KS DoR K-40 2022 free printable template

Show details

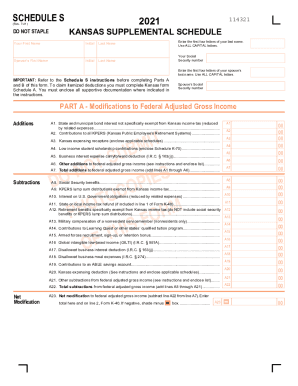

40. KANSAS HOMETOWN HEROES FUND. 41. KANSAS CREATIVE ARTS INDUSTRY FUND. 42. LOCAL SCHOOL DISTRICT CONTRIBUTION FUND 43. Kansas income tax withheld from W-2s and/or 1099s. 22. Amount paid with Kansas extension. return complete lines 25 26 and 27 23. Mail to Kansas Income Tax Kansas Dept. of Revenue PO Box 750260 Topeka KS 66699-0260 ENTER AMOUNTS IN WHOLE DOLLARS ONLY Income 1. Deductions 4. Standard deduction OR itemized deductions if itemizing complete Kansas Schedule A. 5. Example 2....Modifications from Schedule S line A25 enclose Schedule S. 3. Kansas adjusted gross income line 2 added to or subtracted from line 1. 36. CHICKADEE CHECKOFF Kansas Nongame Wildlife Improvement Program. The amount you enter will reduce your refund or increase the amount you owe. K-40 Rev. 7-22 DO NOT STAPLE 114522 KANSAS INDIVIDUAL INCOME TAX Your First Name Initial Last Name Enter the first four letters of your last name. If filing status above is Head of household add one exemption. Total...Kansas exemptions. Enter the requested information for all persons claimed as dependents. Use ALL CAPITAL letters. Spouse s First Name Your Social Security Number Mailing Address Number and Street including Rural Route School District No* last name. Use ALL CAPITAL letters. City Town or Post Office State Zip Code County Abbreviation Spouse s Social If your name or address has changed since last year mark an X in this box. Complete this section to determine your qualifications and credit. A. Had...a dependent child who lived with you all year and was under the age of 18 all of 2022. YES NO B. Were you or spouse 55 years of age or older all of 2022 born before January 1 1967. YES If you answered No to A B and C STOP HERE you do not qualify for this credit. If line D is more than 30 615 STOP HERE you do not qualify for this credit. E* Number of exemptions claimed*. F* Number of dependents that are 18 years of age or older born before January 1 2005. G* Total qualifying exemptions subtract...line F from line E. H. Food Sales Tax Credit multiply line G by 125. Enter the result here and on line 18 of this form*. Federal adjusted gross income as reported on your federal income tax return. Shade the box for negative amounts. Exemption allowance 2 250 x number of exemptions claimed. 6. Total deductions add lines 4 and 5. 7. Taxable income subtract line 6 from line 3 if less than zero enter 0. 8. Tax from Tax Tables or Tax Computation Schedule. 13. Credit for taxes paid to other states...see instructions enclose return s from other states. 14. Credit for child and dependent care expenses residents only - see instructions. 15. Other credits enclose all appropriate credit schedules. 16. Subtotal subtract lines 13 14 and 15 from line 12. 17. Earned income tax credit from worksheet on page 8 of instructions. 18. Food sales tax credit from line H front of this form. 19. Total tax balance subtract lines 17 and 18 from line 16 cannot be less than zero. Tax Computation Credits 20....Refundable portion of earned income tax credit from worksheet page 8 of instructions. 25. Payments remitted with original return.

pdfFiller is not affiliated with any government organization

Instructions and Help about KS DoR K-40

How to edit KS DoR K-40

How to fill out KS DoR K-40

Instructions and Help about KS DoR K-40

How to edit KS DoR K-40

To edit the KS DoR K-40 Tax Form, use a PDF editor that allows you to modify text and fields. You can upload the form to platforms like pdfFiller, which provides tools for adding, deleting, or modifying entries on the form, ensuring that all information is accurate and compliant with tax regulations.

How to fill out KS DoR K-40

Filling out the KS DoR K-40 requires detailed attention to each section of the form. Begin by entering your personal information, such as name, address, and Social Security number. Next, accurately report your income, tax deductions, and any relevant credits. Finally, double-check your information for accuracy before submission. For online assistance, consider using pdfFiller to manage electronic filling and ensure compliance with Kansas tax laws.

About KS DoR K-40 2022 previous version

What is KS DoR K-40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About KS DoR K-40 2022 previous version

What is KS DoR K-40?

KS DoR K-40 is the Kansas Individual Income Tax Return form used by residents to report their income and calculate their state income tax liability. This form is essential for individuals who wish to comply with Kansas state tax regulations and obligations.

What is the purpose of this form?

The purpose of the KS DoR K-40 form is to enable Kansas residents to report their income to the state and determine their tax liability. By completing this form, taxpayers can apply any applicable deductions and credits to lower their taxable income and ensure accurate tax calculations for the state of Kansas.

Who needs the form?

Individuals who reside in Kansas and earn income must file the KS DoR K-40 form. This includes full-time residents and part-year residents earning above the minimum threshold defined by the Kansas Department of Revenue. Additionally, any tax-exempt organizations that may have taxable income must also complete this form.

When am I exempt from filling out this form?

You may be exempt from filing the KS DoR K-40 if your income is below the taxable income threshold set by the state. Furthermore, individuals who are claimed as dependents on someone else’s tax return, or those qualifying for certain exemptions due to age or disability, may also be exempt.

Components of the form

The KS DoR K-40 consists of several key components including personal information sections, income reporting lines, and deduction sections. Each component is essential for ensuring that all relevant financial information is accurately captured for state tax calculations. Be mindful to fill out each section completely to avoid processing delays.

Due date

The due date for submitting the KS DoR K-40 is generally April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of late filing penalties if they do not file their returning by the due date.

Form vs. Form

This section is not applicable, as the KS DoR K-40 does not have a direct equivalent or comparison with another form addressing similar tax issues.

What payments and purchases are reported?

The KS DoR K-40 requires taxpayers to report various forms of income including wages, interest, dividends, and capital gains. Additionally, any self-employment income must be detailed, as well as any other taxable payments received throughout the year to ensure proper tax assessment.

How many copies of the form should I complete?

Generally, only one copy of the KS DoR K-40 should be completed for filing purposes. However, it is advisable to keep a copy for your records. If you are mailing your form, ensure that you have all necessary supporting documents attached, as required by Kansas tax law.

What are the penalties for not issuing the form?

Filing the KS DoR K-40 late can result in penalties, which may include fines based on the amount of tax owed and the length of delay. The Kansas Department of Revenue may impose additional interest charges. Regularly filing your form on time is crucial to avoiding these consequences.

What information do you need when you file the form?

When filing the KS DoR K-40, gather all necessary information related to your income, such as W-2 forms, 1099s, and records of other taxable income. Additionally, have documentation for any deductions or credits you intend to claim, as well as your Social Security number and other personal identification details ready at hand.

Is the form accompanied by other forms?

When filing your KS DoR K-40, you may need to attach other supporting documents. These may include schedules for additional income types, proof of deductible expenses, and any applicable forms for credits. Ensuring you have all required paperwork can facilitate a smoother processing of your tax return.

Where do I send the form?

Completed KS DoR K-40 forms should be sent to the Kansas Department of Revenue. The mailing address varies depending on whether you are enclosing a payment. Be sure to check the latest instructions from the Kansas Department of Revenue website for the precise address to ensure your tax return is received timely.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has made many areas of my professional and personal life easier.

Works well enough but the interface is a bit clunky.

See what our users say