VA DoT ST-9 & ST-9A 2012 free printable template

Show details

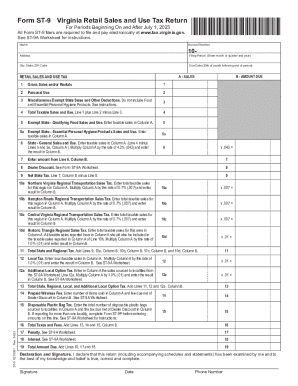

O. Box 26627 Richmond VA 23261-6627 DO NOT staple your payment to Form ST-9. Required Send the signed return even if no tax is due. Virginia Form ST-9 Virginia Retail Sales and Use Tax Return Use for periods ending before July 1 2013 New Electronic Filing Requirement Dealers who file on a monthly basis are required to file and pay electronically beginning with the July 2012 return due August 20 2012. General Sales And Use Tax 9d. 9e. 9c. 9f. see Tax Bulletin 10-5 at www. policylibrary. tax....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT ST-9 ST-9A

Edit your VA DoT ST-9 ST-9A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT ST-9 ST-9A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA DoT ST-9 ST-9A online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit VA DoT ST-9 ST-9A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT ST-9 & ST-9A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT ST-9 ST-9A

How to fill out VA DoT ST-9 & ST-9A

01

Obtain the VA DoT ST-9 & ST-9A forms from the Department of Veterans Affairs website or your local VA office.

02

Start with the ST-9 form, which is the application for a veteran's status.

03

Fill out the veteran's personal information including name, Social Security number, dates of service, and contact details.

04

Provide any supporting documentation required to verify your service, such as discharge papers or military IDs.

05

Review the ST-9 form for accuracy and completeness before signing and dating it.

06

Next, move on to the ST-9A form if applicable, which is the application for a veteran's motor vehicle license plate.

07

Fill in the vehicle details including the make, model, and VIN along with your name and address.

08

Indicate the type of license plate you are requesting and any additional special requests.

09

Double-check the ST-9A form for completeness and accuracy before signing and dating it.

10

Submit both forms together to the appropriate VA office or designated authority.

Who needs VA DoT ST-9 & ST-9A?

01

Any veteran who is looking to apply for veteran's status or requesting a special motor vehicle license plate based on their service.

02

Family members or survivors of veterans who may need to file these forms for benefits or recognition.

Fill

form

: Try Risk Free

People Also Ask about

What is form VA 5?

Form VA-5 Employer's Quarterly Return of Virginia Income Tax Withheld.

What is the sales tax in VA Dept of Taxation?

The sales tax rate for most locations in Virginia is 5.3%. Several areas have an additional regional or local tax as outlined below. In all of Virginia, food for home consumption (e.g. grocery items) and certain essential personal hygiene items are taxed at a reduced rate of 1%.

How do you calculate sales tax in Virginia?

How 2023 Sales taxes are calculated in Virginia. The state general sales tax rate of Virginia is 4.3%. Cities and/or municipalities of Virginia are allowed to collect their own rate that can get up to 1% in city sales tax.

What is tax exempt in Virginia?

Industrial materials sold to make things, or parts of things, that will be sold to someone else are not subject to sales tax. Machinery, tools, fuel, and supplies used to make things out of these industrial materials are also exempt from sales tax.

What is Form ST-9?

Form ST-9 - Virginia Retail Sales and Use Tax Return.

What in Virginia charge a 6% sales tax?

The sales tax rate for most locations in Virginia is 5.3%. Three areas have an additional regional tax as outlined below: Hampton Roads - 6% - Includes: Chesapeake.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my VA DoT ST-9 ST-9A directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your VA DoT ST-9 ST-9A and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send VA DoT ST-9 ST-9A to be eSigned by others?

When your VA DoT ST-9 ST-9A is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute VA DoT ST-9 ST-9A online?

pdfFiller makes it easy to finish and sign VA DoT ST-9 ST-9A online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is VA DoT ST-9 & ST-9A?

VA DoT ST-9 is a form used for reporting sales and use tax information in Virginia, while ST-9A serves a similar purpose but is specifically for exemption claims.

Who is required to file VA DoT ST-9 & ST-9A?

Businesses and individuals who sell or purchase goods and services subject to sales and use tax in Virginia are required to file VA DoT ST-9 & ST-9A.

How to fill out VA DoT ST-9 & ST-9A?

To fill out VA DoT ST-9 & ST-9A, taxpayers should enter their contact information, detail the items sold or purchased, and provide the associated tax amounts as required by the form instructions.

What is the purpose of VA DoT ST-9 & ST-9A?

The purpose of VA DoT ST-9 & ST-9A is to ensure compliance with Virginia sales and use tax laws by collecting information on taxable transactions and exemption claims.

What information must be reported on VA DoT ST-9 & ST-9A?

The information required on VA DoT ST-9 & ST-9A includes the seller's and buyer's details, a description of the goods or services, tax amounts collected or claimed as exempt, and dates of transactions.

Fill out your VA DoT ST-9 ST-9A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT ST-9 ST-9a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.