KS DoR K-40 2013 free printable template

Show details

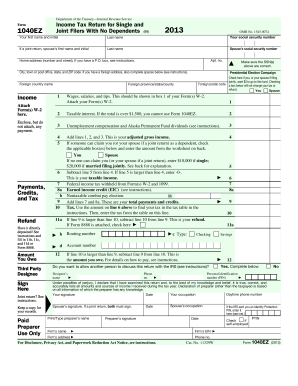

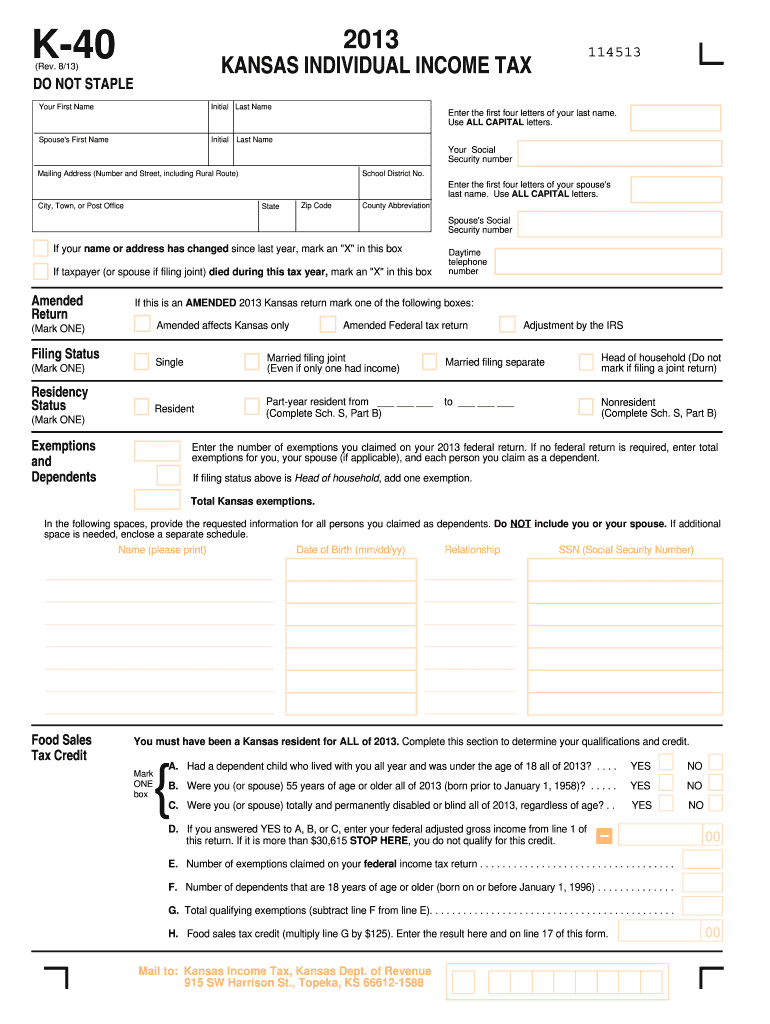

K-40 2013 114513 KANSAS INDIVIDUAL INCOME TAX (Rev. 8/13) DO NOT STAPLE Your First Name Initial Last Name Spouse's First Name Initial Enter the first four letters of your last name. Use ALL CAPITAL

pdfFiller is not affiliated with any government organization

Instructions and Help about KS DoR K-40

How to edit KS DoR K-40

How to fill out KS DoR K-40

Instructions and Help about KS DoR K-40

How to edit KS DoR K-40

To edit the KS DoR K-40 tax form, you can use pdfFiller's editing tools. Start by uploading the form to the platform. Once uploaded, utilize the text box feature to make any necessary amendments. Save your changes once you have completed the edits. Always double-check the accuracy of the information before submission.

How to fill out KS DoR K-40

To fill out the KS DoR K-40 form, follow these steps:

01

Gather all necessary personal and financial information, including your Social Security number and income details.

02

Begin with your personal identification information at the top of the form.

03

Proceed to the income section, where you will report your total income and any deductions.

04

Review all entries for accuracy and completeness before finalizing.

05

Sign and date the form at the designated section.

About KS DoR K-40 2013 previous version

What is KS DoR K-40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About KS DoR K-40 2013 previous version

What is KS DoR K-40?

KS DoR K-40 is the state income tax return form used by residents of Kansas to report their income, deductions, and tax liability. This form is essential for individual taxpayers to fulfill their state tax obligations and is submitted annually to the Kansas Department of Revenue.

What is the purpose of this form?

The purpose of the KS DoR K-40 form is to calculate the amount of state income tax owed by Kansas residents based on their income and applicable deductions. The form allows taxpayers to report earnings, claim credits, and establish their tax responsibilities for the year.

Who needs the form?

Residents of Kansas who earn income must file the KS DoR K-40 form if their income meets the minimum filing threshold set by the state's tax regulations. This form is required for most individuals, including those who are self-employed, receive wages, or collect taxable interest and dividends.

When am I exempt from filling out this form?

You may be exempt from filling out the KS DoR K-40 form if your income falls below the required minimum threshold for filing, or if you are a full-time student who qualifies for specific exemptions. Additionally, certain types of income might be excluded from taxation, which can also impact your filing requirement.

Components of the form

The KS DoR K-40 form comprises several critical components, including sections for personal information, income details, deduction claims, and tax calculations. Taxpayers must accurately complete each section to ensure proper assessment and to avoid potential penalties.

What are the penalties for not issuing the form?

Failing to submit the KS DoR K-40 form can result in penalties, including fines and interest on unpaid taxes. The Kansas Department of Revenue may also initiate enforcement actions for non-compliance, exacerbating the financial impact on the taxpayer. It's important to file, even if you owe no tax, to avoid these consequences.

What information do you need when you file the form?

When filing the KS DoR K-40 form, you will need your Social Security number, details of all income sources, any applicable deductions, and credits. Additionally, be prepared with records of previous tax returns, and any relevant financial documents, such as W-2s and 1099 forms.

Is the form accompanied by other forms?

The KS DoR K-40 form may need to be accompanied by additional schedules or forms, depending on your specific tax situation. For example, if you are claiming certain deductions or credits, you might need to include supplementary forms that provide the necessary details for the Kansas Department of Revenue.

Where do I send the form?

Completed KS DoR K-40 forms should be sent to the Kansas Department of Revenue. Ensure that you mail your form to the correct address based on the type of return you are filing and whether you are enclosing payment. Check the Kansas Department of Revenue's website for the latest information on mailing addresses and any other specific submission guidelines.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has made many areas of my professional and personal life easier.

Works well enough but the interface is a bit clunky.

See what our users say