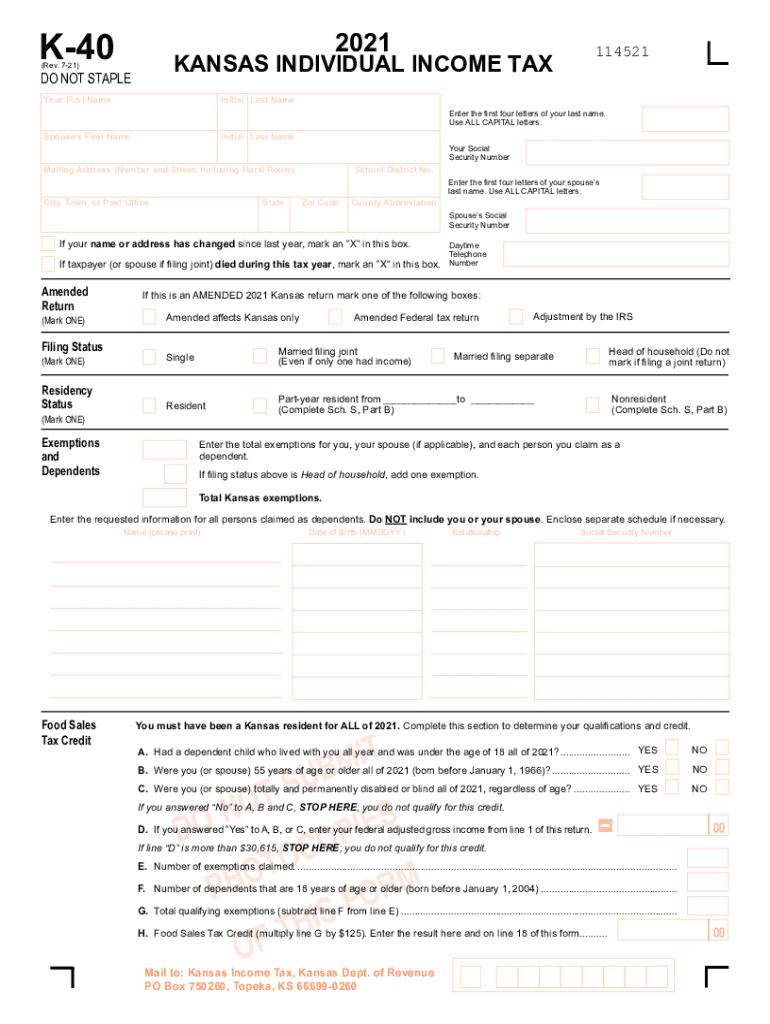

KS DoR K-40 2021 free printable template

Instructions and Help about KS DoR K-40

How to edit KS DoR K-40

How to fill out KS DoR K-40

About KS DoR K-40 2021 previous version

What is KS DoR K-40?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about KS DoR K-40

What should I do if I need to correct an error on my kansas form?

If you've made a mistake on your kansas form after submission, you will need to file an amended return. Ensure that you indicate the correct information clearly and reference the original submission. It's advisable to keep records of both submissions for your reference.

How can I check the status of my filed kansas form?

You can verify the status of your kansas form by using the online portal provided by the state or contacting the relevant department. Keep your confirmation receipt handy, as it may be required to track your submission's progress.

What are common reasons for rejection when e-filing a kansas form?

Common e-file rejection codes for kansas forms include mismatched taxpayer information, incorrect Social Security numbers, or incomplete fields. Review your submission carefully against the instructions provided to minimize the chance of rejection.

Are there specific rules about who can file on behalf of someone else in kansas?

In kansas, authorized representatives holding a Power of Attorney (POA) can file forms on behalf of taxpayers. Ensure you have the necessary documentation in place to avoid delays or complications during the filing process.

See what our users say