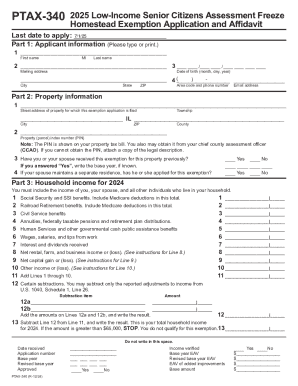

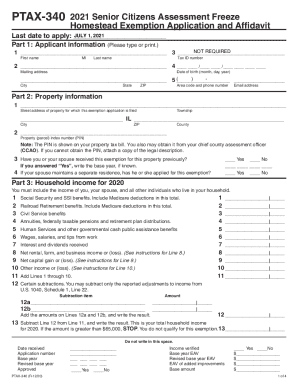

IL PTAX-340 2019 free printable template

Show details

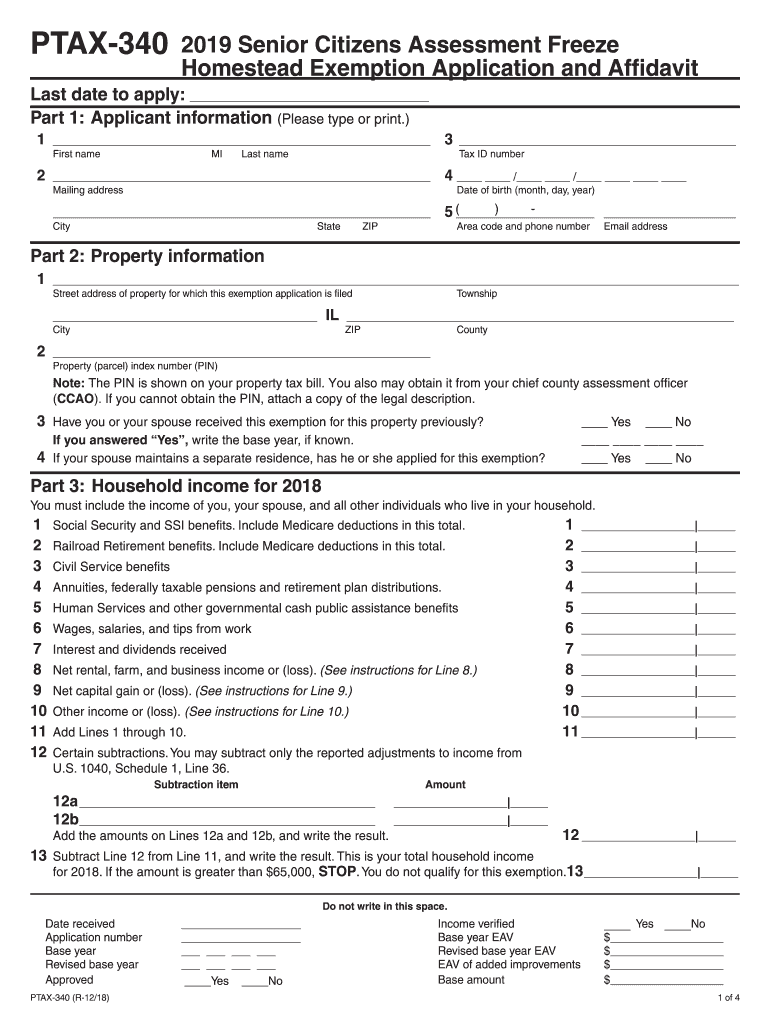

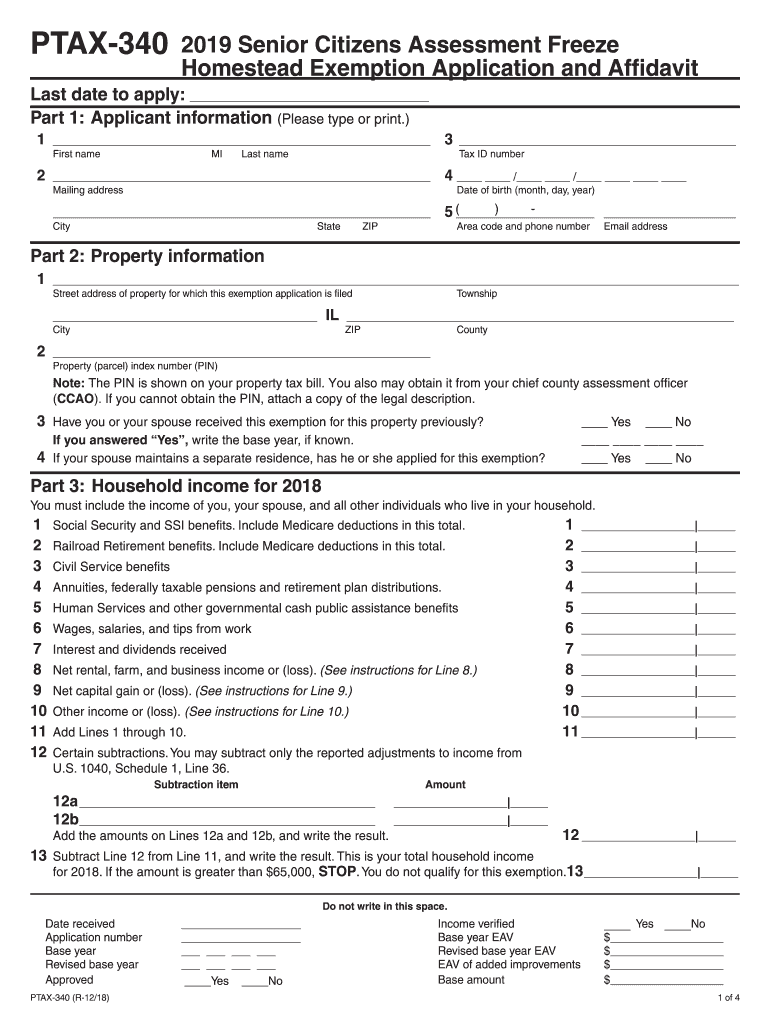

Note You must sign your Form PTAX-340 and have it notarized before you file it with your CCAO. Return your completed Form PTAX-340 to your CCAO s office or mail it to the address printed. When must I file File Form PTAX-340 with the CCAO by the due date printed on the bottom of Page 2. You must file Form PTAX-340 every year and meet the qualifications for that year to continue to receive the exemption. Note The CCAO may require additional documentation i.e. birth certificates tax returns to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL PTAX-340

Edit your IL PTAX-340 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL PTAX-340 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL PTAX-340 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL PTAX-340. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-340 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL PTAX-340

How to fill out IL PTAX-340

01

Begin by obtaining the IL PTAX-340 form from the Illinois Department of Revenue website or a local office.

02

Fill in your personal information, including your name, address, and contact information at the top of the form.

03

Indicate the property details including the parcel number and the address of the property in question.

04

Choose the appropriate reasons for your request in the designated section.

05

Provide a detailed explanation or statement regarding the reasons for your submission.

06

Include any supporting documentation required, such as property tax bills or previous assessments.

07

Review the completed form carefully to ensure all information is accurate.

08

Sign and date the form at the bottom to certify that all the information provided is true.

09

Submit the form as directed, either by mail or in person to the local assessment office.

Who needs IL PTAX-340?

01

Property owners in Illinois who wish to challenge their property tax assessments may need to fill out IL PTAX-340.

02

Individuals who believe they qualify for a property tax exemption or need to report changes to their property status should also use this form.

03

Real estate agents or property managers who handle assessments for clients may also need this form.

Fill

form

: Try Risk Free

People Also Ask about

What is Ptax 340 in Madison County IL?

Click Here for Form 2023 (PTAX-340) This exemption allows senior citizens who have a total household maximum income of less than $65,000 and meet certain other qualifications to elect to maintain the EAV of their homes at the base year EAV and prevent any increase in that value due to inflation.

What is the Illinois senior freeze exemption?

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2021 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

What is the home improvement exemption in Illinois?

The Home Improvement Exemption allows a homeowner to add improvements to their home that add to its value (for example, by increasing the building's square footage, or repairing after structural flood damage) without being taxed on up to $75,000 of the added value for up to four years. No application is required.

At what age do seniors stop paying property taxes in Illinois?

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

Is there a tax break for homeowners in Illinois?

What is the Illinois Property Tax Credit? The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax (real estate tax) you paid on your principal residence. You must own and reside in your residence in order to take this credit.

How much is the Illinois homeowner exemption?

The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IL PTAX-340 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including IL PTAX-340, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit IL PTAX-340 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing IL PTAX-340.

How can I fill out IL PTAX-340 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your IL PTAX-340. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is IL PTAX-340?

IL PTAX-340 is a form used in Illinois for reporting the status of property tax exemptions for various types of property owners, businesses, or organizations.

Who is required to file IL PTAX-340?

Organizations or individuals who wish to claim a property tax exemption in Illinois are required to file IL PTAX-340.

How to fill out IL PTAX-340?

To fill out IL PTAX-340, you need to provide information such as your name, address, details about the property, and the specific exemption being claimed. It is important to follow the instructions provided with the form.

What is the purpose of IL PTAX-340?

The purpose of IL PTAX-340 is to assist the Illinois Department of Revenue in assessing eligibility for property tax exemptions and to ensure accurate reporting of the properties that qualify for these exemptions.

What information must be reported on IL PTAX-340?

IL PTAX-340 requires reporting information including property details, the exemption type, the property's use, and your identification information as the applicant.

Fill out your IL PTAX-340 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL PTAX-340 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.