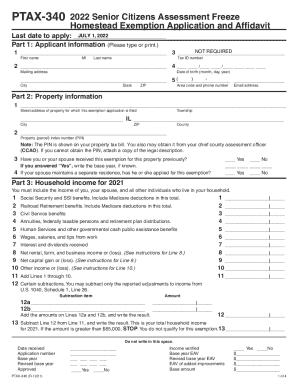

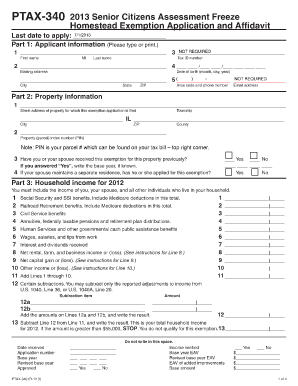

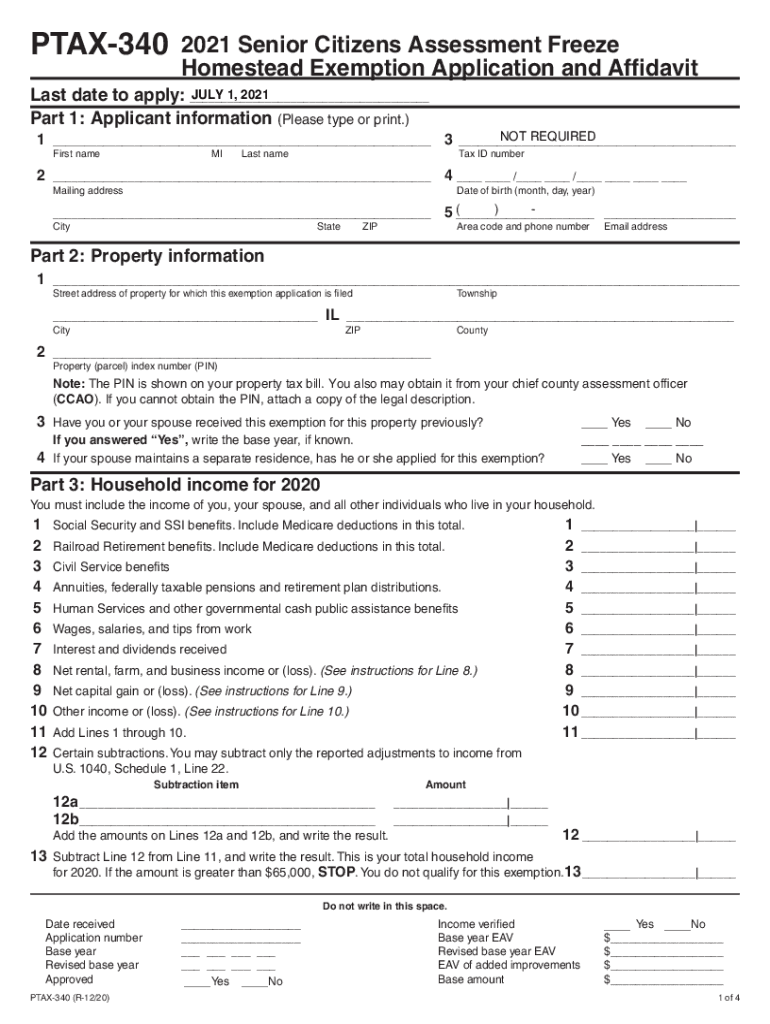

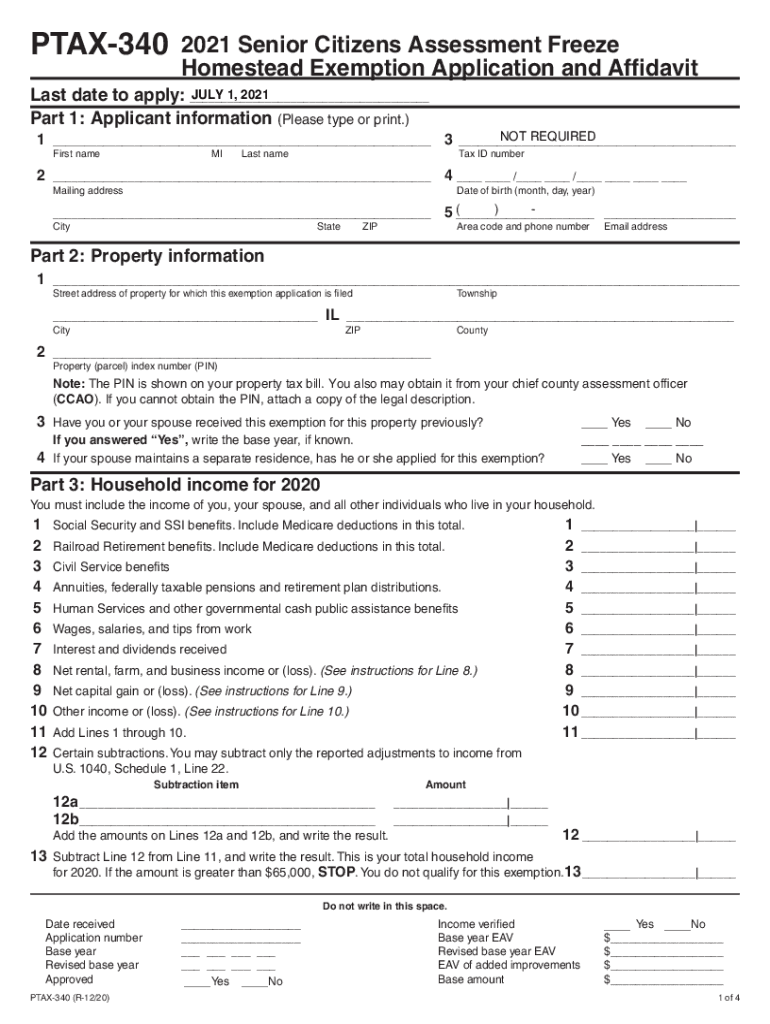

IL PTAX-340 2021 free printable template

Show details

Note You must sign your Form PTAX-340 and have it notarized before you file it with your CCAO. Return your completed Form PTAX-340 to your CCAO s office or mail it to the address printed. When must I file File Form PTAX-340 with the CCAO by the due date printed on the bottom of Page 2. You must file Form PTAX-340 every year and meet the qualifications for that year to continue to receive the exemption. Note The CCAO may require additional documentation i.e. birth certificates tax returns to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ptax 340 illinois 2021

Edit your ptax 340 illinois 2021 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

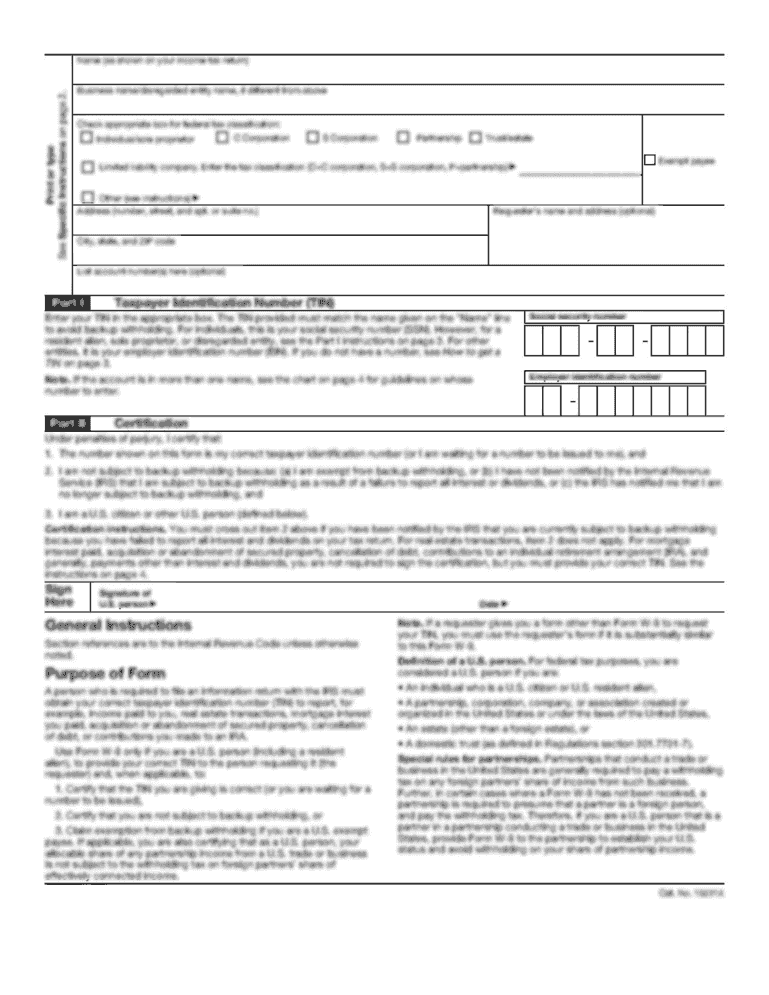

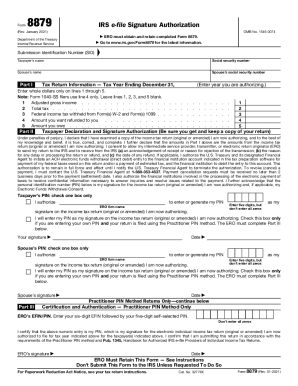

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ptax 340 illinois 2021 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ptax 340 illinois 2021 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ptax 340 illinois 2021. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-340 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ptax 340 illinois 2021

How to fill out IL PTAX-340

01

Obtain the IL PTAX-340 form from the Illinois Department of Revenue website or your local assessor's office.

02

Fill in your property details such as address, parcel number, and property owner information.

03

Provide details on the type of exemption you are applying for, including eligibility criteria.

04

Attach any required documents that support your exemption claim.

05

Review your completed application for accuracy.

06

Submit the form to the appropriate local authority by the specified deadline.

Who needs IL PTAX-340?

01

Property owners in Illinois who are applying for an exemption on their property taxes, such as veterans, seniors, and individuals with disabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is Ptax 340 in Madison County IL?

Click Here for Form 2023 (PTAX-340) This exemption allows senior citizens who have a total household maximum income of less than $65,000 and meet certain other qualifications to elect to maintain the EAV of their homes at the base year EAV and prevent any increase in that value due to inflation.

What is Ptax 340 Madison County IL 2023?

Click Here for Form 2023 (PTAX-340) This exemption allows senior citizens who have a total household maximum income of less than $65,000 and meet certain other qualifications to elect to maintain the EAV of their homes at the base year EAV and prevent any increase in that value due to inflation.

How do I get senior discount on property taxes in Illinois?

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

Who qualifies for senior freeze in Illinois?

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2021 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

Who qualifies for homeowners exemption in Illinois?

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.

What is Ptax 340 Illinois?

The Low-Income Senior Citizens Assessment Freeze Homestead Exemption (35 ILCS 200/15-172) allows you, as a qualified senior citizen, to have your home's equalized assessed value (EAV) “frozen” at a base year value and prevent or limit any increase due to inflation.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ptax 340 illinois 2021?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ptax 340 illinois 2021 and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the ptax 340 illinois 2021 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your ptax 340 illinois 2021 and you'll be done in minutes.

How do I edit ptax 340 illinois 2021 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign ptax 340 illinois 2021 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is IL PTAX-340?

IL PTAX-340 is a form used in Illinois for reporting the use of property by a non-profit organization for property tax exemption purposes.

Who is required to file IL PTAX-340?

Non-profit organizations that are claiming a property tax exemption in Illinois are required to file IL PTAX-340.

How to fill out IL PTAX-340?

To fill out IL PTAX-340, organizations must provide details such as property information, the purpose for which the property is used, and any supporting documentation showing eligibility for the exemption.

What is the purpose of IL PTAX-340?

The purpose of IL PTAX-340 is to assess and confirm the eligibility of non-profit organizations for property tax exemptions.

What information must be reported on IL PTAX-340?

IL PTAX-340 requires reporting information such as the location of the property, the type of nonprofit organization, the specific uses of the property, and any relevant financial data.

Fill out your ptax 340 illinois 2021 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ptax 340 Illinois 2021 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.