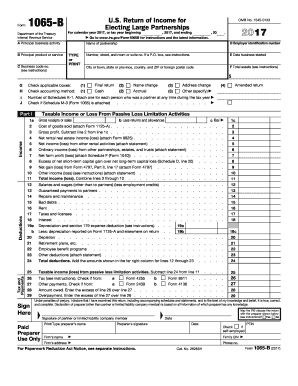

IRS 1065-B 2015 free printable template

Show details

Form 1065-B Department of the Treasury Internal Revenue Service U.S. Return of Income for Electing Large Partnerships For calendar year 2015, or tax year beginning ...

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065-B

How to edit IRS 1065-B

How to fill out IRS 1065-B

Instructions and Help about IRS 1065-B

How to edit IRS 1065-B

To edit IRS 1065-B, access the form from your computer or an online platform that supports PDF editing. Ensure that any corrections made are clear and do not alter the integrity of the original data. If using pdfFiller, you can easily modify text fields using their editing tools to ensure your submission is accurate and complete.

How to fill out IRS 1065-B

Filling out IRS 1065-B requires gathering relevant financial information about your partnership. Here’s a step-by-step guide:

01

Obtain the IRS 1065-B form from the IRS website or an authorized provider.

02

Enter the partnership's name, address, and identifying number at the top of the form.

03

Fill in the income and deductions sections accurately, based on your partnership's financial records.

04

Complete the necessary schedules and supplementary information as required.

05

Review the completed form for any errors or omissions before submission.

About IRS 1065-B 2015 previous version

What is IRS 1065-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1065-B 2015 previous version

What is IRS 1065-B?

IRS 1065-B is a tax form used by certain partnerships to report income, deductions, and other information. Specifically, it is designed for electing large partnerships, enabling them to report partnership income without disclosing partner-level information. This form facilitates compliance with federal tax obligations efficiently.

What is the purpose of this form?

The primary purpose of IRS 1065-B is to allow electing large partnerships to report their income and expenditures to the Internal Revenue Service (IRS). This form is essential for tax compliance, enabling partnerships to accurately declare their financial activities and ensure transparency in their business operations.

Who needs the form?

Partnerships that qualify as electing large partnerships must use IRS 1065-B to report their income. To qualify, a partnership must have at least 100 partners and meet certain criteria as outlined in IRS regulations. If your partnership meets these thresholds, you are mandated to file this form.

When am I exempt from filling out this form?

Exemptions from filing IRS 1065-B typically apply to partnerships that do not meet the criteria for electing large partnerships. If your partnership has fewer than 100 partners or does not choose to make the large partnership election, you may be exempt from this form and should use the standard IRS Form 1065 instead.

Components of the form

The IRS 1065-B includes several critical components, such as the partnership’s income statements, deductions, and other financial information. It also requires details about the partnership’s operations and distributions made to partners. Each section is designed to collect comprehensive data regarding the partnership's financial activities over the year.

What are the penalties for not issuing the form?

Failing to file IRS 1065-B can lead to significant penalties for partnerships. The IRS may impose a late filing penalty, which is assessed for each month the form is overdue. Additionally, inaccuracies or omissions on the form can draw further scrutiny, possibly resulting in additional fines or corrective measures.

What information do you need when you file the form?

When filing IRS 1065-B, ensure you gather the following information:

01

The partnership's name, address, and taxpayer identification number.

02

Details of all income received, including ordinary business income and other sources.

03

A complete record of all deductible expenses and losses incurred throughout the tax year.

04

Information about distributions to partners and any other relevant financial transactions.

Is the form accompanied by other forms?

IRS 1065-B may require supplementary schedules and forms, such as Schedule B and other relevant schedules that provide more detailed information about the partnership’s financial activities. Ensure that all necessary forms are completed and submitted together with the IRS 1065-B to avoid delays and penalties.

Where do I send the form?

The completed IRS 1065-B form should be mailed to the appropriate IRS address based on your partnership’s location. Confirm the correct mailing address on the IRS website, as it may vary depending on whether you are filing with a payment or not. Properly addressing your submission is crucial to ensure timely processing.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.