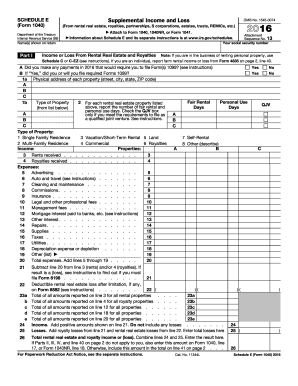

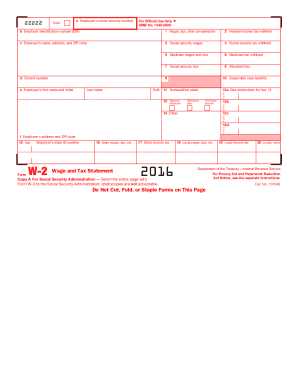

IRS 1040 - Schedule E 2015 free printable template

FAQ about IRS 1040 - Schedule E

What should you do if you realize you've made an error on your IRS 1040 - Schedule E after submission?

If you discover a mistake after submitting your IRS 1040 - Schedule E, you can file an amended return using Form 1040-X. This allows you to correct errors, add missing information, or change your filing status. Ensure you reference the original form and clearly explain the corrections made.

How can you track the status of your IRS 1040 - Schedule E submission?

To track the status of your IRS 1040 - Schedule E, you can use the IRS 'Where's My Refund?' tool on their website, which provides updates on processing. Additionally, if e-filed, you may receive emails confirming receipt but be aware of common rejection codes to monitor.

What common errors should you avoid when filing IRS 1040 - Schedule E?

Common errors when filing the IRS 1040 - Schedule E include misreporting income or expenses, failing to include all required schedules, and discrepancies in names or Social Security numbers. Carefully review your entries and ensure consistency with other forms submitted to avoid issues.

What documentation should you prepare if you receive a notice regarding your IRS 1040 - Schedule E?

If you receive a notice regarding your IRS 1040 - Schedule E, gather relevant documentation such as a copy of your original return, supporting documents for reported income or deductions, and any correspondence from the IRS. Prepare to respond promptly and accurately to resolve the matter.

What are the software requirements for e-filing your IRS 1040 - Schedule E?

For e-filing your IRS 1040 - Schedule E, ensure compatibility with IRS-approved software which supports required forms and meets technical specifications. Check for updates on your browser and operating system to ensure a smooth filing process and to prevent issues.

See what our users say