Get the free Basel III Liquidity Standards - davy

Show details

Www.davy.ie/creditunions Basel III Liquidity Standards: The Implications for Credit Union Investments MAY 2013 CONTENTS Section Title Page 1 Introduction & Background 1 2 Liquidity Ratios under Basel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign basel iii liquidity standards

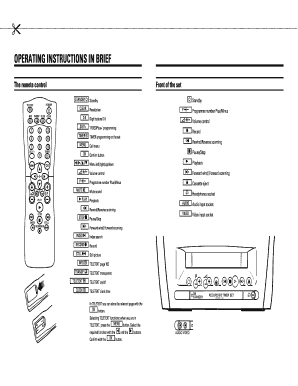

Edit your basel iii liquidity standards form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your basel iii liquidity standards form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit basel iii liquidity standards online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit basel iii liquidity standards. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out basel iii liquidity standards

How to fill out Basel III liquidity standards:

01

Understand the requirements: Before filling out Basel III liquidity standards, it is essential to familiarize yourself with the specific requirements and guidelines outlined in the Basel III framework. This will give you a clear understanding of what needs to be completed.

02

Gather necessary data: To fill out Basel III liquidity standards, you will need to gather relevant financial data for your institution. This may include information on liquidity ratios, liquidity coverage ratio (LCR), net stable funding ratio (NSFR), and other liquidity metrics.

03

Assess current liquidity position: Evaluate your institution's current liquidity position based on the data gathered. This involves analyzing your institution's assets, liabilities, and cash flow patterns to determine its ability to meet liquidity requirements under stress scenarios.

04

Identify any gaps: Compare your institution's current liquidity position to the Basel III liquidity standards. Identify any gaps or shortcomings that need to be addressed to ensure compliance with the regulations. This may include implementing strategies to improve liquidity risk management, liquidity buffers, and funding sources.

05

Develop an action plan: Develop a comprehensive action plan to address any identified gaps and ensure compliance with Basel III liquidity standards. This plan should outline specific steps and timelines for implementing necessary changes, such as improving risk management practices, diversifying funding sources, or establishing contingency plans.

06

Implement necessary changes: Put your action plan into motion by implementing the required changes to meet Basel III liquidity standards. This may involve revising liquidity management policies, enhancing risk monitoring systems, or updating reporting procedures.

07

Monitor and evaluate: Continuously monitor and evaluate your institution's compliance with Basel III liquidity standards. Regularly review liquidity metrics, stress-testing results, and other key indicators to assess the effectiveness of implemented changes. Make adjustments and improvements as needed to maintain ongoing compliance.

Who needs Basel III liquidity standards?

01

Banks and financial institutions: Basel III liquidity standards are primarily aimed at banks and financial institutions. These regulations are designed to enhance the resilience and stability of the global banking system, ensuring that institutions maintain adequate liquidity buffers to withstand financial shocks.

02

Regulatory authorities: Basel III liquidity standards are essential for regulatory authorities responsible for overseeing the banking sector. These standards provide guidance and benchmarks for assessing the liquidity risk management capabilities of banks and establishing regulatory requirements.

03

Investors and stakeholders: Investors and stakeholders in the banking sector rely on Basel III liquidity standards to gauge the liquidity risk profile of banks. These standards ensure that banks maintain sufficient liquidity to fulfill their obligations, reducing the likelihood of financial distress and potential systemic risks.

04

Global financial stability: Basel III liquidity standards contribute to global financial stability by fostering sound liquidity risk management practices and promoting resilience in the banking sector. This ultimately benefits the broader economy by reducing the likelihood of liquidity crises and financial disruptions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is basel iii liquidity standards?

Basel III liquidity standards are regulatory requirements that aim to ensure that banks maintain adequate levels of liquid assets to withstand unexpected financial stress.

Who is required to file basel iii liquidity standards?

Banks and financial institutions are required to file Basel III liquidity standards.

How to fill out basel iii liquidity standards?

Basel III liquidity standards can be filled out by providing detailed information on the amount of liquid assets held by the bank and the calculation of the liquidity coverage ratio (LCR).

What is the purpose of basel iii liquidity standards?

The purpose of Basel III liquidity standards is to enhance the resilience of banks to liquidity risks and improve the stability of the financial system.

What information must be reported on basel iii liquidity standards?

Information such as the amount of high-quality liquid assets, net cash outflows under stressed scenarios, and the calculation of the liquidity coverage ratio must be reported on Basel III liquidity standards.

How can I modify basel iii liquidity standards without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including basel iii liquidity standards, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit basel iii liquidity standards in Chrome?

basel iii liquidity standards can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the basel iii liquidity standards in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your basel iii liquidity standards directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your basel iii liquidity standards online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Basel Iii Liquidity Standards is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.