS 1065-B are exempt from filling out this form. Additionally, single-member LLCs that are disregarded for tax purposes and partnerships that do not operate in the U.S. may not be required to file. Always verify eligibility based on current IRS guidelines.

Components of the form

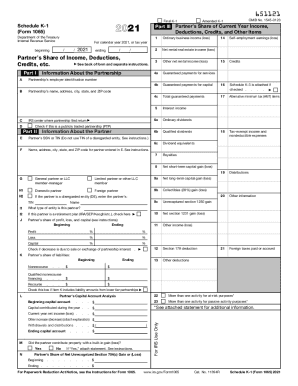

The components of IRS 1065-B include sections for general information about the partnership, income statements, and detailed schedules that report each partner's share of income, deductions, and credits. Additionally, the form contains specific sections for certain taxes and payments that need to be reported, ensuring comprehensive financial disclosure.

What are the penalties for not issuing the form?

Failing to issue IRS 1065-B can result in significant penalties. The IRS may impose penalties for late filing, and if the form is not submitted, the partnership may face additional complications regarding compliance issues. Partners may also face difficulties proving their income and deductions during tax audits.

What information do you need when you file the form?

When filing IRS 1065-B, you need to provide your partnership's name, address, taxpayer identification number (TIN), and information about each partner. Financial information, including income, deductions, and any specific schedules related to partners' capital accounts, must also be included. Ensure all information is accurate to avoid complications.

Is the form accompanied by other forms?

Yes, IRS 1065-B often needs to be accompanied by other forms, such as Schedule B and Schedule K-1, which detail each partner’s share of the partnership's income, deductions, and credits. Additional schedules may be necessary depending on the partnership's specific activities, ensuring comprehensive reporting.

Where do I send the form?

IRS 1065-B must be mailed to the address specified in the form instructions. Usually, partnerships should send the completed form to the IRS center that corresponds with their principal business location. It's crucial to follow the mailing guidelines to ensure the form is processed correctly by the IRS.

See what our users say