VA DoT ST-9 & ST-9A 2013 free printable template

Show details

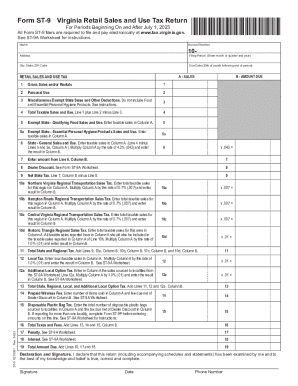

Form ST-9 Virginia Retail Sales and Use Tax Return For Periods Beginning On and After July 1, 2013 *VAST09113888* All Form ST-9 filers are required to file and pay electronically at www.tax.virginia.gov.

pdfFiller is not affiliated with any government organization

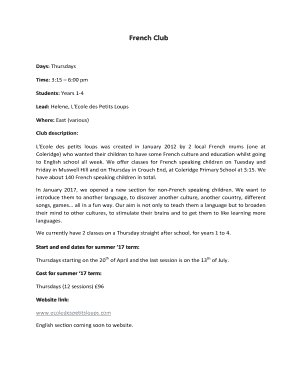

Get, Create, Make and Sign VA DoT ST-9 ST-9A

Edit your VA DoT ST-9 ST-9A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT ST-9 ST-9A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA DoT ST-9 ST-9A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VA DoT ST-9 ST-9A. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT ST-9 & ST-9A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT ST-9 ST-9A

How to fill out VA DoT ST-9 & ST-9A

01

Obtain a copy of the VA DoT ST-9 and ST-9A forms from the Department of Veterans Affairs website or your local VA office.

02

Begin with the ST-9 form, which is used for the registration of a motor vehicle.

03

Fill in your personal information, including your name, address, and contact details in the designated fields.

04

Provide details about the vehicle including the make, model, year of manufacture, and the Vehicle Identification Number (VIN).

05

Indicate the type of title you are applying for (original title, duplicate title, etc.) and any applicable fees.

06

Review the completed ST-9 form for accuracy before signing and dating it at the bottom.

07

For the ST-9A form, if necessary, fill out any additional information required pertaining to the vehicle's prior ownership or lienholder details.

08

Attach any required documents such as proof of identification, previous title documents, or lien release forms, as instructed.

09

Submit the completed ST-9 and ST-9A forms along with the necessary documentation to the appropriate VA office or agency.

Who needs VA DoT ST-9 & ST-9A?

01

Veterans who are purchasing a vehicle and need to register it with the Department of Veterans Affairs.

02

Individuals applying for a title or registration for a motor vehicle that is owned by or associated with a veteran.

03

Any eligible active-duty members or their dependents seeking vehicle registration benefits under the VA.

Fill

form

: Try Risk Free

People Also Ask about

What is form VA 5?

Form VA-5 Employer's Quarterly Return of Virginia Income Tax Withheld.

What is the sales tax in VA Dept of Taxation?

The sales tax rate for most locations in Virginia is 5.3%. Several areas have an additional regional or local tax as outlined below. In all of Virginia, food for home consumption (e.g. grocery items) and certain essential personal hygiene items are taxed at a reduced rate of 1%.

How do you calculate sales tax in Virginia?

How 2023 Sales taxes are calculated in Virginia. The state general sales tax rate of Virginia is 4.3%. Cities and/or municipalities of Virginia are allowed to collect their own rate that can get up to 1% in city sales tax.

What is tax exempt in Virginia?

Industrial materials sold to make things, or parts of things, that will be sold to someone else are not subject to sales tax. Machinery, tools, fuel, and supplies used to make things out of these industrial materials are also exempt from sales tax.

What is Form ST-9?

Form ST-9 - Virginia Retail Sales and Use Tax Return.

What in Virginia charge a 6% sales tax?

The sales tax rate for most locations in Virginia is 5.3%. Three areas have an additional regional tax as outlined below: Hampton Roads - 6% - Includes: Chesapeake.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my VA DoT ST-9 ST-9A in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your VA DoT ST-9 ST-9A right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit VA DoT ST-9 ST-9A on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share VA DoT ST-9 ST-9A from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit VA DoT ST-9 ST-9A on an Android device?

You can make any changes to PDF files, like VA DoT ST-9 ST-9A, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is VA DoT ST-9 & ST-9A?

VA DoT ST-9 is a form used to report sales and use tax for vehicle sales in Virginia, while ST-9A is the corresponding form for motor vehicle purchases by a non-profit organization.

Who is required to file VA DoT ST-9 & ST-9A?

Dealers and individuals who sell or purchase motor vehicles subject to sales tax in Virginia are required to file VA DoT ST-9 and ST-9A respectively.

How to fill out VA DoT ST-9 & ST-9A?

To fill out VA DoT ST-9 and ST-9A, include details such as seller and buyer information, vehicle identification number (VIN), sale price, taxable amount, and any applicable exemptions.

What is the purpose of VA DoT ST-9 & ST-9A?

The purpose of VA DoT ST-9 & ST-9A is to ensure proper reporting and payment of sales and use tax on vehicle transactions in Virginia.

What information must be reported on VA DoT ST-9 & ST-9A?

Information required includes seller and buyer names and addresses, vehicle description, VIN, sale price, applicable tax rates, and any claimed exemptions.

Fill out your VA DoT ST-9 ST-9A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT ST-9 ST-9a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.