IL PTAX-340 2015 free printable template

Show details

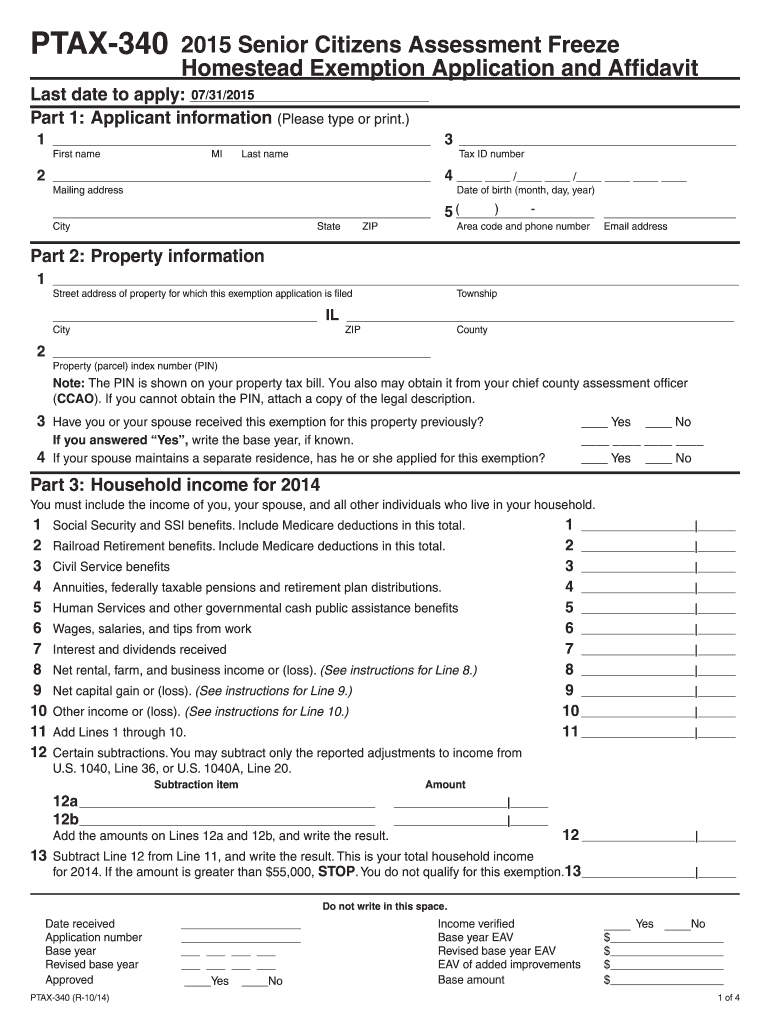

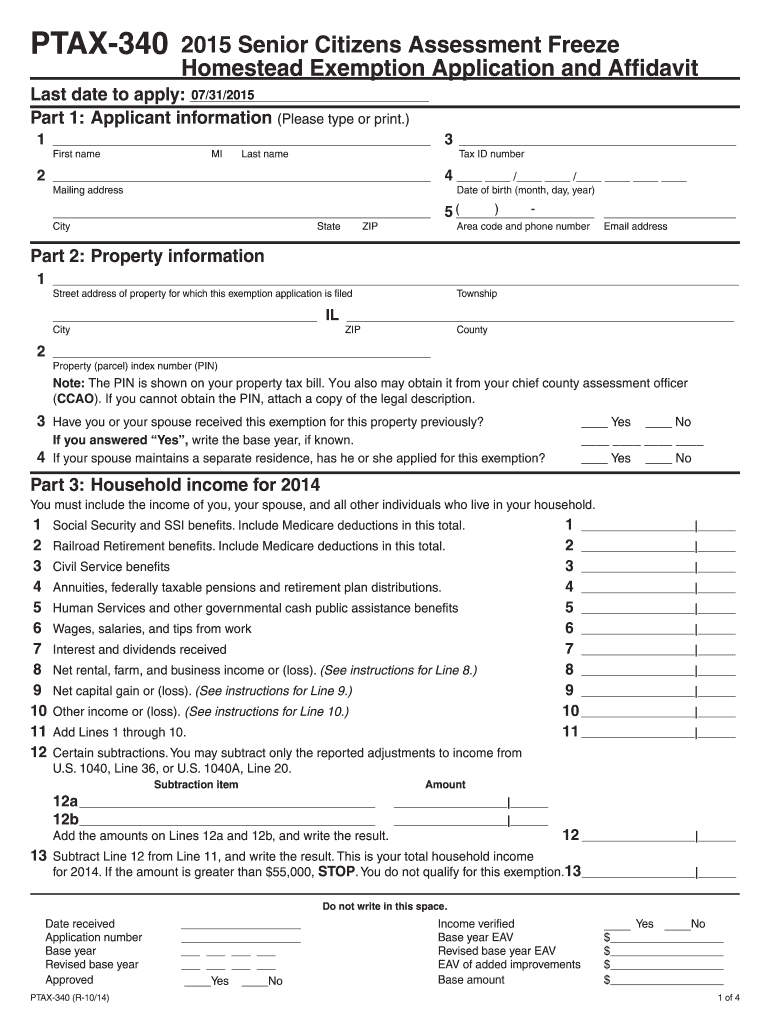

SUITE 229 If you have any questions please call Month Day Year EDWARDSVILLE 6 2 0 2 5 This form is authorized in accordance with the Illinois Property Tax Code. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in 2 of 4 a penalty. Reset Print Form PTAX-340 General Information What is the Senior Citizens Assessment Freeze The Senior Citizens Assessment Freeze Homestead Exemption 35 ILCS 200/15-172 allows you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2015 illinois ptax 340

Edit your 2015 illinois ptax 340 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 illinois ptax 340 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2015 illinois ptax 340 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2015 illinois ptax 340. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-340 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2015 illinois ptax 340

How to fill out IL PTAX-340

01

Obtain a copy of the IL PTAX-340 form from the Illinois Department of Revenue website.

02

Fill out the necessary identification information at the top of the form, including the property owner's name, address, and contact information.

03

Specify the type of exemption you are applying for in the designated section.

04

Provide details about the property, such as the parcel number and legal description.

05

Complete the sections related to your eligibility for the exemption, providing any required financial information or supporting documentation.

06

Review all entries for accuracy and completeness to ensure all required fields are filled out.

07

Sign and date the form to certify that the information provided is true and accurate.

08

Submit the completed form to the appropriate local assessment office by the required deadline.

Who needs IL PTAX-340?

01

Property owners in Illinois who are seeking property tax exemptions or reductions.

02

Individuals who qualify for specific exemptions based on their residency status, age, disability, or other qualifying factors.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for homeowners exemption in Illinois?

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.

What is Ptax 340 in Madison County IL?

Click Here for Form 2023 (PTAX-340) This exemption allows senior citizens who have a total household maximum income of less than $65,000 and meet certain other qualifications to elect to maintain the EAV of their homes at the base year EAV and prevent any increase in that value due to inflation.

How do you qualify for Illinois property tax credit?

You will qualify for the property tax credit if: your principal residence during the year preceding the tax year at issue was in Illinois, and. you owned the residence, and. you paid property tax on your principal residence (excluding any applicable exemptions, late fees, and other charges).

How much do property taxes go down when you turn 65 in Illinois?

The Senior Citizen Homestead Exemption reduces the assessed value of your property by $5,000 and is available for a residence owned and occupied by a person 65 or older during the tax year. If you qualify and do not receive this exemption, contact the Board of Review at (618) 277-6600, ext.

What is Ptax 340 Illinois?

The Low-Income Senior Citizens Assessment Freeze Homestead Exemption (35 ILCS 200/15-172) allows you, as a qualified senior citizen, to have your home's equalized assessed value (EAV) “frozen” at a base year value and prevent or limit any increase due to inflation.

How do I get senior discount on property taxes in Illinois?

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2015 illinois ptax 340 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 2015 illinois ptax 340, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the 2015 illinois ptax 340 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2015 illinois ptax 340 in seconds.

How do I fill out the 2015 illinois ptax 340 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2015 illinois ptax 340 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is IL PTAX-340?

IL PTAX-340 is a form used in Illinois for reporting information related to the rental of real estate properties for tax purposes.

Who is required to file IL PTAX-340?

Property owners or operators of short-term rental properties in Illinois are required to file IL PTAX-340.

How to fill out IL PTAX-340?

To fill out IL PTAX-340, you will need to provide details about the property, including the address, the owner's information, and the rental activity for the reporting period.

What is the purpose of IL PTAX-340?

The purpose of IL PTAX-340 is to assist the state in tracking rental activity for tax collection and to ensure compliance with local tax regulations.

What information must be reported on IL PTAX-340?

IL PTAX-340 requires information such as the rental property's address, the owner's name and contact details, the rental income earned, and the duration of rental periods.

Fill out your 2015 illinois ptax 340 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015 Illinois Ptax 340 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.