Get the free W-2 General Information - Human Resources SIU

Show details

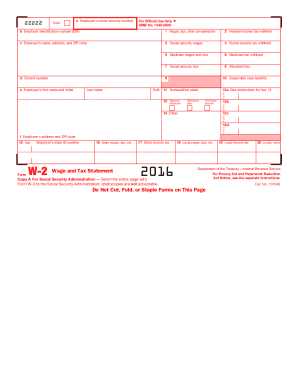

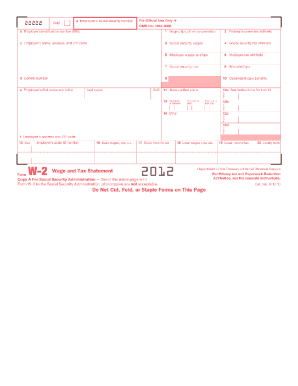

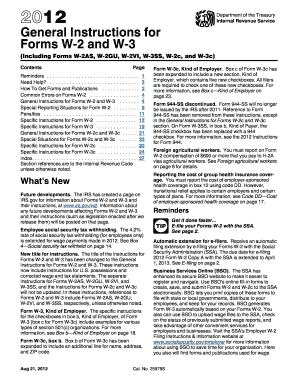

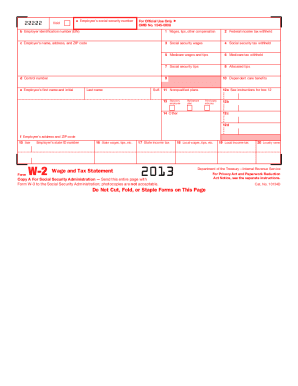

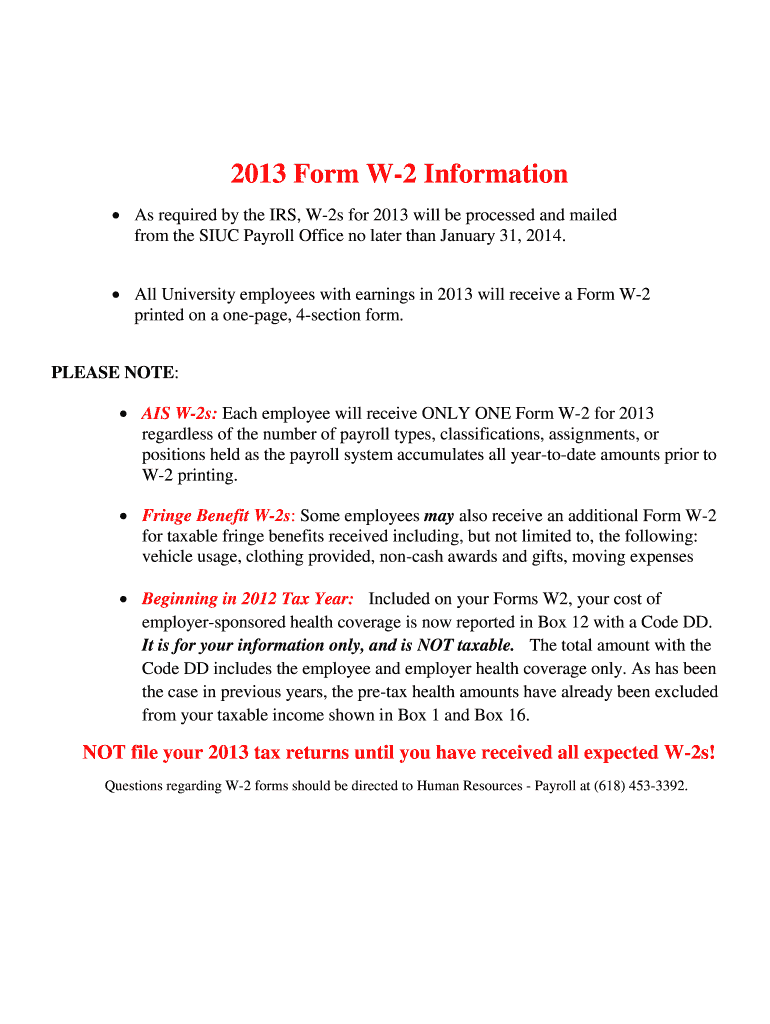

2013 Form W-2 Information

? As required by the IRS, W-2s for 2013 will be processed and mailed

from the SIC Payroll Office no later than January 31, 2014.

? All University employees with earnings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w-2 general information

Edit your w-2 general information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-2 general information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w-2 general information online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit w-2 general information. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

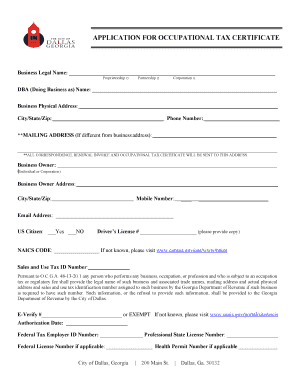

How to fill out w-2 general information

How to fill out w-2 general information:

01

Gather necessary information: Before starting to fill out the w-2 form, you will need a few key pieces of information. Ensure that you have the employee's full name, social security number, address, and other relevant personal details.

02

Review the employer's information: Provide the employer's complete information, including the company name, address, and employer identification number (EIN). Double-check for any errors or typos to ensure accuracy.

03

Provide employee identification: In this section, enter the employee's social security number. Make sure it matches the information you gathered in step 1. If there are any discrepancies, it is essential to resolve them before submitting the form.

04

Verify personal details: Include the employee's full name and address in the appropriate spaces. Double-check for any spelling errors or punctuation mistakes.

05

Determine the correct filing status: In this section, the employee must choose the appropriate marital status from options like single, married filing jointly, married filing separately, etc. Select the option that accurately represents the employee's status.

06

Claim dependents, if applicable: If the employee has dependents, provide the necessary information, such as their names and social security numbers, in the appropriate section. This can help the employee qualify for certain tax benefits.

07

Enter wage and income information: Provide details regarding the employee's earnings, including wages, tips, and other compensation. Ensure accurate reporting of these figures to avoid discrepancies or potential audits.

08

Report federal income tax withheld: In this section, the employer should enter the amount of federal income tax that has been deducted from the employee's paycheck throughout the year. This information can typically be found on the employee's pay stubs or payroll records.

09

Complete state and local tax information: If applicable, provide information about state and local income tax withholding in the specified sections. Different states may have varying requirements, so consult the appropriate state tax agency or resources to ensure accurate reporting.

10

Submit the form to the appropriate entities: After completing the w-2 form, provide copies to the employee, the Social Security Administration (SSA), and state/local tax agencies as required. Remember to retain a copy for your records as well.

Who needs w-2 general information?

01

Employers: Employers are responsible for filling out the w-2 general information for their employees. They must accurately report income and tax withholding details, and provide copies to employees and relevant government agencies by the specified deadlines.

02

Employees: Employees also need access to the w-2 general information. It helps them understand their earnings, tax withholding amounts, and other vital details necessary for filing their personal income tax returns accurately.

03

Government agencies: The Internal Revenue Service (IRS), the Social Security Administration (SSA), and state/local tax agencies require w-2 general information to track individual taxpayer's earnings, monitor tax payments, and verify information provided on tax returns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my w-2 general information in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your w-2 general information and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find w-2 general information?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific w-2 general information and other forms. Find the template you need and change it using powerful tools.

How do I edit w-2 general information online?

With pdfFiller, it's easy to make changes. Open your w-2 general information in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is w-2 general information?

W-2 general information is a tax form used in the United States to report wages paid to employees and the taxes withheld from them.

Who is required to file w-2 general information?

Employers are required to file w-2 general information for each employee who received $600 or more in wages during the year.

How to fill out w-2 general information?

Employers must fill out w-2 general information by entering the employee's personal information, wages paid, taxes withheld, and other relevant details.

What is the purpose of w-2 general information?

The purpose of w-2 general information is to report wage and tax information to employees and the IRS for tax purposes.

What information must be reported on w-2 general information?

Information such as employee's name, address, social security number, wages, tips, other compensation, federal and state taxes withheld, etc. must be reported on w-2 general information.

Fill out your w-2 general information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W-2 General Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.